Featured News Headlines

Ethereum Price Could Slide to $2,140 Amid Bear Flag Breakdown

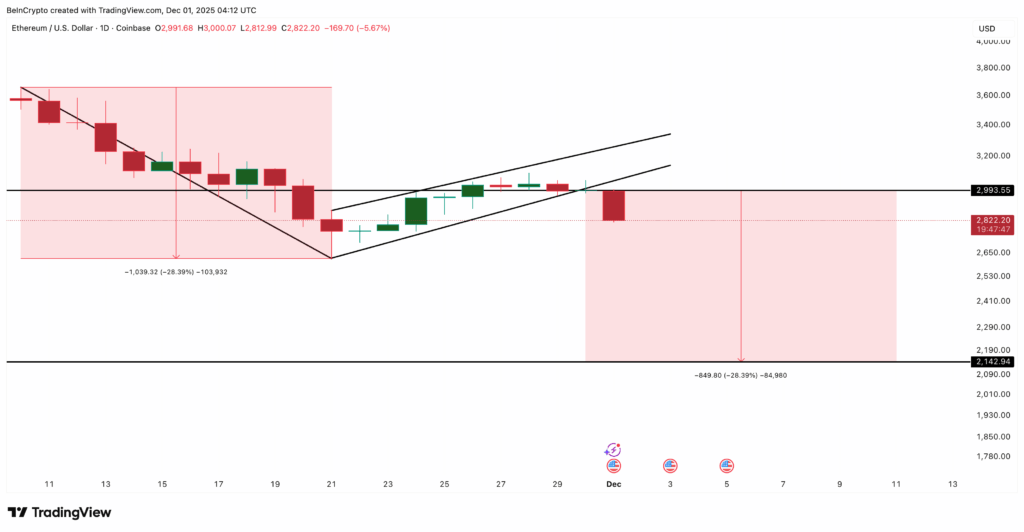

Ethereum (ETH) is under heavy pressure after a sharp sell-off wiped more than 6% from its price in the past 24 hours and pushed its 30-day decline to roughly 27%. A major breakdown from a continuation pattern has now opened the door to a potentially deeper fall—one that aligns with an on-chain signal hinting at a possible 28% downside window.

Source: TradingView

Bear Flag Breakdown Points Toward $2,140

ETH recently broke down from a clean bear flag, a move triggered after the asset failed to reclaim $2,990 and slipped below the rising channel it had maintained for a week. The initial drop that formed the pole measured 28.39%, giving the pattern a projected target near $2,140—almost exactly 28% below the breakdown level.

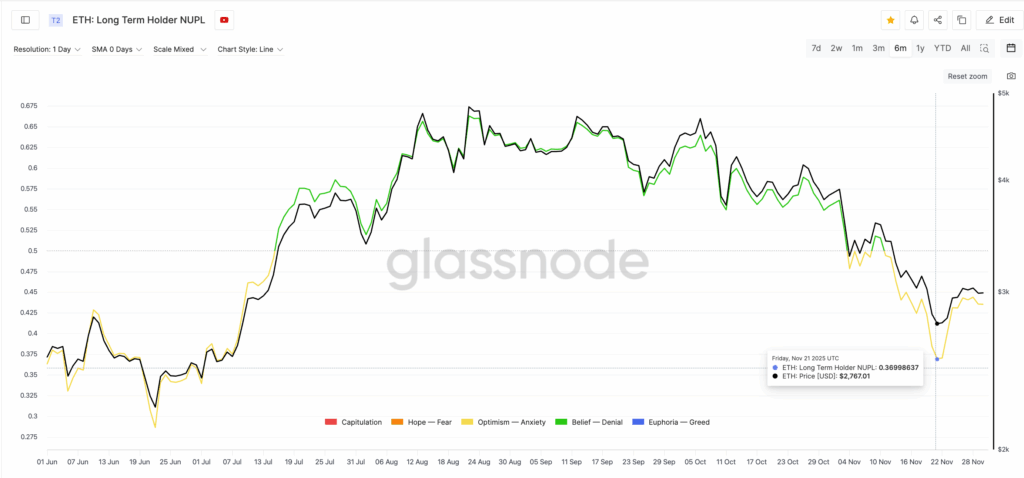

To validate this target, analysts are comparing price action to long-term holder NUPL, a metric that tracks unrealized profits. NUPL has been trending lower since August 22, showing long-term holders steadily reducing conviction. Its six-month low sits at 0.28, recorded on June 22, when ETH traded around $2,230 before rallying 116% to $4,820.

Source: Glassnode

If NUPL revisits that 0.28 zone again, the implied drawdown from ETH’s recent $2,990 high would fall in the 20–25% range, perfectly overlapping with the bear flag’s $2,140 target.

Strongest Support Zone Under Pressure

The Cost Basis Distribution Heatmap reveals Ethereum’s strongest support between $2,801–$2,823, where 3.59 million ETH were accumulated. With ETH already trading below $2,840, pressure on this support wall is mounting.

If sellers maintain control, downside targets stack up quickly:

- $2,690 (-4.5%)

- $2,560 (-4.6%)

- $2,440 (-4.8%)

- $2,260, near June’s NUPL bottom

Beneath them all sits $2,140, the full bear-flag projection.

Bullish Invalidation Requires Multiple Breaks

For the bearish structure to fail, ETH must first reclaim $2,840, then break back above $2,990 and secure a close over $3,090. Only a move through $3,240 would fully invalidate the pattern.

For now, ETH trades below its strongest cost-basis cluster, long-term holders continue shedding unrealized profit, and both on-chain and technical signals point to the $2,260–$2,140 region as the most likely zone for Ethereum’s next cycle bottom.

Comments are closed.