Featured News Headlines

Whale Goes Long on ETH With $44.5M Position Amid Market Recovery

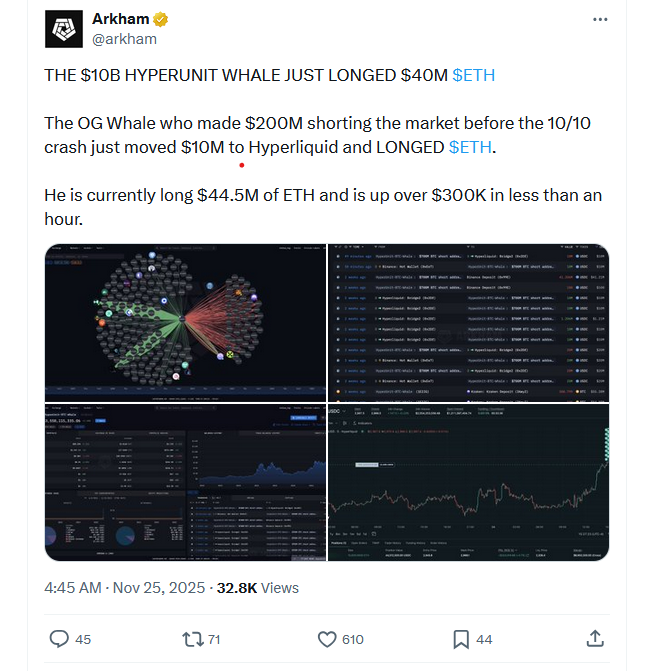

The famous Hyperliquid whale who made approximately $200 million from October’s market crash has now placed a major bet on Ethereum. The mysterious investor known as “OG Whale” or “$10B HyperUnit Whale” added $10 million to an existing long position on Monday. According to Arkham Intelligence data, the total position size reached $44.5 million.

$300K Profit in Under an Hour

Arkham Intelligence summarized the whale’s status in a post on X platform. “He is currently long $44.5M of ETH and is up over $300K in less than an hour,” the statement read.

The whale gained notoriety last month through several well-timed short positions. Each time, they captured perfect timing and secured significant gains. If proven right again, they’ll capitalize substantially on Ethereum’s potential rally.

ETH gained 2% over the past 24 hours alongside the broader crypto market recovery. According to CoinGecko data, it’s currently trading around $2,900.

The Whale’s Identity Remains Unknown

Arkham Intelligence lists the wallet owner as an “unverified custom entity.” Although the identity remains uncertain, some blockchain detectives have uncovered clues. Garret Jin, former CEO of defunct crypto exchange BitForex, denied owning the wallet.

However, Jin’s statements last month indirectly confirmed a connection to the whale. Blockchain researchers revealed some links by examining wallet movements. Still, the definitive identity remains a mystery.

Is the Market Forming a Bottom?

Industry analysts and experts are pointing to changes in futures data. Futures market indicators suggest the crypto market may be forming a bottom. However, whether bulls or bears will take control hasn’t yet become clear.

The whale’s large ETH long position shows experienced investors expect upward movement in Ethereum. Given their past successful predictions, market participants are closely monitoring this move.

A Risky But Bold Move

The $44.5 million position represents both confidence and risk. The whale previously profited from short positions, but now expects a long-term rally. This strategy shift may signal a possible reversal in market sentiment.

As volatility remains elevated, such large bets are being carefully tracked. Ethereum’s performance in the coming days will reveal whether the whale’s move was accurate. For market participants, this action could be an important signal of a potential trend change.

Comments are closed.