Featured News Headlines

HBAR Faces Selling Pressure as Correlation with Bitcoin Soars

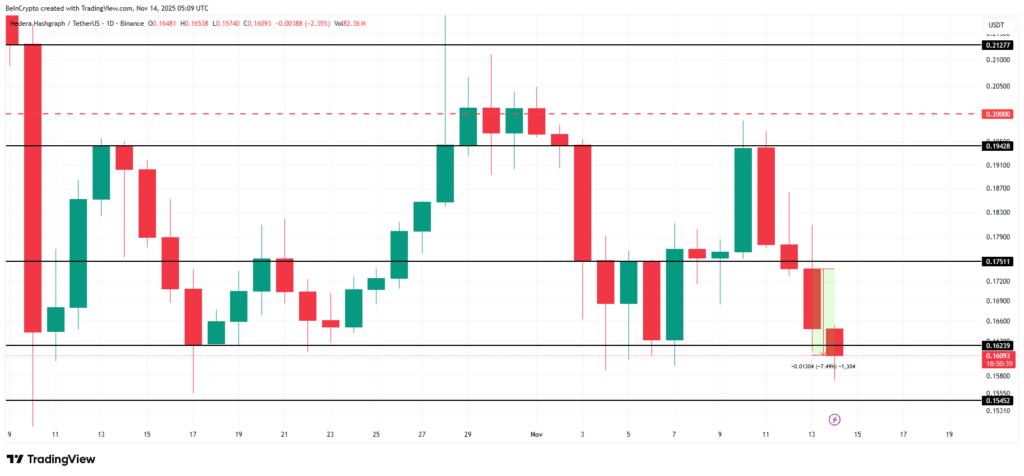

Hedera (HBAR) declined 7.5% over the past 24 hours, dropping to the $0.160 level. Its correlation with Bitcoin has climbed to 0.76, while BTC’s fall below $100,000 directly impacted HBAR’s performance. The break of the critical $0.162 support level signals new weakness for the altcoin.

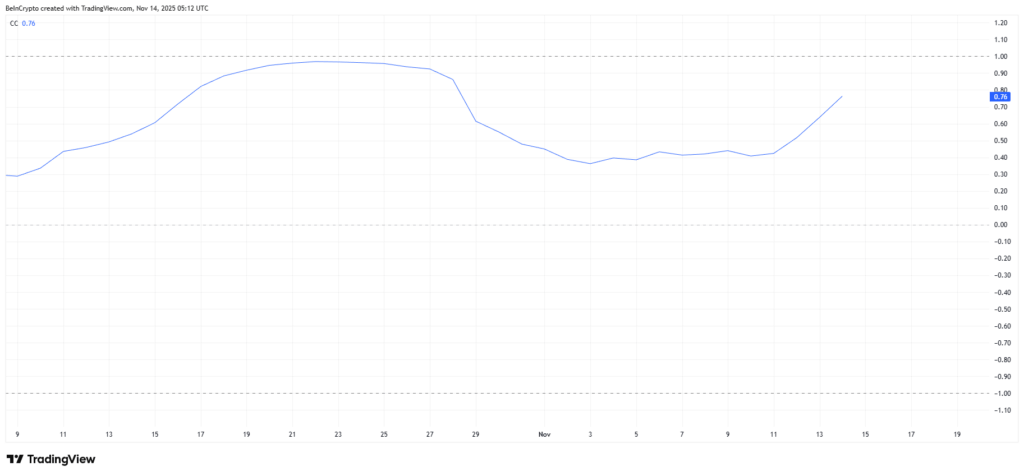

Bitcoin Relationship Amplifies Risk

HBAR’s correlation with Bitcoin has recently surged to 0.76. This figure indicates the altcoin is closely tracking BTC’s movements. Under normal conditions, this relationship offers opportunities to benefit from positive Bitcoin momentum.

However, the current market environment is working in reverse. Bitcoin’s drop below $100,000 today broke a psychological barrier for investors. HBAR simultaneously lost its own critical support and experienced a synchronized decline.

This parallel movement reveals how vulnerable correlated assets become during downturns. Particularly when overall market sentiment turns defensive, such connections amplify volatility and magnify losses across linked tokens.

Technical Indicators Signal Outflows

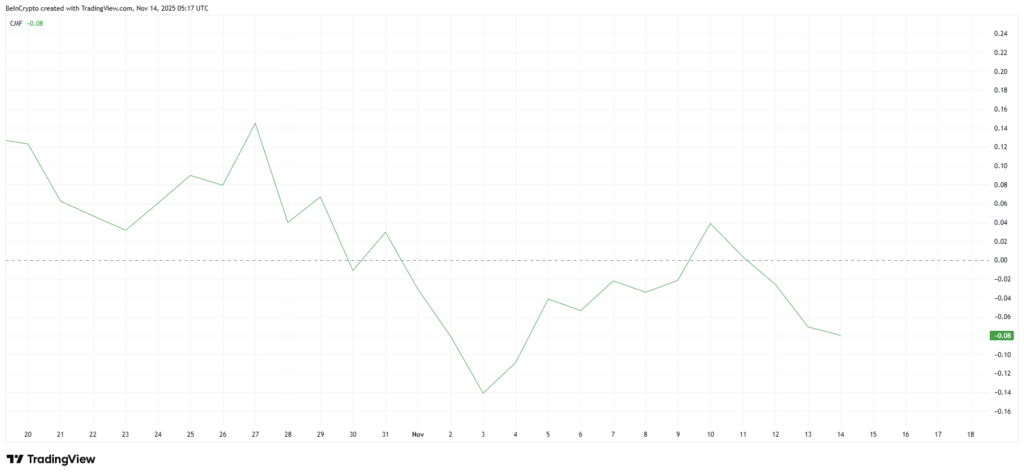

Hedera’s macro momentum shows signs of weakening as technical indicators point toward sustained outflows. The Chaikin Money Flow (CMF) indicator is sliding deeper into negative territory. This movement reflects declining accumulation and suggests buyers are pulling back.

Sellers currently control short-term direction, painting an unfavorable picture for HBAR. Without incoming liquidity, the token faces difficulty recovering from recent losses.

Investor support serves as a key driver of upward momentum. The absence of this support limits potential for a meaningful rebound. Until inflows stabilize, HBAR will likely struggle to hold higher levels on the chart.

Critical Support Level Lost

HBAR’s drop below $0.162 marks a significant breakdown point. This level had served as crucial support, preventing deeper losses several times over recent weeks. Trading below this support now introduces new risks for the token.

Continued decline below the broken support could push the price toward $0.154 or even lower levels. Such a move would increase investor losses and potentially trigger additional selling pressure.

Rising uncertainty across the broader market may encourage short-term traders to exit their positions. This situation carries the potential to intensify pressure on HBAR and accelerate downward movement.

Is Recovery Scenario Possible?

If HBAR reclaims the $0.162 support, the token could regain stability and target a move toward $0.175. A successful break above that level may open the path toward $0.192.

Such a scenario would invalidate the current bearish outlook and restore confidence among cautious investors. However, achieving this requires stabilization in Bitcoin first and renewed buying pressure returning to HBAR.

In the coming days, the behavior of critical support levels and Bitcoin’s trajectory stand out as key factors determining HBAR’s short-term direction. Investors should closely monitor these levels for effective position management and risk assessment.

Comments are closed.