Featured News Headlines

XPL Slumps 11%: Is the Massive Unlock to Blame?

Plasma lost more than 11% in recent hours, standing out as the broader market traded green throughout the day. XPL joined Starknet among the day’s worst-performing tokens, both posting double-digit losses. After the post-launch excitement faded, XPL continued its downtrend into bearish territory.

Token Unlock Creates Selling Pressure

The first wave of selling was triggered by the massive unlock scheduled for November 25th. Approximately 88.88 million XPL, worth $18.13 million, is set to hit the market. This figure represents the largest of the sector’s weekly $80 million in total token unlocks.

More than 80% of the supply remains locked. However, anticipation of this unlock created significant selling pressure on the token. Investors chose to exit positions ahead of the supply increase.

During the launch phase, an airdrop worth approximately 10,000 XPL was distributed to early users. This airdrop initially supported the rally, but as excitement waned, the price began cooling off.

On-Chain Data Shows Weak Performance

Stablecoin TVL has fallen 68% since October. On a weekly basis, the decline reached 8.24%. Stablecoin market cap hovers around $1.82 billion while total TVL slipped to $6.695 billion.

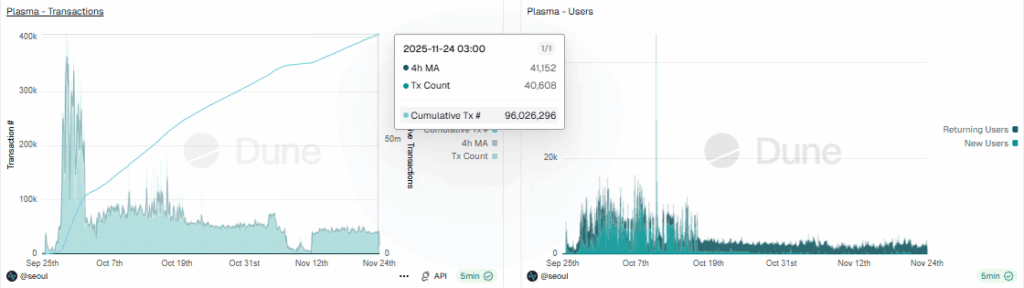

Bridge protocols account for $5.79 billion of that figure. Although cumulative transactions hit a new high, daily activity slowed down. Transaction count declined from 42,398 to 39,725.

Daily new users stood at just 137 while returning users totaled 1,831. DEX volume dropped to $8.39 million at press time from its peak of $47.81 million on November 19th.

Usage metrics have generally trended downward since late October. This decline reflected in price charts and weakened the token’s momentum.

Technical Indicators Show Bear Dominance

On the charts, XPL displays a clear bearish structure, trading within a trend channel. The token lost more than 36% over the past five days. This drop continues the post-launch bubble burst.

The Bull Bear Power indicator has favored bears for the past five days. Net volume sits at negative $5.07 million. Bears are gaining momentum, and if this dominance continues, the next target appears at $0.15.

Conversely, breaking above the upper resistance would invalidate the current bearish scenario. However, sellers currently show more momentum, suggesting further downside ahead.

Strong Signal Needed for Recovery

XPL remains predominantly bearish, with on-chain activity following the same trajectory as price. A resurgence in bullish action could reverse direction, but the price hasn’t shown any such signs yet.

The coming days are critically important for XPL. How supply pressure is managed after the token unlock and whether investor interest returns will be worth monitoring. Current technical and fundamental indicators justify a cautious stance in the short term.

Comments are closed.