Bitcoin Falls to $90K as Short-Term Holder Accumulation Signals Potential Recovery

Bitcoin (BTC) has slid to $90,000, marking its lowest level in seven months after several days of steady decline. While the drop may raise eyebrows, market indicators suggest it could serve as a strategic accumulation opportunity rather than a sign of prolonged weakness.

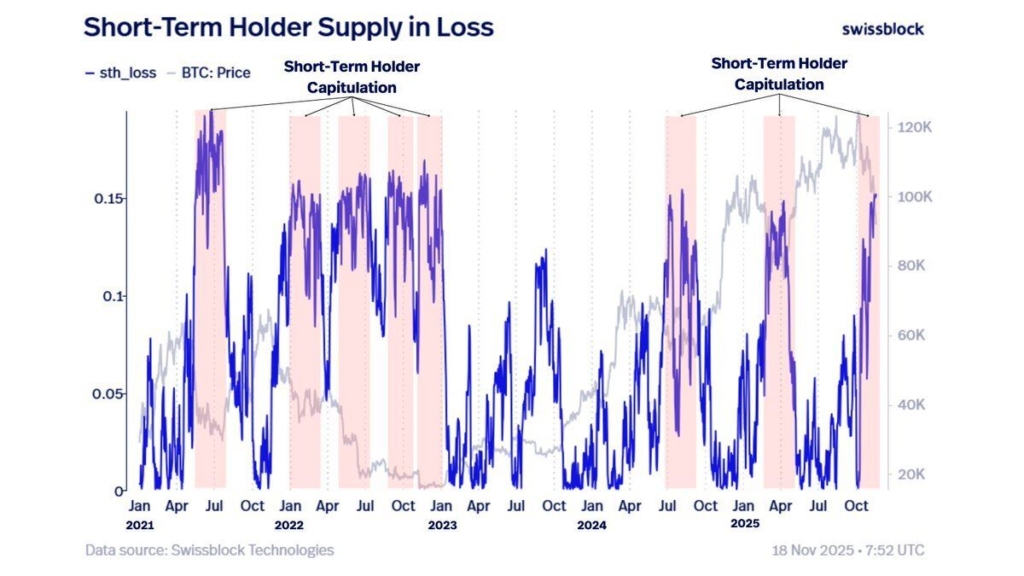

Accumulation by Short-Term Holders Signals Stabilization

Data from Swissblock reveals that Short-Term Holder supply in loss has surged to levels historically associated with medium-term bottoms. These spikes often occur just before recovery phases, reflecting extreme market stress without triggering panic selling. Analysts note that these patterns indicate a bottoming window rather than the start of a deeper bear market.

In parallel, macro momentum is showing positive signs. Exchange net position change has flipped back to outflows after a brief period of inflows. Over the past 24 hours, more than 20,167 BTC worth $1.82 billion exited exchanges, signaling growing investor confidence. Sustained outflows typically suggest long-term conviction, as coins are moved into storage rather than traded, reinforcing the narrative that the market is preparing for potential upside.

BTC Price Holds Key Support

Bitcoin currently trades at $90,331, maintaining a critical support level at $89,800. Historical patterns and current investor behavior indicate that a deeper drop is unlikely. A bounce from this support could see BTC climb back toward $95,000 as confidence strengthens.

However, analysts caution that if bullish momentum fades and broader market weakness intensifies, Bitcoin could slip below $89,800, potentially falling toward $86,822. Such a scenario would invalidate the current bullish thesis and point to a deeper retracement.

With strong accumulation, exchange outflows, and behavioral indicators aligning, the market may be setting the stage for a near-term recovery, making this period a potential opportunity for investors seeking strategic entry points.

Comments are closed.