Featured News Headlines

What the Coinbase Premium Index Shows

The Coinbase Premium Index measures the percentage difference between Bitcoin’s price on Coinbase—widely used by U.S. institutions trading in USD—and Binance, where global retail activity is concentrated in USDT. A positive premium typically indicates stronger U.S. demand, while a negative premium reflects softer buying interest or heightened selling pressure from U.S. markets.

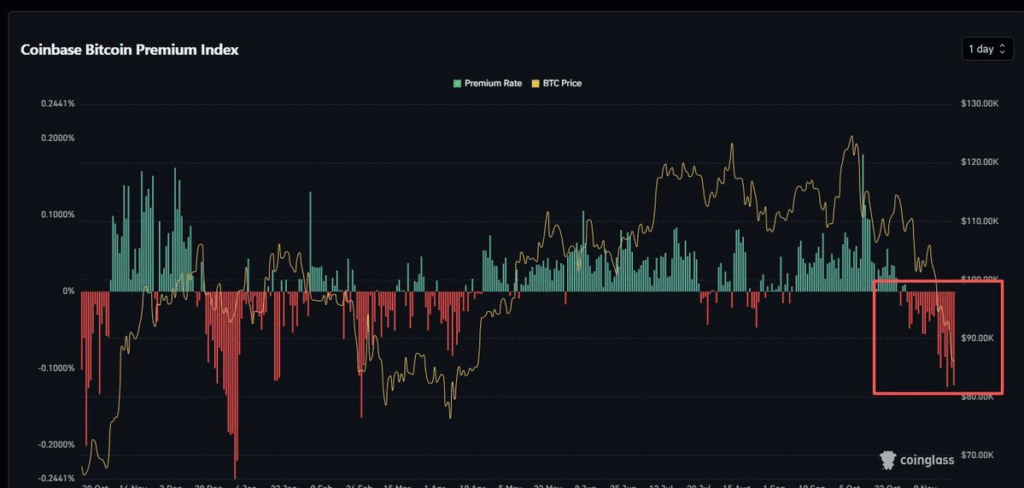

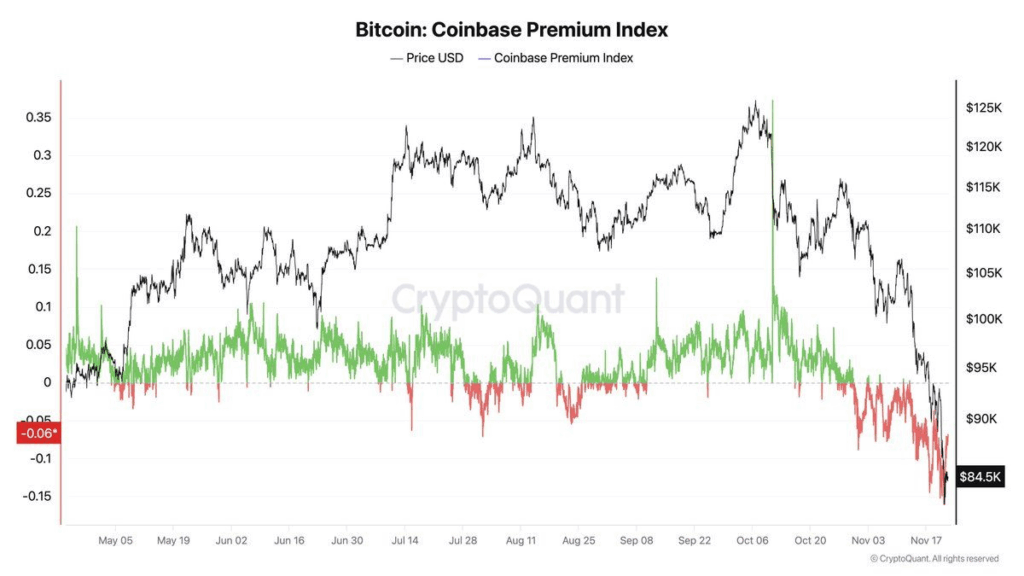

In the recent cycle, the index has recorded 21 consecutive days of negative readings, an unusually extended streak for a metric that normally swings between positive and negative territory. Coinglass data shows a consistent stretch of red bars, mirroring Bitcoin’s broader market softness. After previously topping $120,000, Bitcoin has slid to around $84,500 as of November 24, 2025.

