Featured News Headlines

Ethereum Dips After Fed Minutes, $2,800 Emerges as Key Support Zone

Ethereum (ETH) briefly fell to $2,870 on November 19, marking its lowest level since July, after the release of Federal Reserve minutes stirred market uncertainty. Despite the pullback, on-chain indicators and analyst insights suggest the second-largest cryptocurrency may be forming a short-term bottom, supported by strong fundamentals and institutional activity.

Fed Minutes Spark Market Volatility

The drop followed the October 28–29 Fed meeting minutes, which revealed a divided stance on a potential December interest rate cut. While some officials opposed a cut, others stated it “could well be appropriate,” fueling uncertainty across both traditional and crypto markets. The news pushed Bitcoin to a seven-month low and dragged Ethereum near $2,870, though it later recovered to around $3,036, still down 1.13% for the day.

On-Chain Support Near $2,800

Analysts highlight $2,800 as a strong on-chain support zone, aligning with realized price clusters of retail traders and whales. Historically, these levels have coincided with market bottoms, providing potential foundation for a rebound. Current data shows retail selling while whales with 10,000+ ETH continue accumulating. Reduced forced long liquidations and growing short positions increase the likelihood of a short squeeze in the coming days.

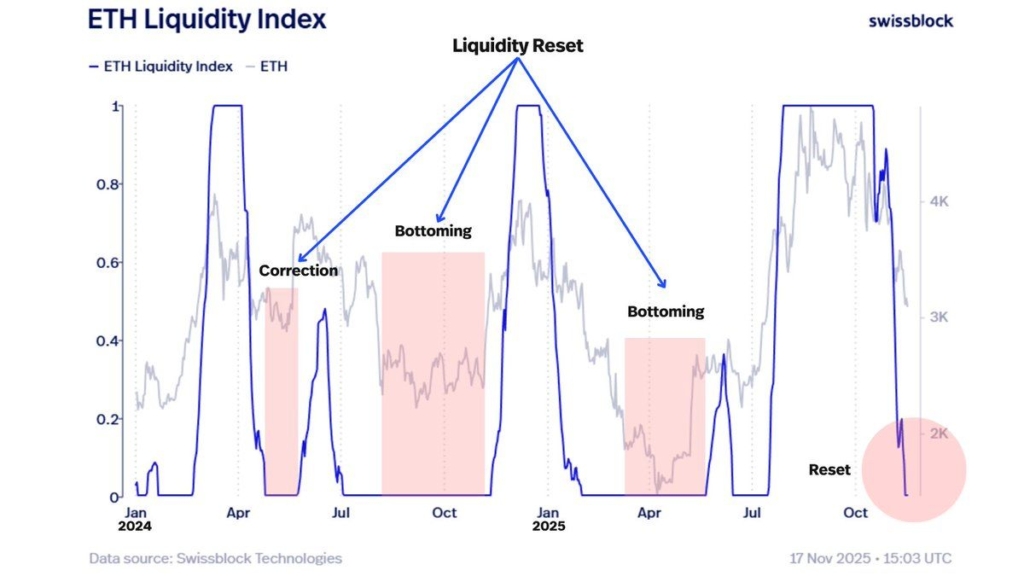

Liquidity Reset Signals Possible Bottom

Altcoin Vector notes that Ethereum just experienced a liquidity reset similar to previous major bottoms. Historical patterns suggest these events often precede multi-week bottoming periods rather than outright breakdowns, offering a potential window for consolidation before the next growth leg.

Institutional Accumulation and Network Fundamentals Remain Strong

Despite price turbulence, network fundamentals remain robust. ETH staking reached a record high of over 33 million tokens in November 2025. Institutional interest is also rising, with firms like BlackRock advancing their iShares Staked Ethereum Trust ETF. Meanwhile, exchange reserves have dropped by more than 1 million ETH, reflecting aggressive accumulation.

The convergence of on-chain support, whale accumulation, shrinking exchange reserves, and record staking paints a bullish structural outlook. Whether Ethereum embarks on a sustained recovery will depend on broader macroeconomic trends and overall market sentiment.

Comments are closed.