Grayscale’s DOGE and XRP ETFs Get Final NYSE Approval Ahead of Trading Debut

Crypto ETF Boom – The New York Stock Exchange (NYSE) has officially approved the listing of Grayscale’s Dogecoin and XRP exchange-traded funds (ETFs), clearing the way for both products to debut on Monday. The move marks another significant step in the rapid expansion of crypto-themed ETFs across U.S. markets.

Grayscale’s DOGE and XRP ETFs Receive Final Green Light

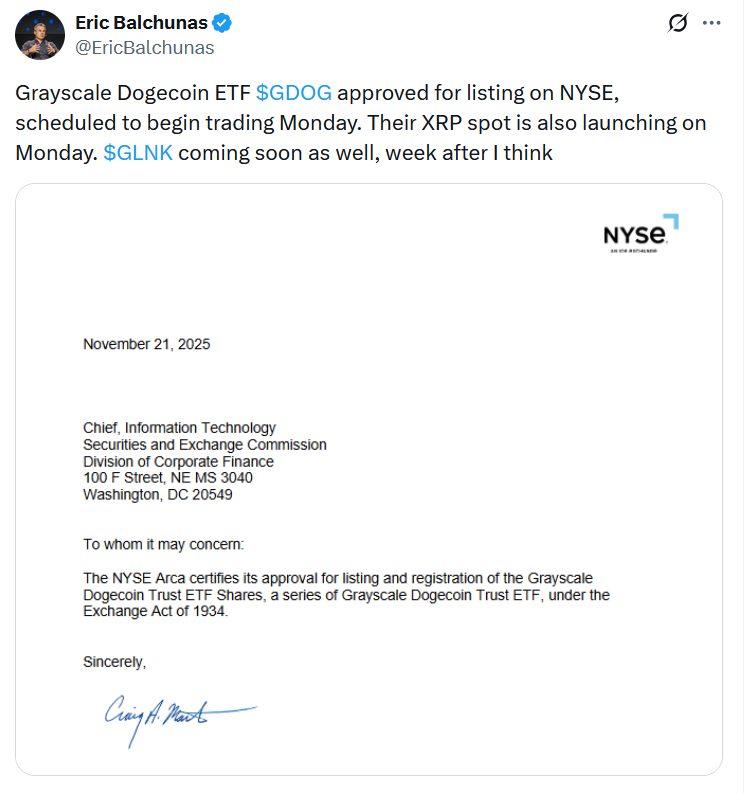

In a filing submitted Friday, NYSE Arca — a subsidiary of the exchange — notified the Securities and Exchange Commission (SEC) that it had certified its approval to list the Grayscale XRP Trust ETF (GXRP) and the Grayscale Dogecoin Trust ETF (GDOG).

Bloomberg senior ETF analyst Eric Balchunas shared the approvals on X, adding that Grayscale’s upcoming ETF tied to Chainlink (LINK) is expected to follow “in the next week or so.”

“Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday,” Balchunas said, noting that “$GLNK coming soon as well.”

The NYSE’s sign-off represents the final regulatory step for Grayscale’s spot Dogecoin (DOGE) ETF, which converts the firm’s existing DOGE trust into a fully tradable ETF tracking Dogecoin’s price. Balchunas estimated that GDOG could see around $11 million in first-day volume.

XRP ETFs Surge as Competition Intensifies

Grayscale’s GXRP ETF will enter a rapidly crowding field. It is expected to launch alongside a competing XRP ETF from Franklin Templeton, while WisdomTree is also preparing its own offering. The first U.S. spot XRP ETF — Canary Capital’s XRPC — launched on Nov. 13 and drew over $250 million in inflows on its first day.

Since then, Bitwise, 21Shares, and CoinShares have all introduced XRP ETFs, contributing to a wave of new products hitting the market following the end of the U.S. government shutdown and the SEC easing its scrutiny of crypto ETFs.

However, despite the flood of new investment vehicles, XRP has fallen roughly 18% since early November, according to CoinGecko — a reminder that ETF launches don’t always translate into immediate price strength.

Comments are closed.