Institutional Pressure and the Shift in Market Behavior

Insights from analysts highlight the role of institutional flows behind the persistent negative premium. CryptoQuant CEO Ki Young Ju remarked that U.S. institutional sentiment remains weak, pointing to an hourly Coinbase premium reading of -0.06, which he described as evidence of continued caution among larger domestic traders.

Analyst Giannis added that the market’s latest downturn “is primarily driven by aggressive institutional selling on Coinbase rather than retail capitulation.” He noted that global buyers have not been able to counterbalance this wave of selling, preventing Bitcoin from establishing a stronger support level. Historically, meaningful trend reversals tend to occur once the premium returns to neutral or positive territory.

Open interest data also reflects this dynamic. Futures open interest has climbed from below 20,000 contracts in late October to roughly 70,000 by mid-November. Rising open interest amid falling prices often signals an increase in short positioning, reinforcing the presence of bearish sentiment.

Weekend Effects and Short-Term Mean Reversion

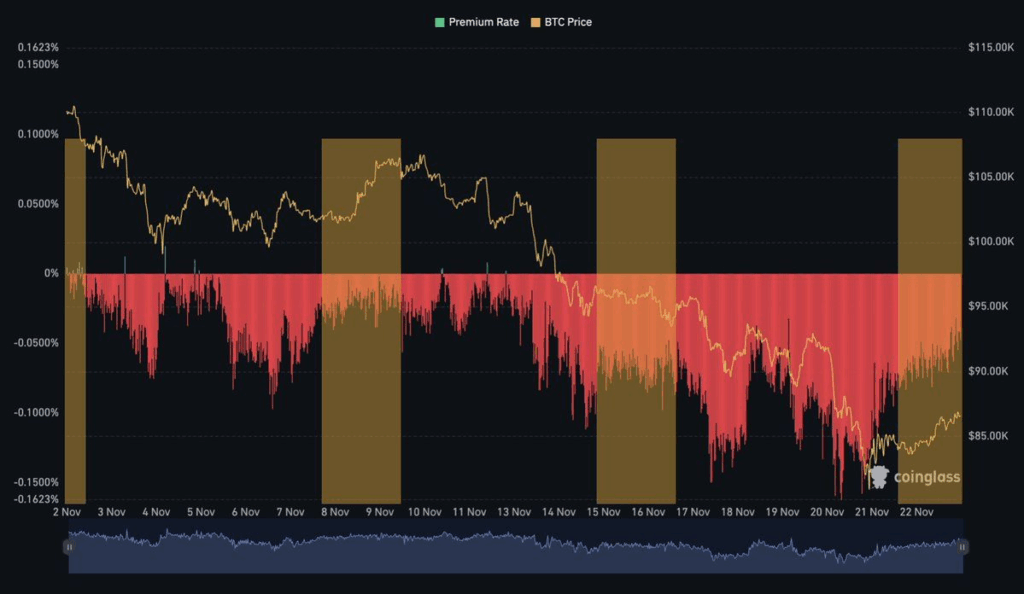

Some analysts argue that the negative premium does not uniformly imply bearish momentum. Market watcher CryptoCondom highlighted recurring weekend patterns, stating that “ETF flows and major U.S. sellers typically step back on weekends, allowing the premium to drift toward zero.” This pause in institutional activity often aligns with short-term price stabilization or mild gains.

Charts tracking recent weeks show a clear contrast between weekend improvements—when the premium rises—and weekday declines, when institutional activity resumes and selling pressure intensifies. This cycle underscores how U.S. market behavior influences Bitcoin’s intraday and weekly volatility.

What This Means for Market Outlook

The ongoing negative premium suggests that Bitcoin may not yet have formed a durable bottom. Historically, a shift back toward neutral or positive premium levels has coincided with renewed institutional demand and improved market tone. Until such a shift occurs, any rebound may remain vulnerable to renewed selling from U.S. participants.

Current conditions share similarities with past capitulation phases, yet the sustained negative premium implies that selling pressure has not fully dissipated. Market observers continue to watch for signs of stabilization in U.S. trading flows, which could mark the beginning of a more constructive phase.

A return to a neutral or positive Coinbase Premium would represent a potential turning point—indicating a reduction in selling pressure and a change in institutional behavior. Until then, caution appears likely to guide short-term market expectations.

Comments are closed.