Featured News Headlines

Could Trump’s $2,000 Plan Trigger a Bitcoin Rally?

A controversial proposal from the White House has caught the attention of crypto investors. The Donald Trump administration is working on a payment plan of $2,000 for American households earning less than $100,000 annually. While Treasury Secretary Scott Bessent has confirmed the income threshold, the structure remains unclear—whether payments will come as direct checks or tax relief is still undecided.

Economists warn that both options face serious budget and legislative hurdles. However, the crypto sector is watching this development closely, as past stimulus cycles show that similar payments increased liquidity flow into risk assets like Bitcoin.

How Did Previous Stimulus Checks Impact Bitcoin?

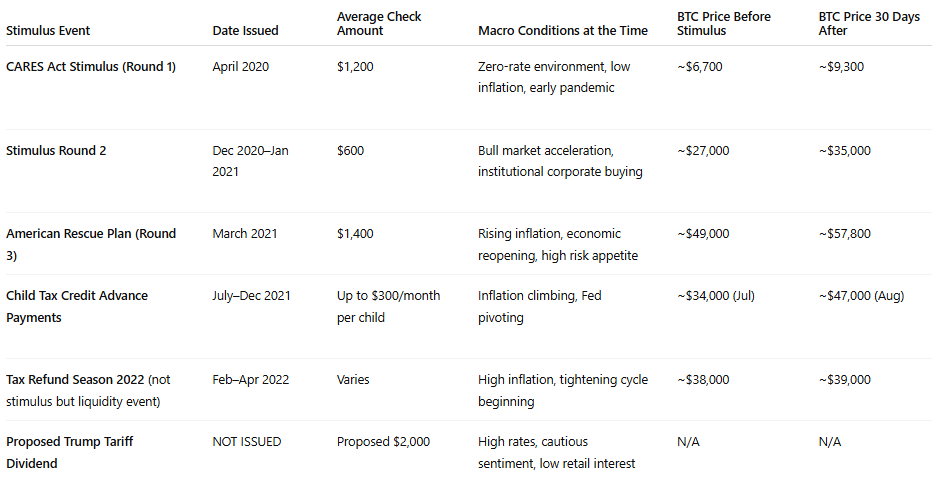

Direct payments made in 2020 and 2021 triggered sudden spikes in small-ticket Bitcoin purchases on crypto exchanges. Bitcoin recorded sharp price increases during the 30-day periods following stimulus check deposits. Many retail investors at that time chose to channel their extra cash into digital assets.

But today’s market conditions differ significantly from those days. Crypto market sentiment is weak, retail participation is low, and trading volumes have thinned. Bitcoin has traded sideways over the past week, pulling back from the $107,000 level on profit-taking.

Macro Conditions Change the Game Rules

Analysts say any new liquidity injection could influence short-term behavior. Direct cash payments would likely boost retail buying more than tax credits. Even a modest increase in risk appetite could create volatility in a market already showing reduced momentum.

However, the broader cycle depends on macroeconomic conditions. High interest rates, inflation pressure, and fragile market sentiment may limit the impact of any potential payout. The 2022 tax refund season provided a concrete example: when the macro environment is restrictive, liquidity injections fail to lift the crypto market.

Is the Inflation Spiral Starting Again?

Some crypto analysts warn that the proposed stimulus package represents fiscal expansion. One Twitter user wrote: “A $2,000 ‘tariff stimulus’ for Americans earning under $100K is basically fiscal QE redistribution through trade penalties. It props up short-term demand but fuels the same inflation loop we’ve been trying to escape since 2020.”

This perspective highlights the long-term consequences of the policy. Direct payments may boost consumption but could also strengthen inflationary pressure. Such a move might send conflicting signals while the Federal Reserve maintains tight monetary policy.

What’s the Bottom Line for Crypto?

The impact of Trump’s proposal on the crypto market will depend on its final form. Immediate cash payments could create a short-term upside, but reversing the long-term trend seems unlikely unless broader economic conditions shift.

Comments are closed.