KAS Token Rally Fueled by Derivatives, On-Chain Metrics Signal Caution

Kaspa (KAS), the layer-1 blockchain token, has drawn significant attention this week after experiencing a notable inflow of new capital. While derivatives activity has fueled a strong upward push, several on-chain indicators suggest that the current momentum may not be fully supported by the broader network fundamentals.

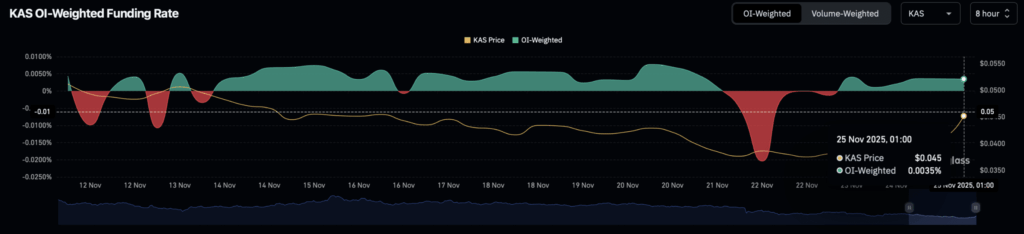

Derivatives Inflows Drive the Latest Rally

Kaspa’s derivatives market recorded a sharp surge in participation over the past 24 hours, marking one of the most active trading sessions for the token in recent weeks. According to market data, open interest reached $66.92 million, representing a 42% increase within a single day.

Of the additional $27.9 million injected into open interest, the majority appeared to come from bullish traders. This shift was reflected in the positive OI Weighted Funding Rate of 0.0035%, suggesting that most of the new liquidity was deployed by traders opening long positions in anticipation of continued upside.

Analysts caution, however, that rallies driven primarily by high leverage can carry heightened risks. As one market observer noted, “when a price move accelerates due to leveraged positioning rather than organic demand, the likelihood of a swift reversal increases.”

On-Chain Activity Signals Market Hesitation

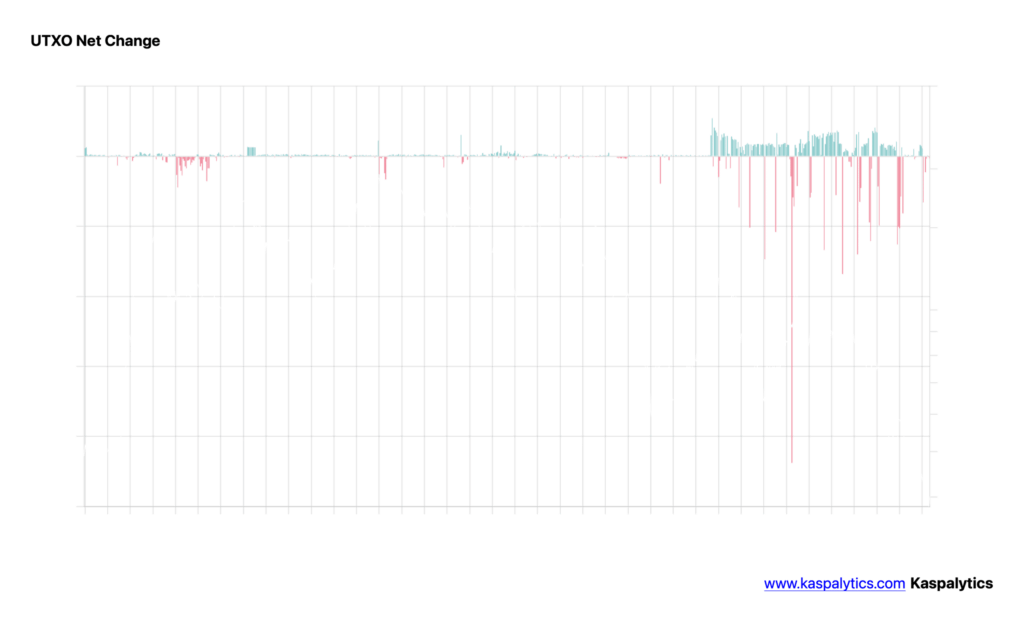

Despite strong derivatives activity, multiple on-chain indicators show weakening engagement within the Kaspa network. One of the clearest signals comes from the Unspent Transaction Output (UTXO) metric. UTXO readings typically suggest accumulation when positive and distribution when negative. Current readings point toward reduced willingness among holders to keep long-term positions.

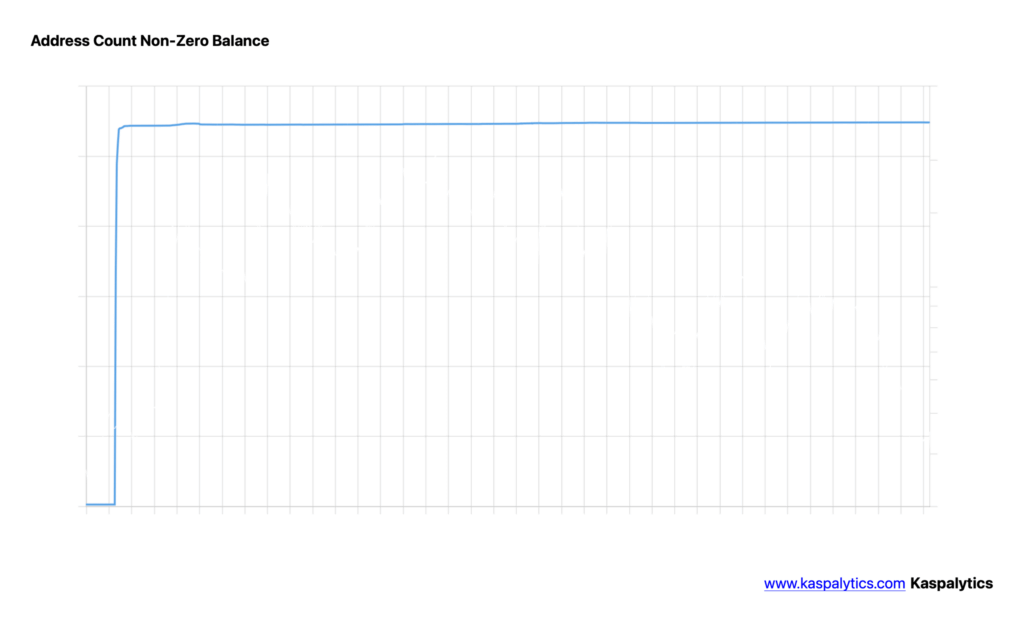

Network activity has also declined significantly. Data from Kaspalytics reveals that active unique addresses fell from 513,110 on 11 November to just 11,770, marking a dramatic 97.72% decrease. This sharp contraction raises concerns about declining user participation and fading confidence in Kaspa’s long-term traction.

Similarly, overall account balances and transactional activity have slowed, adding to doubts about whether the latest rally can be sustained without a corresponding rise in network usage.

Comments are closed.