Featured News Headlines

QNT Price Rebounds with Exchange Supply Drop

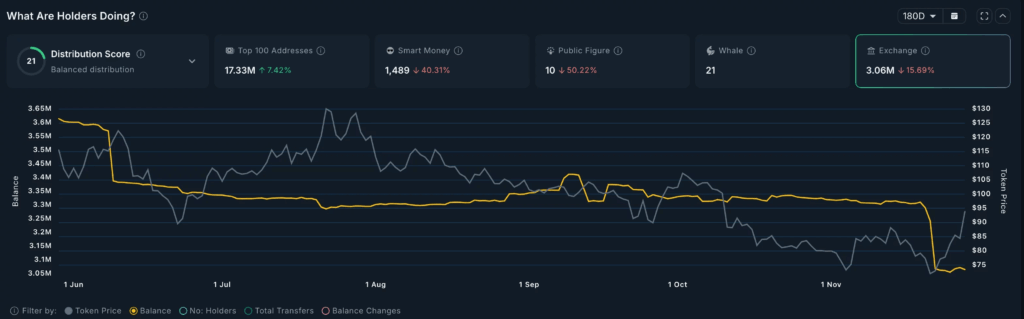

Quant (QNT) token retested the crucial resistance level of $100 on November 28, emerging as one of the top-performing cryptocurrencies of the day. The surge coincided with increasing market interest in the token, reflecting broader attention to real-world asset tokenization trends. According to Nansen data, exchange supply of QNT sharply declined this month, signaling that more investors are holding rather than selling their tokens.

The supply on exchanges fell to 3.06 million, down from a June high of over 3.6 million tokens. At current market prices, this indicates that investors have moved tokens worth more than $53 million off exchanges. Exchange outflows are generally interpreted as a bullish indicator, suggesting active accumulation by holders.

Meanwhile, futures market activity for Quant rebounded, with demand reaching $20 million, marking the highest point since October 10, when the crypto market experienced one of its largest-ever liquidations. Open interest in QNT futures has been gradually rising from this week’s low of $11 million, indicating renewed participation in derivatives markets.

QNT Gains Attention as RWA Token

Quant has drawn notable attention in recent months due to the real-world asset (RWA) tokenization theme. The project is widely recognized as an RWA-focused token, largely because of its Overledger product, now utilized by Oracle.

Overledger serves as an interoperability platform, enabling seamless communication and asset transfers across multiple blockchains and traditional financial systems. Market analysts note that Overledger is considered more advanced than platforms like Chainlink’s CCIP, offering broader integration capabilities.

In addition to Overledger, Quant developed QuantNet, which functions as an operating system for the RWA industry. QuantNet addresses fragmentation by connecting tokenized assets, tokenized money, and existing payment systems through a single layer. This approach simplifies the integration of real-world assets into blockchain infrastructure, further strengthening QNT’s reputation in the tokenization space.

Technical Indicators Signal Rebound

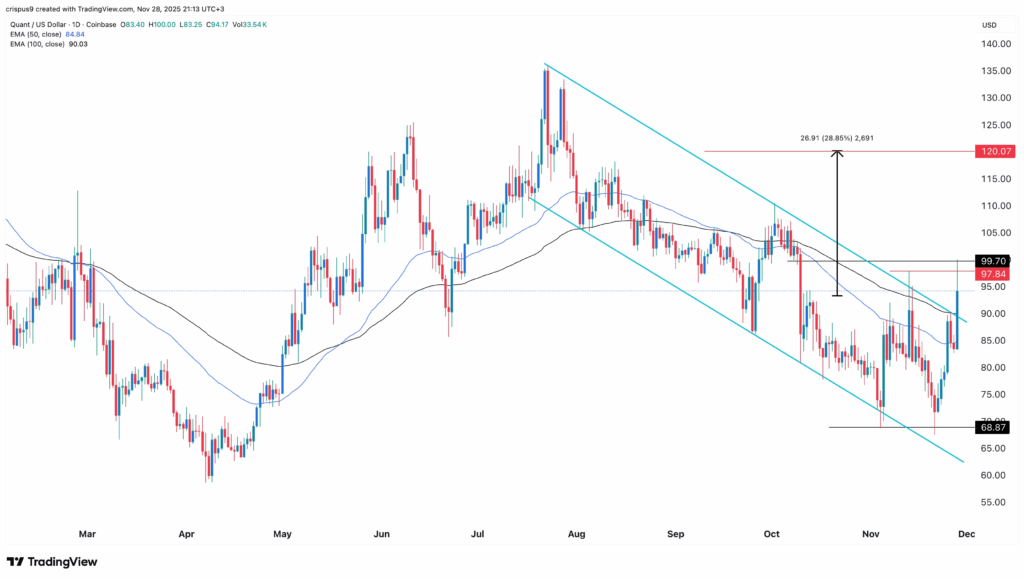

Technical analysis of QNT indicates a short-term recovery. On the daily chart, QNT rebounded to its highest level in a month after forming a double-bottom pattern at $68.87 and a neckline at $97.85, which was its peak on November 13.

The token has moved above the upper boundary of a descending channel, confirming a breakout from the previous downtrend. Additionally, QNT has surpassed both the 50-day and 100-day Exponential Moving Averages (EMAs), suggesting that bullish momentum is gradually strengthening.

Analysts highlight that the technical setup points to potential further upward movement, with $120 identified as a key resistance level, approximately 28% above the current price.

Exchange Flows and Market Behavior

The sharp reduction in QNT’s exchange supply reflects a broader trend of investor accumulation. Outflows from exchanges typically indicate that tokens are moving into long-term storage, either in private wallets or institutional custody, rather than being sold on the open market.

This dynamic, combined with increased activity in the futures market, demonstrates that the Quant ecosystem is experiencing both spot and derivatives market attention. Nansen’s metrics show that the decrease in circulating supply on exchanges aligns with a surge in investor confidence and market participation.

Real-World Asset Tokenization Drives Interest

Quant’s appeal is not only technical but also thematic. The token has become a key player in the RWA space, which has seen a surge in adoption in 2025. By enabling tokenized money and assets to interact with traditional financial systems, Quant provides practical applications for businesses and institutional investors looking to leverage blockchain for real-world operations.

Overledger’s cross-chain capabilities and QuantNet’s operating system approach allow for efficient asset management, interoperability, and reduced fragmentation. This integration has led to recognition from major technology partners and positions QNT as a prominent infrastructure token for tokenized assets.

Comments are closed.