The Rise of Transparent Crypto Lending: Why is Transparency Winning?

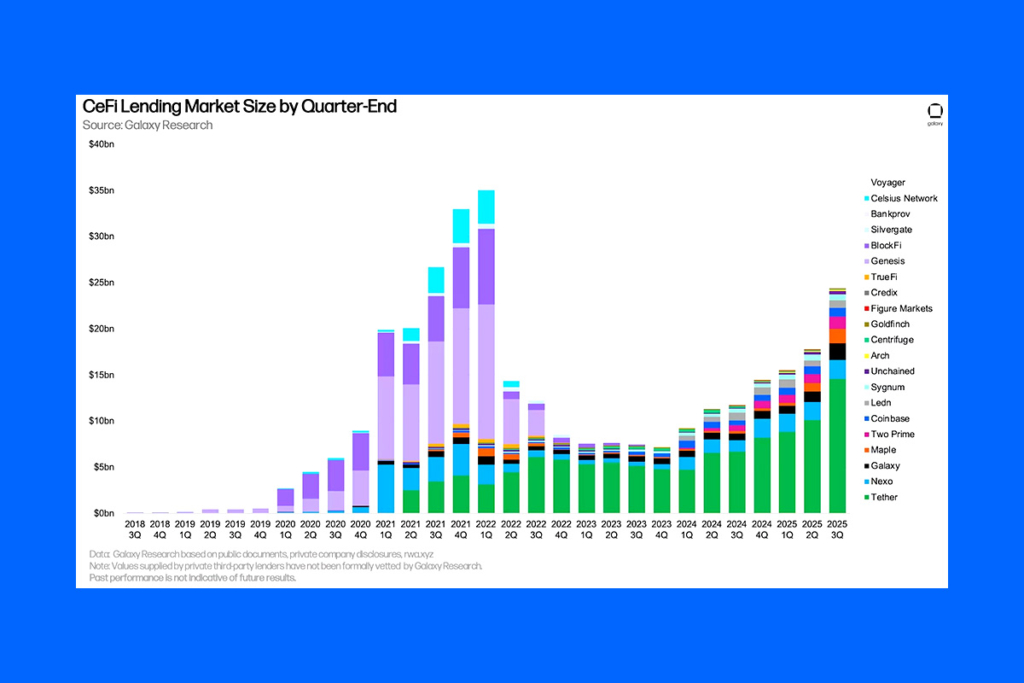

Due to companies like Tether, Nexo, and Galaxy, the cryptocurrency credit market is now more transparent than ever. Thus, the whole credit portfolio reached $25 billion in the third quarter. The size of the crypto loan market has risen by more than 200% since the beginning of 2024, according to Galaxy Research. It is currently at its greatest level since its peak in Q1 2022. However, it is still below its peak of $37 billion.

The quantity of new centralized finance lending platforms is the primary distinction between then and now. According to Alex Thorn, head of research at Galaxy, there is also a lot more openness. Thorn said on Sunday he was proud of the chart and the transparency of its contributors, noting that it represents a huge difference from earlier market cycles.

FTX Fallout Sparks Rise of Healthier Crypto Lending Platforms

During the previous market cycle high, a few platforms dominated the CeFi lending sector. These included Genesis, BlockFi, Celsius, and Voyager. Their exposure to the FTX exchange, which failed in November 2022, had a profound effect on all of them. Because of its exposure to Three Arrows Capital, Celsius had already declared bankruptcy in July 2022, before FTX’s demise. However, Thorn contends that more open players have filled the void left by the departure of numerous FTX-affiliated platforms. He also remarked that healthy habits have taken root in the market.

DeFi Lending Reaches New Quarter-End High of $41B

In the meantime, Q3 saw a new quarter-end all-time high for the dollar-denominated value of outstanding loans on decentralized finance platforms. Galaxy claims that last month, it increased by 54.8% to $41 billion. Combining DeFi applications with CeFi lending platforms, the total outstanding crypto-collateralized borrows hit $65.4 billion at quarter-end. According to the research, this is a new all-time high.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.