Featured News Headlines

ETH Price Drops Below $2,900 as Institutional Selling Rises

Ethereum (ETH) is facing increasing selling pressure, with major holders such as SharpLink continuing to liquidate their positions. Ongoing outflows from U.S. Ethereum Spot ETFs and rising ETH reserves on exchanges are reinforcing the bearish market sentiment. ETH has lost more than 20% of its value in November, and losses are expected to widen in the coming days.

SharpLink Sells $33.5 Million Worth of ETH

According to Onchain Lens data, SharpLink—the first publicly traded company to hold Ethereum as its primary asset—sold 10,975 ETH on the Galaxy Digital OTC exchange. The sale amounted to approximately $33.54 million.

Following this significant transfer by SharpLink, Ethereum’s chart structure weakened. ETF outflows and increasing ETH reserves on exchanges are among the indicators reflecting this weakness. Institutional investors reducing their exposure is creating psychological pressure on retail investors.

Seven Consecutive Days of ETF Outflows

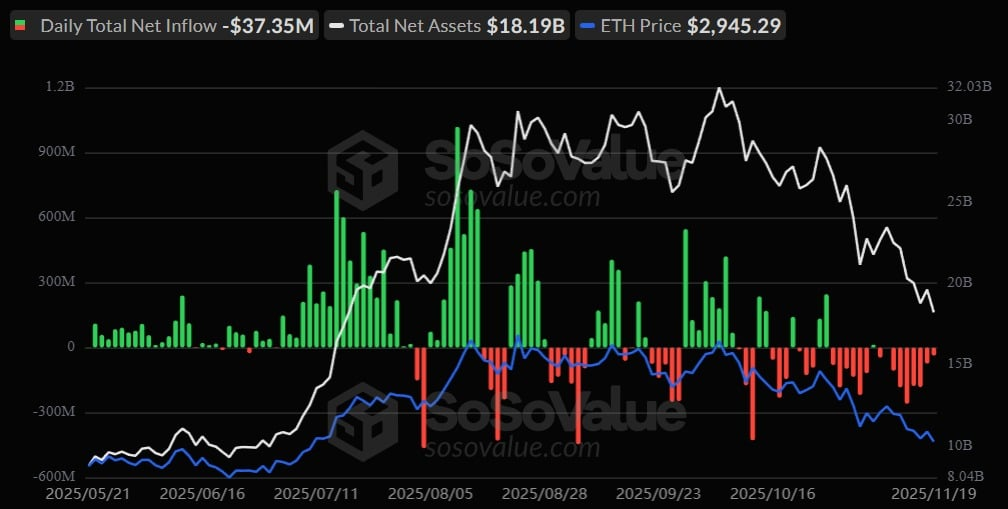

According to on-chain analytics platform SoSoValue, U.S. Ethereum Spot ETFs recorded outflows for seven consecutive days. Total outflows reached $1.022 billion during this period, indicating that American investors have been withdrawing capital from these funds.

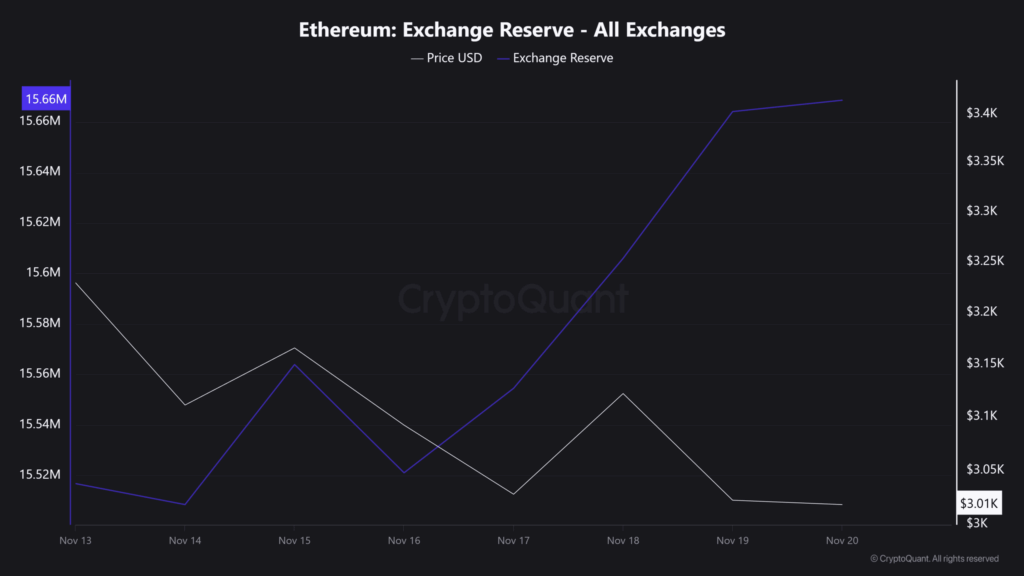

These figures point to declining interest and strengthen the bearish outlook. It is not just institutions—crypto investors in general also appear to be offloading ETH holdings. CryptoQuant data reveals a significant increase in Ethereum reserves across all exchanges over the past week.

Investors and long-term holders sold a total of 152,426 ETH during the week. The impact of this selling is clearly visible in the price charts, with ETH dropping below $2,900. Meanwhile, some traders and investors showed strong interest in the asset, reflected in a 22% increase in trading volume, which rose to $38.55 billion.

When trading volume rises while price declines, it typically suggests that market participants are reinforcing a bearish trend. Increasing volume often indicates the presence of a strong trend, and at the moment, that trend is downward.

Technical Analysis Points to $2,750

According to AMBCrypto’s analysis, Ethereum is currently in a downtrend. After breaking a key support level, further decline appears likely. ETH could fall to the $2,750 level.

However, this bearish outlook will only be confirmed if ETH continues to trade below $3,000 on the charts. At the time of publication, Ethereum’s Average Directional Index (ADX) stands at 43.60. This is above the key threshold of 25, indicating strong directional momentum.

A high ADX value signals the strength of the current trend. Values above 25 suggest a high likelihood of trend continuation, while a level like 43.60 indicates a particularly strong move.

Market Liquidity at a Critical Stage

Ethereum’s performance in the coming days will depend on liquidity conditions and overall crypto market dynamics. If selling pressure from institutional and retail investors persists, the $2,750 target may materialize.

On the other hand, an unexpected wave of buying or positive macro developments could reverse the trend. The $3,000 level currently stands out as a critical pivot point, and the duration for which ETH remains below this threshold will determine the strength of the bearish scenario.

Comments are closed.