Balancer’s Massive Recovery Plan Announced After Huge DeFi Hack

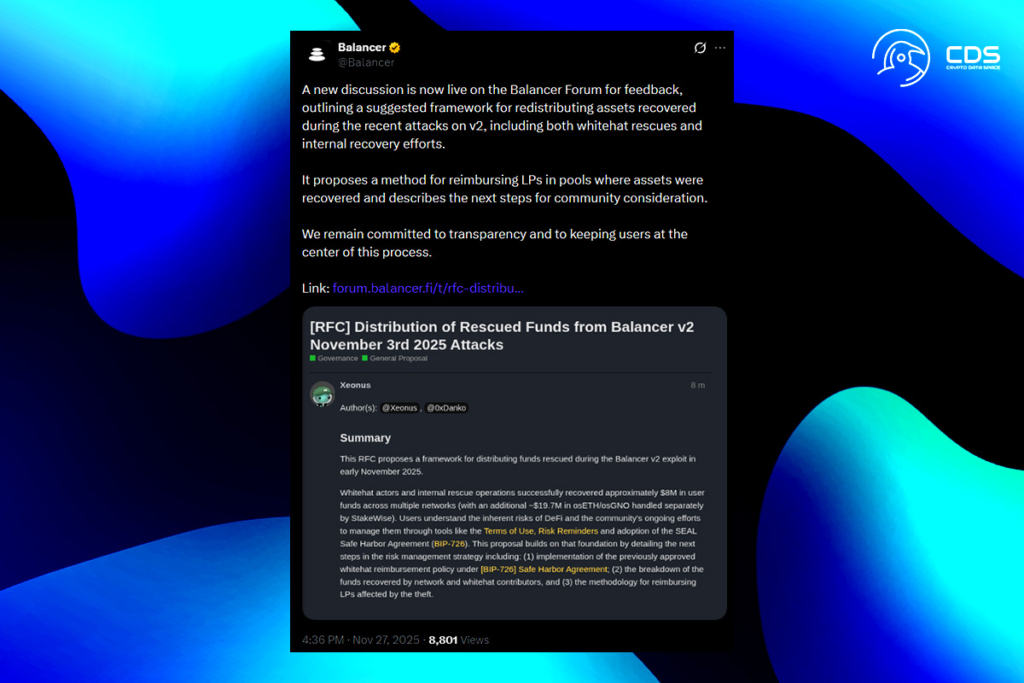

A proposal to refund millions of recovered assets to liquidity providers has been laid out by Balancer. This comes after an exploit that depleted its V2 pools of over $128 million. One of the biggest DeFi exploits of the year was this incident. Two members of the protocol community released the proposal on Thursday. It requests input on proposals to disburse approximately $8 million in funding, encompassing both internal recovery initiatives and whitehat rescues. According to the proposal, a combination of internal rescues, third-party efforts, and whitehat initiatives saved almost $28 million of the pilfered monies.

Incidents like this show how important it is for DeFi to have clear, real-time visibility into what’s happening on-chain. The more transparent and traceable protocols become, the faster the ecosystem can respond, contain damage, and recover funds.

Blockscout, an open-source block explorer for EVM-based chains

Liquidity Providers to Receive Full Reimbursement from Rescued Balancer Funds

Only the $8 million that whitehats and Balancer‘s internal teams directly retrieved is covered by the framework. The remaining $19.7 million in osETH and osGNO will be handled independently by the Ethereum-based liquid staking system StakeWise. StakeWise’s governance procedure will restore this cash to its customers.

The Safe Harbor Agreement, adopted by Balancer DAO, provides clear terms for whitehat interventions,

the proposal

The proposal stipulates that bounties cannot be kept directly from rescued assets and are given in the same tokens as recovered funds. The reimbursement strategy under the plan is non-socialized. This means that rather than distributing losses among all users, the recovered cash from each impacted pool will only be given to the liquidity providers of that particular pool and network. Holdings at particular snapshot blocks taken immediately prior to the initial exploit transaction will determine the distribution.

Whitehat Heroes to Receive 10% Bounties After Major Balancer Exploit

A 10% prize, up to $1 million per operation, will be awarded to Whitehat rescuers who intervened during the attack. According to the platform, this reimbursement is dependent on completing sanctions screening, KYC checks, and legal ID disclosure. Six whitehat players were listed in the proposal as having retrieved roughly $3.9 million from various networks during the exploit. Among these, recoveries of $2.68 million were led by anonymous whitehat “Anon #1” on Polygon, including:

- 8 million WPOL

- 6.8 million MaticX

- 2.9 million TruMATIC

- 72,000 stMatic tokens

In collaboration with the security company Certora, Balancer also carried out an internal rescue mission. From susceptible metastable pools, they retrieved an extra $4.1 million. These pools, which were spread over Ethereum, Optimism, and Arbitrum, were vulnerable but had not yet been taken advantage of.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.