Featured News Headlines

Ethereum Price Alert: $2,710 Support Crucial as Selling Pressure Mounts

Ethereum (ETH) has rebounded nearly 10% from this week’s lows around $2,600, and the price is up roughly 1% today. While this short-term recovery appears positive, underlying market signals suggest the bounce may be fragile, with two major bearish indicators emerging simultaneously.

Hodler Selling Surges 300% Amid Market Fear

The first red flag comes from long-term Ethereum holders, often referred to as hodlers. These wallets typically hold ETH for 155 days or more, and their behavior often reflects confidence—or panic—among long-term investors. On November 22, net selling from these wallets reached about 334,600 ETH, but just one day later, it skyrocketed to 1,027,240 ETH, marking a 300% one-day spike.

This sharp increase in selling indicates heightened fear and adds substantial supply to an already weakening market, pressuring ETH prices even as the short-term bounce unfolds.

Death Cross Signals Mounting Downside Momentum

At the same time, Ethereum’s 50-day exponential moving average (EMA) is approaching a critical point beneath the 200-day EMA, forming a classic death cross. This technical pattern is widely seen as a signal of strong downward momentum, often coinciding with further price declines.

What makes the current scenario more concerning is the timing: hodler selling is surging precisely as the EMA structure turns bearish, reinforcing negative sentiment and threatening the sustainability of the recent recovery.

Key Ethereum Support Levels Under Threat

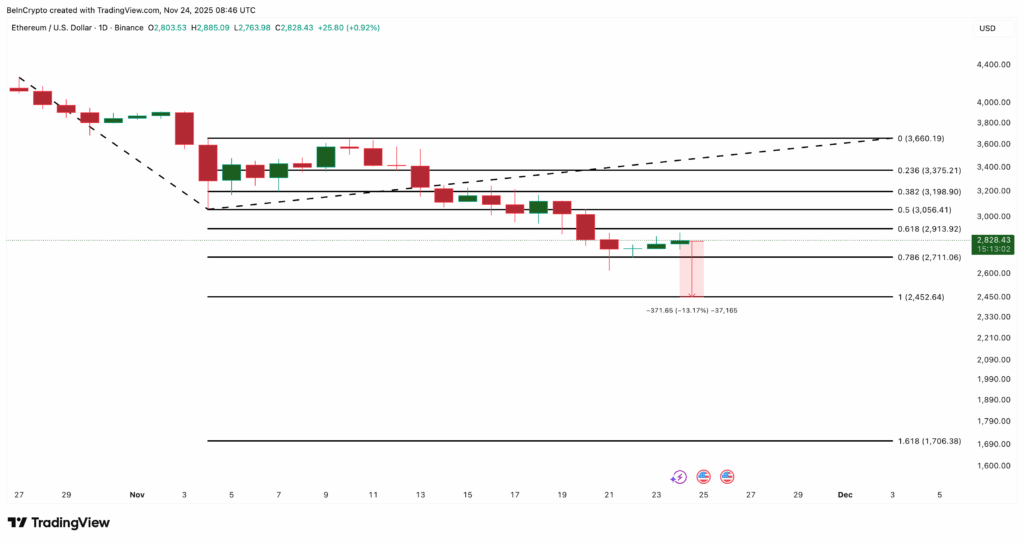

Currently, ETH trades near $2,820, but chart analysis reveals more pressure from above than from supportive zones below. The first critical level for Ethereum to defend is $2,710, aligning with the 0.786 Fibonacci retracement zone. If this level breaks, Ethereum could retest $2,450, a potential 13% drop from current prices.

Should the death cross complete while hodler selling remains elevated, ETH could slip further, with $1,700 emerging as the next significant support level, reflecting a deeper extension of the descending trend.

Limited Upside Unless Resistance Is Reclaimed

On the upside, recovery appears constrained unless Ethereum can climb past key resistance zones: $3,190 for the first meaningful hurdle and $3,660 to indicate a potential trend reversal. Given the simultaneous bearish signals—the death cross setup and hodler selling surge—these levels seem challenging to achieve in the near term.

What This Means for Ethereum Traders

While a bounce from $2,600 offers temporary optimism, Ethereum’s short-term outlook remains vulnerable. Traders should be aware of the mounting downside pressure from long-term holders exiting positions and the technical implications of the impending death cross. Under these conditions, recoveries may be short-lived, with lower support zones likely to be tested before any sustained upward momentum can occur.

Comments are closed.