Featured News Headlines

Pudgy Penguins Show Renewed Market Interest Amid Volatility

After a month of significant outflows that triggered a 49% price drop, Pudgy Penguins (PENGU) has started attracting renewed market interest. This shift has translated into an 11% price increase, yet analysts note that structural risks remain a potential challenge.

Structural Headwinds Ahead

PENGU faces a key technical barrier as it approaches a descending resistance trendline on the daily chart. Historically, this level has restricted strong upward momentum multiple times.

Although a clean break above the resistance, followed by a strong candle close, could signal a broader rally, overall market sentiment remains cautious. Meanwhile, retail investors in the spot market have viewed the recent gains as an opportunity to exit positions, either to cut losses or secure short-term profits. This behavior has added supply pressure and could slow PENGU’s advance toward the resistance zone.

Derivatives Traders Show Confidence

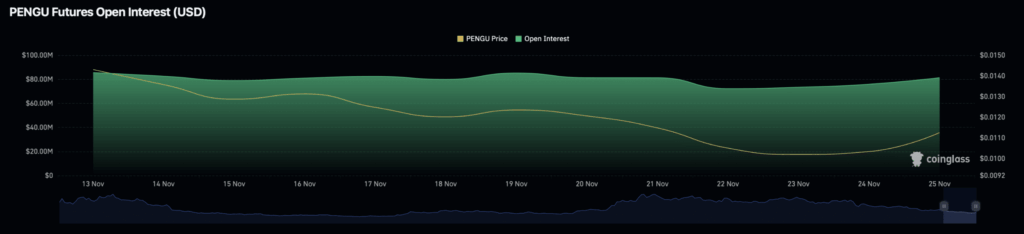

Despite pressure in the spot market, derivatives activity has remained largely bullish. At press time, the Funding Ratewas 0.0030%, signaling a gradual build-up of long positions. Open Interest also increased slightly, with roughly $10.14 million in new capital entering the market, largely driven by bullish traders.

Most long positions originated from OKX, and the Long/Short Ratio of 1.7 indicates that market positioning continues to tilt toward the long side. This alignment suggests that while spot investors are cautious, derivatives traders are maintaining positive exposure.

Indicators Highlight Accumulation

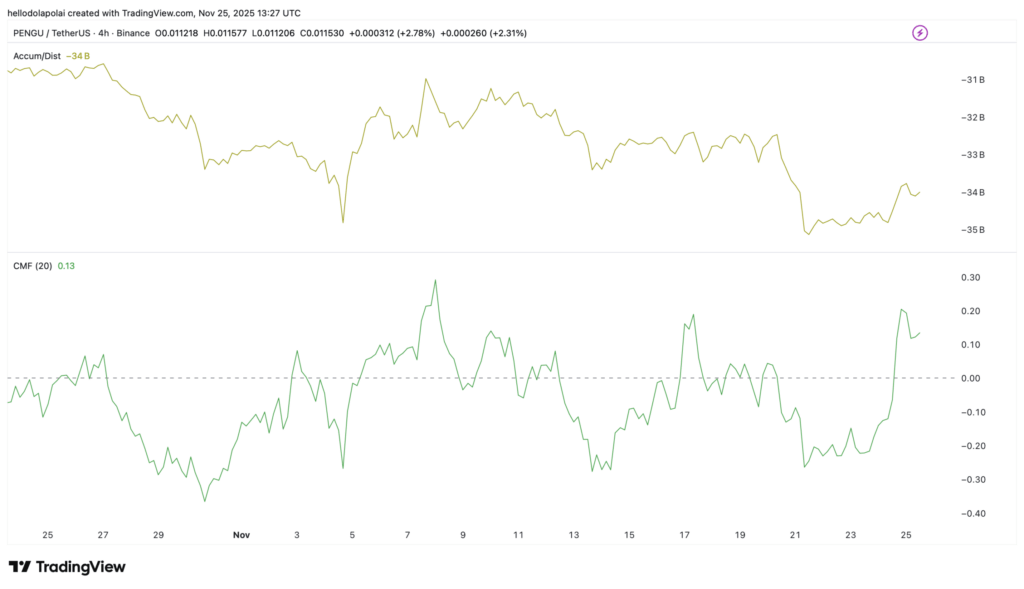

The Accumulation/Distribution (A/D) indicator shows that PENGU is currently in an accumulation phase, supported by rising volume. However, the prolonged downtrend over recent months has kept the A/D line in negative territory.

The Chaikin Money Flow (CMF) offers additional insight, trending above zero and confirming stronger buying pressure in the market. If this upward momentum continues alongside ongoing accumulation, it may point to a more constructive technical environment over the longer term.

Market Outlook Remains Cautious

In summary, PENGU has regained attention following steep outflows, yet it faces structural resistance and supply pressure from retail exits. Bullish activity in derivatives markets and accumulation indicators suggest that longer-term technical conditions could improve if current trends persist.

The current convergence of market signals highlights the delicate balance between short-term volatility and potential structural recovery for PENGU, emphasizing that key technical levels will play a major role in the asset’s near-term trajectory.

Comments are closed.