Featured News Headlines

BitMine Increases ETH Holdings to 3.5 Million Amid Bullish Long-Term Outlook

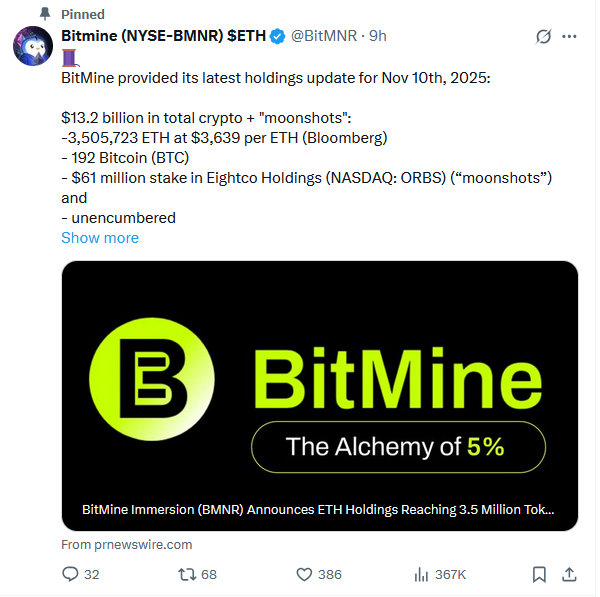

BitMine Immersion Technologies is doubling down on its Ethereum strategy, revealing another major purchase that cements its position as the world’s largest ETH treasury holder. The company announced on Monday that it bought 110,288 Ether (ETH) — a 34% increase from its previous week’s accumulation — bringing its total holdings to 3,505,723 ETH.

BitMine’s Massive Ethereum Bet

According to the firm, the average purchase price for its Ethereum stash stands at $3,639 per token, giving its total ETH holdings an approximate valuation of $12.5 billion at current market levels. BitMine has publicly stated its ambitious goal of owning 5% of Ethereum’s total circulating supply of 120.7 million ETH. With this latest purchase, the company now controls roughly 2.9% of the supply — putting it well on its way toward that milestone.

Originally founded as a cryptocurrency mining enterprise, BitMine has transformed into a major digital asset treasury company, making Ethereum the cornerstone of its long-term investment thesis.

Wall Street’s Growing Ethereum Appetite

BitMine chairman Tom Lee, who is also the co-founder of Fundstrat Global Advisors, expressed optimism about Ethereum’s long-term potential. He noted that the recent ETH price dip created “an attractive opportunity” for accumulation and pointed to Wall Street’s increasing interest in tokenizing assets on the Ethereum blockchain:

“It’s evident that Wall Street is very interested in tokenizing assets onto the blockchain, creating greater transparency and unlocking new value for issuers and investors. This is the key fundamental story and supports our view that Ethereum is a super cycle story over the next decade.”

ETH Price Outlook and BitMine Stock Performance

At the time of writing, ETH trades at $3,561, down 13.4% over the past two weeks and 4.7% in the past month. Despite the current pullback, Lee maintains a bullish long-term forecast, projecting that Ethereum could reach $10,000 to $12,000 by the end of 2025 — a target that would require a 180% rally from current prices.

Meanwhile, BitMine’s stock (BMNR) has been a standout performer in 2025, surging more than 400% year-to-date to hit $41.15. The company’s growing Ethereum exposure and Lee’s bold prediction have continued to capture the attention of both traditional and crypto market investors alike.

Comments are closed.