Featured News Headlines

Proposal to Boost IBIT Option Contracts

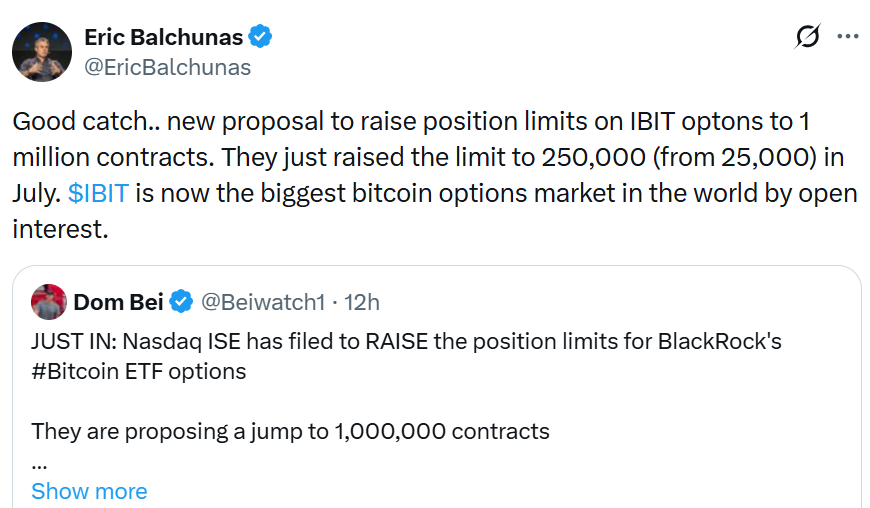

The Nasdaq International Securities Exchange has submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to raise the position limits for options on BlackRock’s iShares Bitcoin Trust (IBIT) from 250,000 contracts to 1 million.

Position limits are designed to prevent any single investor from controlling excessive contracts on the same asset, reducing the risk of manipulative strategies that could influence market prices, according to the SEC filing.

The Nasdaq cited a growing demand for IBIT as the reason for the proposed increase. “A lower limit would hinder trading activity and restrict investor strategies, including hedging and income-generating approaches,” the filing noted.

Analyst Perspectives on the Proposal

Vincent Liu, chief investment officer at quantitative trading firm Kronos Research, told Cointelegraph, “These adjustments are routine once an asset demonstrates it can handle real volume. If approved, expect thicker order books, tighter spreads, and a more efficient options market.”

Liu added, “Super-sizing IBIT option limits is a straight win for liquidity. Bigger traders can operate without friction, creating more depth, cleaner markets, and tighter spreads.”

Evolution of Crypto Derivatives

This move reflects the ongoing institutionalization of crypto derivatives. Nasdaq previously raised the limit from 25,000 to 250,000 contracts in January, after IBIT surpassed the 100 million shares trading volume threshold.

Liu commented, “Increasing IBIT option limits shows Bitcoin markets are moving beyond their training wheels. Larger participants can hedge, scale positions, and enhance price discovery. This is a clear sign crypto derivatives are shifting from niche instruments to essential market tools.”

He noted that higher limits could temporarily increase volatility but ultimately create more stable liquidity, allowing the market to function like a mature institutional venue with better fills and smoother flow.

BlackRock ETF Joins Mega-Cap Asset Class

Bitcoin analyst and author Adam Livingston emphasized the broader significance, stating that Nasdaq’s proposal places BlackRock’s Bitcoin ETF alongside the world’s largest and most liquid equities, including tech giants Apple and Microsoft.

“They did it because the market has already recognized Bitcoin as a mega-cap asset, whether regulators like it or not,” Livingston wrote. “This marks the moment Bitcoin transitions from a decentralized experiment into a fully regulated, institutional-grade asset class. Scaling options by 40× signals imminent demand expansion.”

Implications for Market Structure

The proposed limit increase reflects a growing trend where institutional investors are gaining more influence in cryptocurrency markets. With higher position limits, hedging efficiency improves, and order books become deeper, potentially enhancing overall price stability for Bitcoin-linked derivatives.

Liu summarized the institutional shift: “Bigger limits allow markets to operate like true professional venues. Liquidity is no longer fragmented, volatility is contained, and larger players can contribute to better price discovery.”

Nasdaq’s proposal signals a continued integration of Bitcoin ETFs into mainstream financial markets, bridging the gap between traditional equities and digital assets while fostering a more robust and scalable derivatives ecosystem.

Comments are closed.