Featured News Headlines

Solana ETF Inflows Defy Market Trend as Whales and Funds Buy the Dip

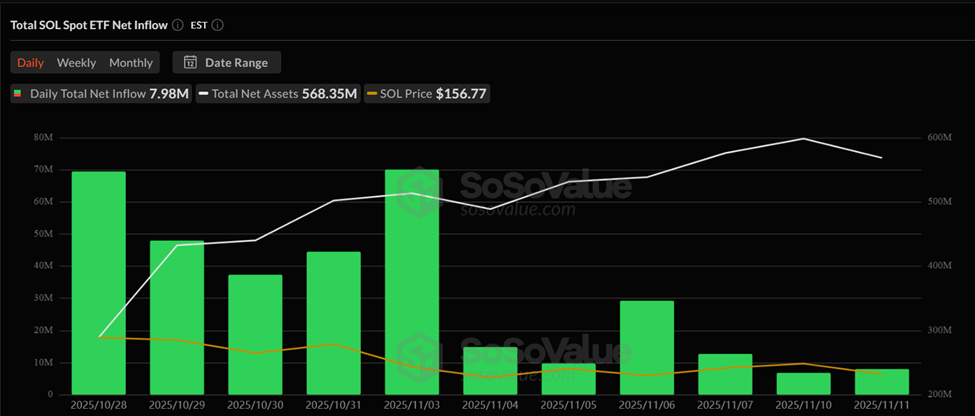

Solana ETFs – While Solana (SOL) has faced a sharp sell-off, tumbling 4% in 24 hours and over 20% in just 11 days, institutional demand for Solana ETFs tells a completely different story. Despite the decline, big money continues to pour in, signaling a strong undercurrent of confidence among professional investors.

Institutions Quietly Accumulate Solana Exposure

As of writing, Solana trades at $158.01, marking a notable correction since October 28 — the first day of inflows for Solana ETFs. Yet, instead of retreating, institutions have kept accumulating. Data shows 11 consecutive days of inflows totaling $351 million across Bitwise’s BSOL and Grayscale’s GSOL funds.

This divergence between falling prices and rising institutional inflows underscores a key shift: while retail traders appear to be taking profits, institutions are buying the dip to gain long-term exposure to the Solana ecosystem.

Crypto analyst AB Kuai Dong pointed out the irony on X (Twitter): “Good news: SOL ETF sees inflows every day. Bad news: The inflow momentum is even faster than SOL’s drop.”

NYSE Launches Options Trading for Solana ETFs

Adding to the bullish narrative, the New York Stock Exchange (NYSE) has officially launched options trading for Solana ETFs, marking a first for the ecosystem. Listings for $GSOL and $BSOL now enable risk management, yield generation, and price discovery tools—key instruments for institutional-grade trading.

Bitwise President Teddy Fusaro called the milestone “remarkable,” highlighting that Solana now has institutional tools for risk management and yield enhancement, typically seen before large-scale adoption cycles.

XRP and Dogecoin Speculation Builds

While Bitcoin ETFs saw $524 million in net inflows and Ethereum ETFs recorded $107 million in outflows, Solana ETFs stood out with $8 million in daily inflows on November 11 alone.

This momentum has fueled speculation about upcoming XRP and Dogecoin ETFs. Canary Capital CEO Steven McClurg suggested that an XRP ETF could outperform Solana’s, citing clearer regulation and payment utility as major draws for institutions.

Despite the price pullback, Solana’s strong ETF inflows, NYSE options debut, and whale accumulation suggest that institutional investors are positioning for the long game—even as retail sentiment cools.

Comments are closed.