Featured News Headlines

Fear & Greed Index Breaks Out of Extreme Fear — Is a BTC Rebound Coming?

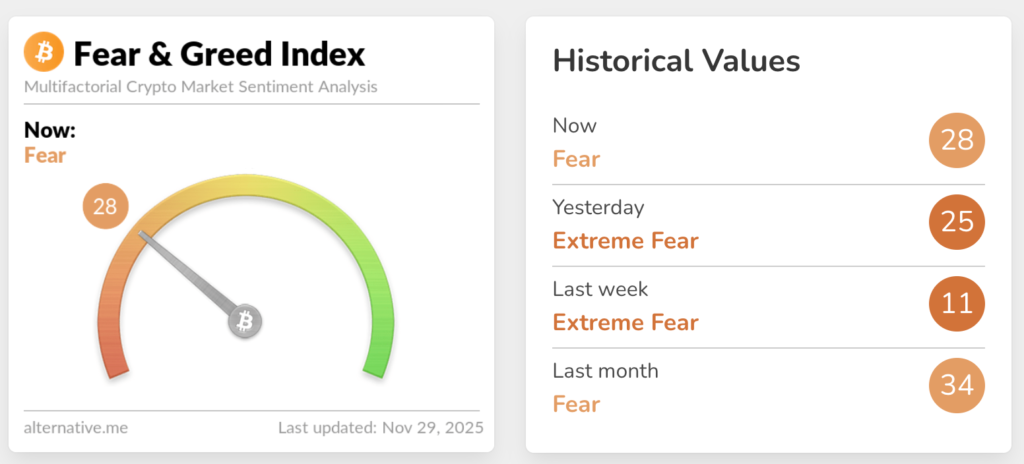

Crypto Sentiment Finally Recovers After 18 Days of Extreme Fear – After spending 18 straight days stuck at the bottom of a widely watched sentiment gauge, the crypto market is finally showing early hints of improvement. The Crypto Fear & Greed Index, a popular indicator measuring overall market mood, climbed to a “Fear” score of 28 on Saturday — the first time since Nov. 10 that it has risen out of the “Extreme Fear” zone.

Extreme Fear Dominated November Despite Bitcoin’s Historically Strong Month

The extended stretch of bearish sentiment throughout November did not go unnoticed, especially as the month has historically been Bitcoin’s best-performing period on average. Earlier this cycle, analysts flagged just how severe the pessimism had become.

On Nov. 15, analyst Matthew Hyland highlighted that the index had reached the “most extreme fear level” of the entire market cycle, suggesting maximum pressure on BTC dominance. By Nov. 23, analyst Crypto Seth went even further, calling the environment “an understatement” of extreme fear.

Yet not all experts viewed the panic negatively. Crypto trader Nicola Duke noted that every time the index has flashed extreme fear, it has historically marked a “local bottom” for Bitcoin. Sentiment data appeared to support this idea as the week progressed.

Bullish Signals Emerge as Bitcoin Rebounds Toward $92K

According to analytics platform Santiment, Bitcoin has recently shown “generally bullish sentiment”, supported by its climb back toward $92,000. The firm cited its social media bullish-to-bearish sentiment indicator, which reflected improving outlooks among traders.

Risk-Off Attitude Still Dominates the Market

Despite the shift in sentiment, broader market behavior suggests investors remain cautious. CoinMarketCap’s Altcoin Season Index currently sits at 22/100, firmly signaling “Bitcoin Season” and indicating that market participants prefer lower-risk exposure over speculative altcoins.

Institutional themes continue to dominate crypto discussions online — including ETF flows, treasury activity, and price volatility — but hesitancy persists.

On Friday, André Dragosch, head of research at Bitwise Europe, said Bitcoin’s current price trend appears misaligned with macroeconomic expectations, particularly rising forecasts of a recession.

“The last time I saw such an asymmetric risk-reward was during COVID,” Dragosch commented, underscoring the unusual market dynamics now unfolding.

Comments are closed.