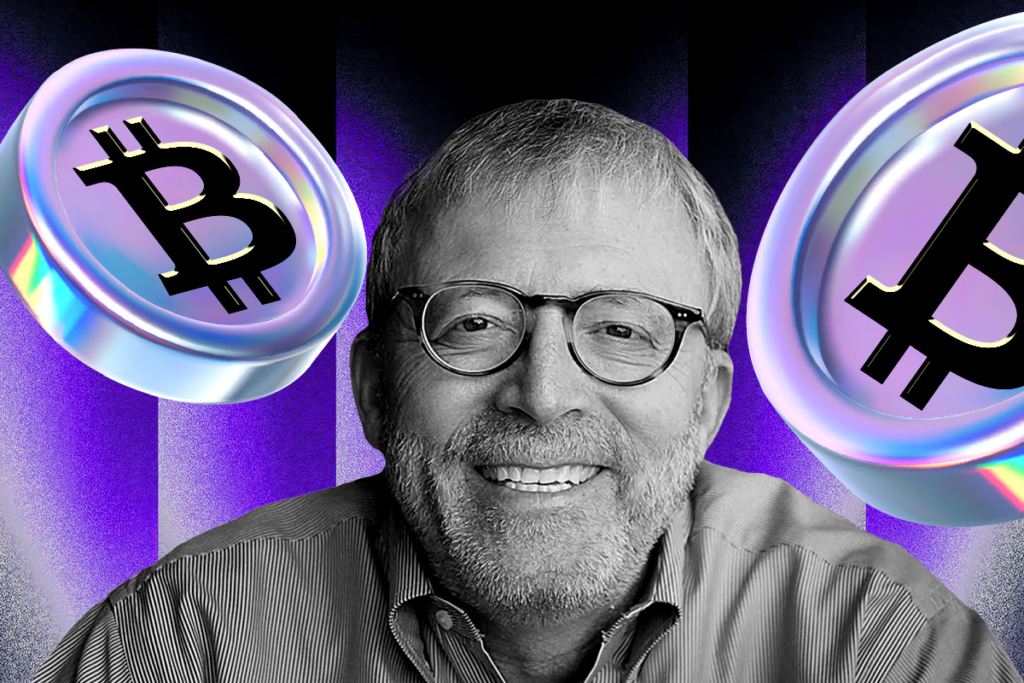

Bitcoin Needs Close Above $92K to Defy Corrective Pattern, Says Peter Brandt

Peter Brandt turned his attention to Bitcoin (BTC) this week, highlighting a chart featuring a hand-drawn “dead cat” figure. According to Brandt, Bitcoin’s two-week slide from above $120,000 to the low $80,000s represents a full five-wave corrective pattern, with only a basic rebound expected on the other side. His chart emphasizes the $88,000 to $92,000 range, which has been the market’s sticking point for days, marking the zone that traders should be watching closely.

Market Liquidity Weakens Amid ETF Outflows

Recent market data supports Brandt’s cautious view. Liquidity has thinned across major exchanges, with widening bid-ask spreads and shallower order books. Bitcoin ETF flows have been erratic: BlackRock’s IBIT experienced several net outflow sessions, while smaller products showed mixed results. The inflow patterns observed earlier in the quarter have largely disappeared, leaving the market more reactionary than proactive.

“Dead Cat” or Bear Trap?

The recent breakdown revealed over $1.2 billion in long positions, indicating that positioning has lightened but not strengthened. There has been no aggressive dip-buying, and BTC has struggled to reclaim key support levels that would indicate strong demand. The overall structure remains corrective, signaling that the market is still digesting previous gains rather than resetting bullishly.

Brandt notes that if Bitcoin closes above $92,000, it would invalidate the dead-cat-bounce scenario and signal renewed market optimism. However, if BTC fails to breach this ceiling, the downside structure will remain dominant, keeping caution in control for traders.

Bitcoin’s current setup underscores a market caught between technical correction and tentative recovery, with liquidity dynamics and key resistance levels dictating the next critical moves.

Comments are closed.