Featured News Headlines

Ethena Buyers Step In as ENA Shows Momentum Recovery

Recent on-chain activity highlights aggressive accumulation pressure for Ethena (ENA), as a wallet linked to the project acquired 25 million ENA worth $6.7 million from Bybit. This purchase raised the wallet’s total holdings to 285.15 million ENA, signaling heightened conviction among large stakeholders near a structurally important zone.

At press time, ENA traded around $0.2624, marking a 7.97% 24-hour gain, reinforcing the narrative of strategic accumulation as buyers step in during a fragile market phase. Repeated acquisitions by this entity suggest confidence at current valuations and a deliberate approach to building positions over time.

ENA Holds Demand Zone Support

ENA continues to trade within the $0.22–$0.28 demand region, following months of compression inside a descending channel. The recent rebound from the channel’s lower boundary indicates strengthening buyer interest at a critical technical level.

The RSI has risen to near 37, showing early signs of momentum recovery after a period of exhaustion. Stability above $0.25 further highlights the ongoing importance of this support region. If buyers maintain traction, ENA could target the channel’s midline to reinforce a stronger technical foundation.

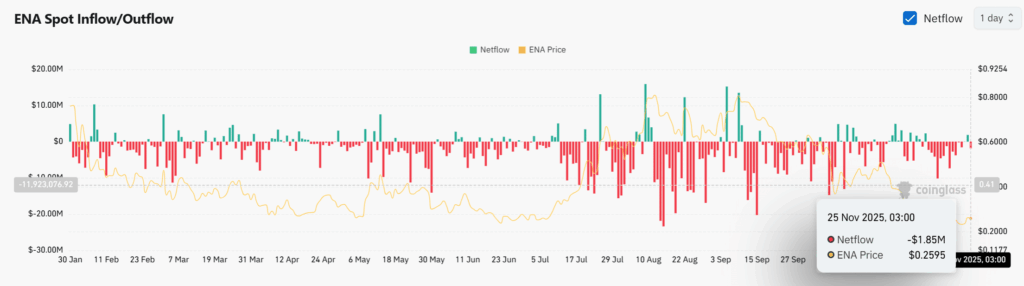

Exchange Outflows Signal Reduced Sell-Side Pressure

Net outflows of $1.85 million from exchanges continue a broader trend of ENA leaving trading platforms, reflecting a preference for off-exchange holding. Multi-week negative netflow patterns suggest sustained accumulation at current levels.

These outflows, when considered alongside recent whale purchases, create a synchronized accumulation signal, indicating that supply pressure is easing and potential structural rebounds may be more likely.

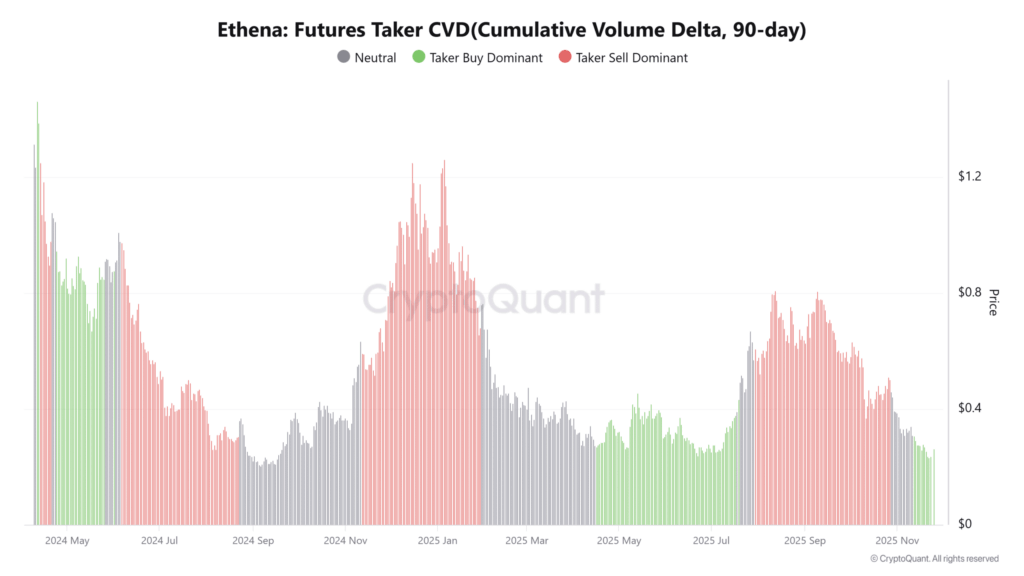

Consistent Buy-Side Momentum

The Taker Buy CVD shows strong dominance across a 90-day window, with market buys outweighing sells despite ENA’s overall downtrend. This trend suggests informed traders may be accumulating early, while sellers struggle to exert meaningful control.

This buy-side strength aligns with whale accumulation and increasing stability in the demand zone, creating a confluence of signals that historically precede directional shifts. If this momentum persists, derivatives flows may support a future rebound.

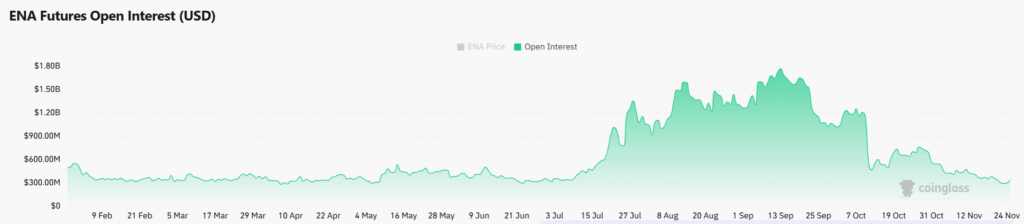

Open Interest Expands at Key Levels

Open Interest (OI) has climbed 9.34% to $334.94 million, indicating heightened participation as traders expand exposure near ENA’s macro support. Increased OI during compression phases often precedes sharp volatility, particularly when combined with strong buy-side CVD dominance.

Leveraged activity also appears to favor bullish positions, further emphasizing engagement at critical structural levels. If this trend continues, ENA could attempt a stronger move away from the bottom of its descending channel.

Comments are closed.