Featured News Headlines

Falling Wedge Pattern Indicates Potential Shift

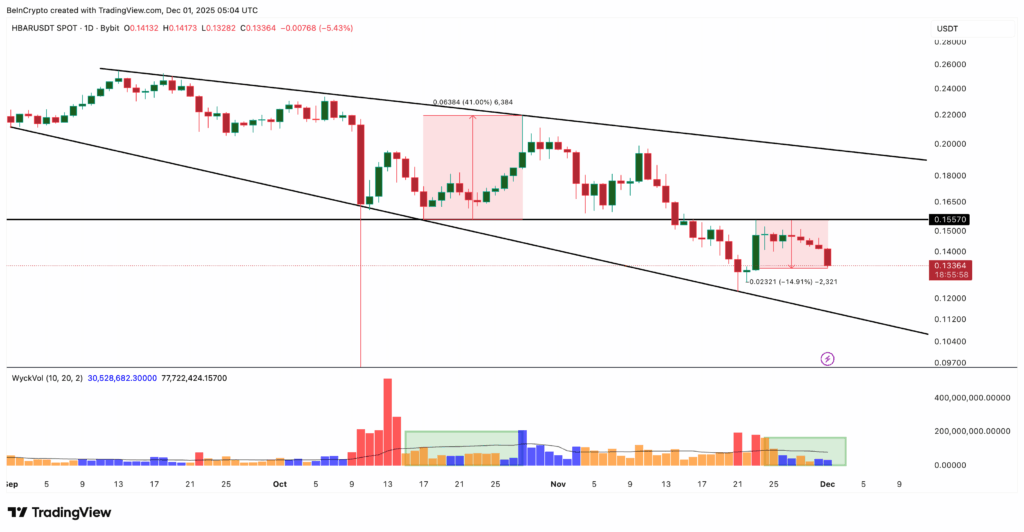

HBAR has been moving within a broad falling wedge since early September, a technical formation that often turns bullish when sellers lose control near the lower boundary. Observers noted the first signs of this potential shift around November 21.

Volume Signals Suggest Seller Exhaustion

HBAR’s trading activity displays a Wyckoff-style color pattern: red indicates sellers in control, yellow shows sellers gaining control, blue signals buyers gaining influence, and green reflects full buyer dominance.

After peaking at $0.155 on November 23 and dropping nearly 15%, HBAR’s bars transitioned from deep red to a mix of yellow and blue. Analysts describe this blend as a classic sign of seller exhaustion and early tug-of-war. A similar pattern occurred between October 15 and 28, preceding a 41% price increase.

Divergence in Money Flow Index (MFI)

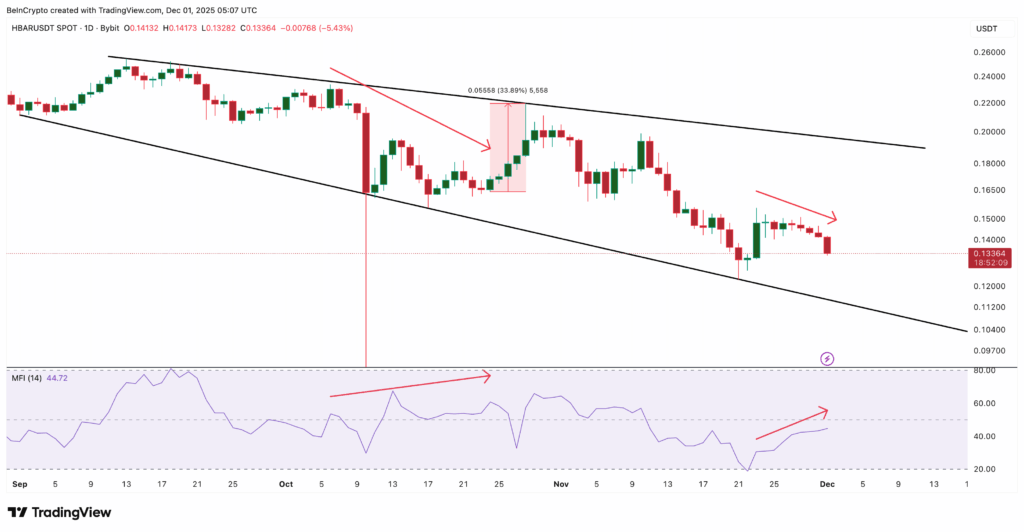

The Money Flow Index (MFI), which measures buying and selling pressure based on price and volume, also points to early accumulation. Between November 23 and December 1, HBAR’s price formed lower highs while the MFI created higher highs. This divergence suggests dips are being quietly bought, echoing a similar pattern from October 6 to 24 that led to a 33% surge.

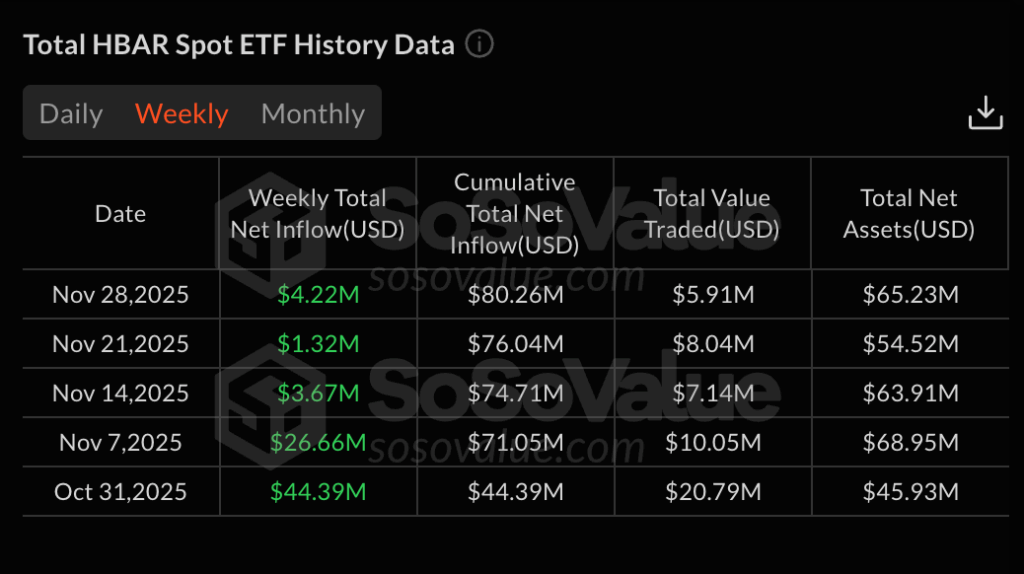

Spot ETF Demand Supports Accumulation Narrative

Further evidence comes from steady inflows into the Canary HBAR Spot ETF, which recorded positive weekly inflows in four of the last five weeks, totaling more than $80 million. While smaller than late October, these inflows indicate ongoing demand even during price declines.

Together, shifting volume control, dip-buying pressure, and continuous ETF inflows point to early accumulation forming beneath the surface.

The lower boundary of the wedge near $0.122 serves as crucial support. Maintaining this level preserves the case for a rebound, while a drop below it exposes a major zone around $0.079, which could indicate a deeper slide rather than accumulation.

For strength to emerge, HBAR needs to reclaim $0.140, a 5% recovery from current levels. Surpassing $0.155 would open the path toward $0.169 and potentially $0.182, assuming broader crypto market conditions improve.

Comments are closed.