Gold and Silver Rally on Dollar Weakness While Bitcoin Struggles

Gold and Silver – Precious metals are shining bright while crypto markets flash red. Gold and silver rallied to powerful highs on Monday as investors ramped up expectations of imminent Federal Reserve interest rate cuts—but Bitcoin is charting a very different path amid heavy ETF outflows and macro turbulence.

Silver Hits Record High Amid Supply Squeeze

Spot gold climbed to $4,241 per ounce, its strongest level in six weeks, while silver briefly touched a new all-time high at $58.83 before easing slightly. The white metal has more than doubled in value this year, handily outperforming gold’s impressive 60% gain.

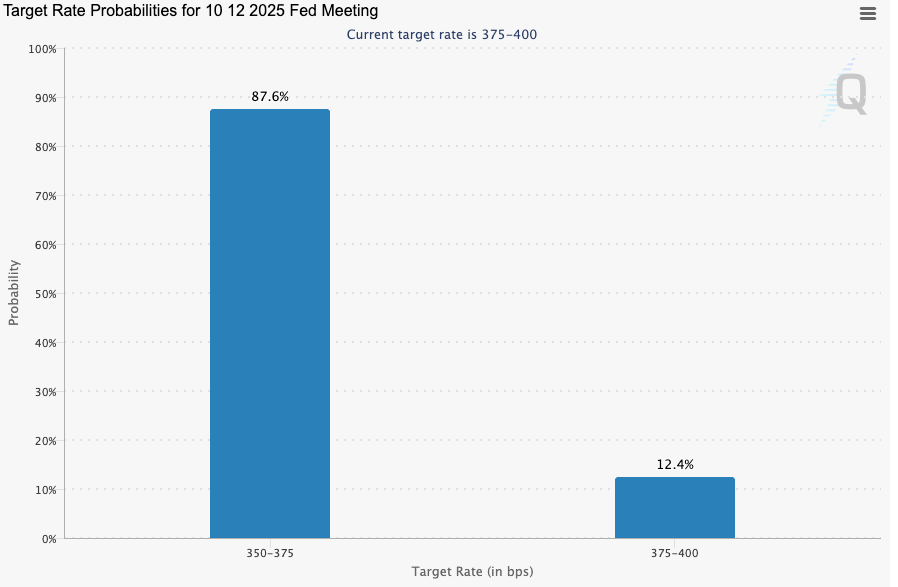

The rally is fueled by growing conviction that the Fed will turn dovish. CME FedWatch data shows traders pricing an 87.6% chance of a 25-basis-point rate cut at the December 10 meeting, with only a 12.4% probability of no change.

But silver’s surge isn’t just about monetary policy. A historic supply crunch continues to electrify the market. A massive squeeze in London during October drained inventories worldwide, while Shanghai Futures Exchange warehouse stocks fell to their lowest levels in nearly a decade. One-month silver borrowing costs remain elevated, underscoring the tightness.

Industrial demand is adding fuel to the fire. Silver’s essential role in electronics and renewable energy, especially solar panel manufacturing, has kept consumption robust. Over the long term, silver’s track record remains striking: up 135.79% over five years and 563.06% over twenty.

A declining dollar—now at a two-week low—combined with dovish comments from Fed officials such as Christopher Waller and John Williams has further boosted precious metals.

Bitcoin Slides Despite Rate-Cut Hopes

While metals rally, Bitcoin is bucking the trend. The world’s largest cryptocurrency plunged toward $86,000, sliding roughly 30% from its October all-time high near $126,000.

The divergence stems from a combination of crypto-specific shocks. US-listed Bitcoin ETFs saw roughly $3.4 billion in net outflows in November, reversing earlier enthusiasm. A $9 million Yearn Finance hack on December 1 dented DeFi sentiment, while comments from Bank of Japan Governor Kazuo Ueda hinting at a potential rate hike triggered fears of a broader carry trade unwind. More than $1 billion in leveraged crypto positions have also been liquidated during the downturn.

Unlike precious metals—currently supported by physical shortages—Bitcoin remains tightly tied to ETF fund flows and leverage dynamics. Although rate-cut expectations may support BTC in the longer term, short-term macro and structural pressures are dominating the narrative for now.

Comments are closed.