Featured News Headlines

Vanguard Finally Embraces Crypto ETFs as Investor Demand Surges

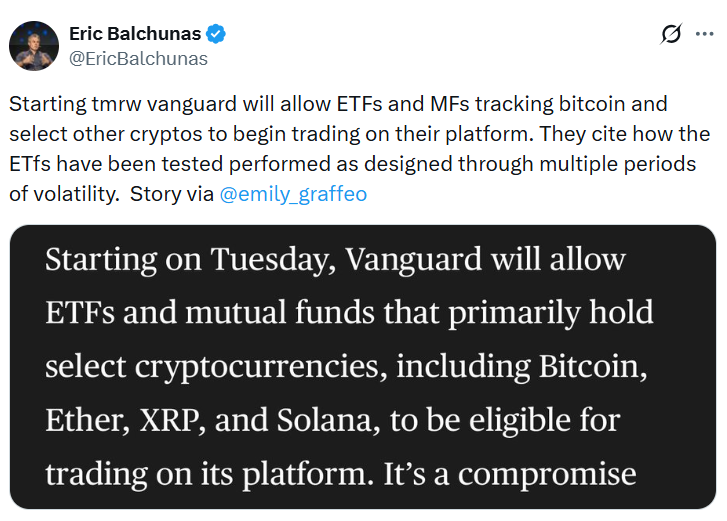

Vanguard, the world’s second-largest asset manager, is preparing to open its doors to digital asset products after years of resistance. Beginning Tuesday, the firm will allow clients to trade crypto exchange-traded funds (ETFs) and mutual funds on its platform — a move that marks a major shift in strategy for the $11 trillion investment powerhouse.

A Major Policy Reversal Driven by Demand

A Vanguard spokesperson confirmed to Cointelegraph that persistent retail and institutional demand prompted the firm to align its approach to crypto products with how it already handles traditional commodities such as gold. The offering will be limited to third-party crypto ETFs and mutual funds, with no plans to launch Vanguard-branded versions.

Only ETFs that meet regulatory requirements will be available. According to Bloomberg, these include products related to Bitcoin, Ether, XRP, and Solana. However, Vanguard emphasized that memecoins are off the table, reinforcing its stance on investor protection and product quality.

“We serve millions of investors who have diverse needs and risk profiles,” the spokesperson said, noting that the primary goal is to provide clients with the freedom to choose while maintaining a responsible platform.

From Crypto Skepticism to Strategic Acceptance

The U-turn is striking given Vanguard’s long-held conservatism toward digital assets. The firm previously rejected crypto ETFs due to concerns over volatility and speculation. Former CEO Tim Buckley said in May 2024 that a Bitcoin ETF “doesn’t belong” in a long-term retirement portfolio.

Buckley stepped down later that year, and although incoming CEO Salim Ramji — formerly of BlackRock’s ETF division — had also dismissed crypto products as recently as August, the firm has since reassessed its stance.

Industry Reactions: “Floodgates” May Be Opening

Crypto analysts and community voices reacted swiftly. Some X users suggested the policy change could be a catalyst for market momentum. Analyst Nilesh Rohilla said he would be surprised if Bitcoin doesn’t rise 5% within 24 hours, while others called the move a “massive signal” that traditional finance is fully entering digital assets. Bitgrow Lab founder Vivek Sen went so far as to predict “trillions incoming.”

As one of the largest asset managers on the planet, Vanguard’s shift could mark a pivotal moment for broader adoption — and potentially the next wave of crypto participation.

Comments are closed.