Featured News Headlines

A Major Policy Shift in One of the World’s Most Closed Economies

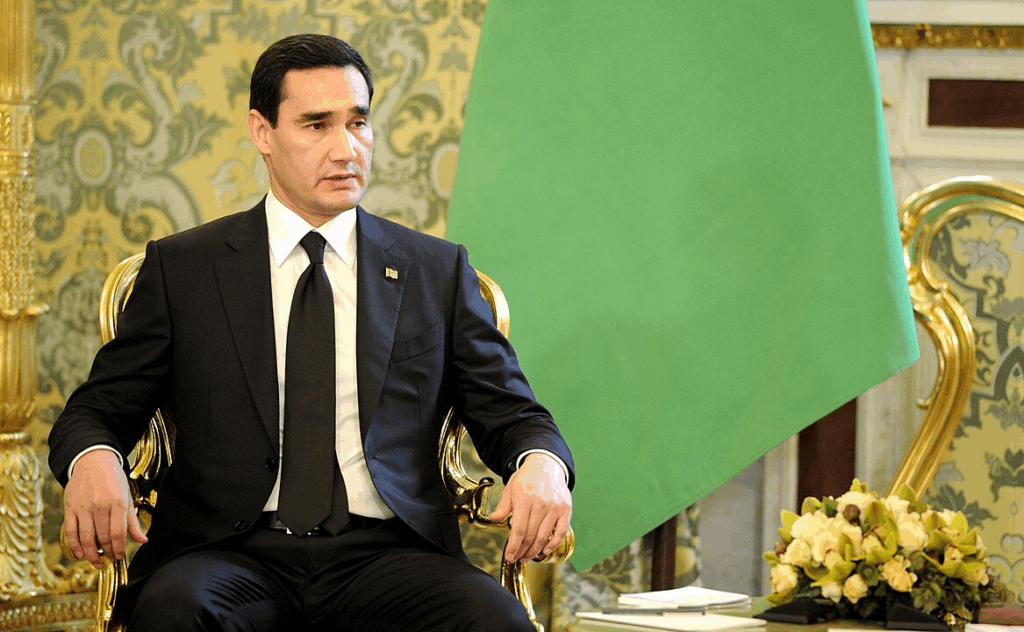

Turkmenistan has taken a dramatic step toward regulating digital assets, approving a sweeping cryptocurrency law that signals a major departure from its traditionally restrictive economic policies. As reported by Business Turkmenistan on Nov. 28, President Serdar Berdimuhamedov signed the comprehensive legislation, setting the stage for a controlled and highly monitored crypto environment starting in 2026.

Strict Licensing and Surveillance-Based Requirements

The new law introduces a detailed regulatory framework for crypto exchanges and custodial service providers, mandating strict licensing, know-your-client (KYC) procedures, anti–money laundering (AML) measures, and cold storagestandards. Notably, it prohibits local credit institutions from offering crypto-related services.

The legislation also grants the state authority to halt, invalidate, or order refunds of token issuances, marking one of the most interventionist digital-asset policies globally.

Additionally, all cryptocurrency mining and mining pool operators will be required to register with the government. The law bans covert or unregistered mining activity, hinting at a fully monitored ecosystem. It further stipulates that the Central Bank of Turkmenistan may approve specific distributed ledger technologies or even operate its own, a move that could enforce a permissioned and heavily surveilled blockchain infrastructure.

Digital Assets Classified as Backed or Unbacked

The law makes it clear that cryptocurrencies will not be recognized as legal tender, currency, or securities in Turkmenistan. Instead, digital assets are divided into two categories—backed and unbacked. Regulators will set liquidity standards, settlement rules, and emergency redemption procedures for backed assets.

These regulatory foundations were outlined during a government meeting on Nov. 21, where Deputy Chairman of the Cabinet of Ministers Hojamyrat Geldimyradov presented a report providing the “legal, technological, and organizational foundations” of Turkmenistan’s digital asset framework. The proposal included forming a special State Commissiondedicated to overseeing the sector.

Part of a Global Push Toward Crypto Regulation

Turkmenistan’s move comes as countries worldwide accelerate efforts to establish regulatory frameworks for crypto and stablecoins. Earlier this week, the United Kingdom’s tax authority proposed a new taxation model to ease the burden on decentralized finance users by deferring capital gains taxes until crypto assets are actually sold.

Similarly, Bank of England Deputy Governor Sarah Breeden noted that the UK will likely maintain regulatory alignment with the United States on stablecoin oversight, suggesting that major economies could move in concert as digital assets expand across payment systems.

Meanwhile, regulators are experiencing increasing pressure to adapt. Erik Thedéen, governor of Sweden’s central bank and chair of the Basel Committee on Banking Supervision, acknowledged that a “different approach” may be needed to the current 1,250% risk weighting for crypto exposures, after several countries declined to adhere to the existing rules.

An Authoritarian State Takes a Controlled Step Into Crypto

Turkmenistan, a landlocked Central Asian nation of roughly 7 million people, is known for its tightly controlled political system and vast natural gas reserves. The country’s government is widely regarded as one of the most authoritarian in the world, operating under a highly centralized presidential system and maintaining bans on platforms such as X and Telegram.

Despite its restrictive political landscape, Turkmenistan is now positioning itself to enter the digital asset sector—albeit through a highly regulated, state-controlled model. The nation is also known for its unusual landmarks, including a national holiday dedicated to melons, the massive “Door to Hell” gas crater that has burned for decades, and Ashgabat’s Guinness World Records for its white marble buildings and the world’s largest indoor Ferris wheel.

Turkmenistan’s new crypto law suggests that even the most closed states are beginning to adapt to the global shift toward digital finance—but entirely on their own terms.

Comments are closed.