Featured News Headlines

- 1 Bitcoin Defies Odds as Whales and Retail Traders Return

- 1.1 BTC Price Action: Bulls Gain Momentum Above $104,500

- 1.2 US Economic Data Returns to Spotlight as Government Shutdown Ends

- 1.3 US Liquidity Surge Fuels Optimism in Crypto Markets

- 1.4 Bitcoin Derivatives Show Skepticism Despite Short-Term Gains

- 1.5 Bitcoin Whales Continue Accumulating Despite Market Dips

Bitcoin Defies Odds as Whales and Retail Traders Return

Bitcoin continues to surpass expectations as the market moves forward in a climate of mixed excitement and caution. According to analysts, this increase is the most despised bull run yet. BTC has maintained important support levels while igniting fresh interest from both whales and retail traders, despite persistent macroeconomic uncertainties, regulatory worries, and a cautious market sentiment. Liquidity flows, on-chain activity, and impending economic data are among the variables that could influence Bitcoin’s future this week. For both long-term investors and short-term traders, this makes it a crucial time.

BTC Price Action: Bulls Gain Momentum Above $104,500

With Bitcoin completing the week above $104,500, bulls were given fresh hope. The 50-week exponential moving average (EMA) is still a crucial support level for the BTC/USD pair, indicating possible resilience in the face of market volatility. The protracted closure of the US government has increased uncertainty, which has an impact on both cryptocurrency markets and more general risk assets. With 24-hour cross-crypto liquidations close to $350 million, liquidity is still substantial despite mild price fluctuations.

Technical analysis identifies key areas for Bitcoin, such as resistance around $106,500 and short liquidation clusters around $105,500. There is still caution because local highs close to $107,000 could cause a reversal, even though the current rebound indicates upside potential.

US Economic Data Returns to Spotlight as Government Shutdown Ends

As the US government shutdown is apparently coming to an end, focus is shifting back to important economic indicators, such as inflation statistics that may have an impact on risk-asset markets and Federal Reserve policy. Later this week, the Producer Price Index (PPI) will be released after the Consumer Price Index (CPI) and initial jobless claims. The US economy and the consequences of the current trade tariffs, which are still being reviewed by the Supreme Court, can be better understood thanks to these reports.

Market sentiment has also been influenced by expectations of further interest rate reductions in 2025. Another 0.25% cut is anticipated at the Federal Reserve’s December meeting. Despite the improving economic outlook, stocks have recovered, but sentiment indices indicate that investors’ high levels of worry are still there. Despite headline worries, analysts point out that this wall of worry rally could make the current market upswing one of the most resilient in recent memory, propelled by solid private-sector fundamentals.

US Liquidity Surge Fuels Optimism in Crypto Markets

Following US President Donald Trump‘s announcement that the majority of Americans could get a dividend of $2,000, Bitcoin experienced a sharp increase. However, the COVID-19 stimulus checks are being compared to this circumstance. It is anticipated that the proposed payment, which is connected to Trump’s international trade tariffs, will significantly increase liquidity in the US economy and enhance investor confidence in riskier assets, such as cryptocurrencies. This new round could serve as a new driver for the cryptocurrency market, according to analysts who pointed out that prior stimulus funds that were invested in Bitcoin produced significant returns.

The bull argument for digital assets is nevertheless supported by the larger context of increasing liquidity. Major economies, including the US and China, have contributed to the worldwide money supply reaching a record $142 trillion. The case for ongoing upward pressure on Bitcoin and other cryptocurrency assets is further strengthened by this.

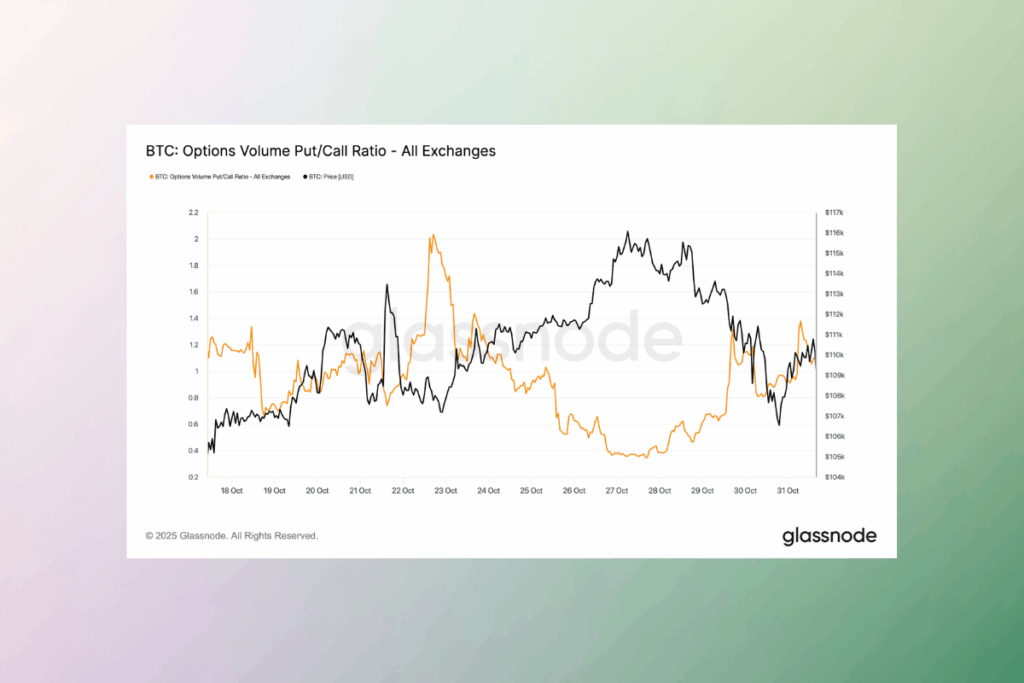

Bitcoin Derivatives Show Skepticism Despite Short-Term Gains

As open interest increases, traders of Bitcoin derivatives continue to exercise caution. This indicates that there is still some uncertainty surrounding the $100,000 mark. The options market is still dominated by fear, according to on-chain analytics, with put-call ratios demonstrating traders’ continued skepticism of a sustained bottom. According to recent data, put activity increases during price declines, whereas call options jump during brief price rises. This implies that rather than placing bets on a robust recovery, market players are hedging against future drops. Despite short-lived increases, traders’ long-term confidence is still low, and many are reluctant to expect a return to $120,000. The road to a steady price recovery for Bitcoin is likely to take longer as open interest steadily rises, showing ongoing market caution.

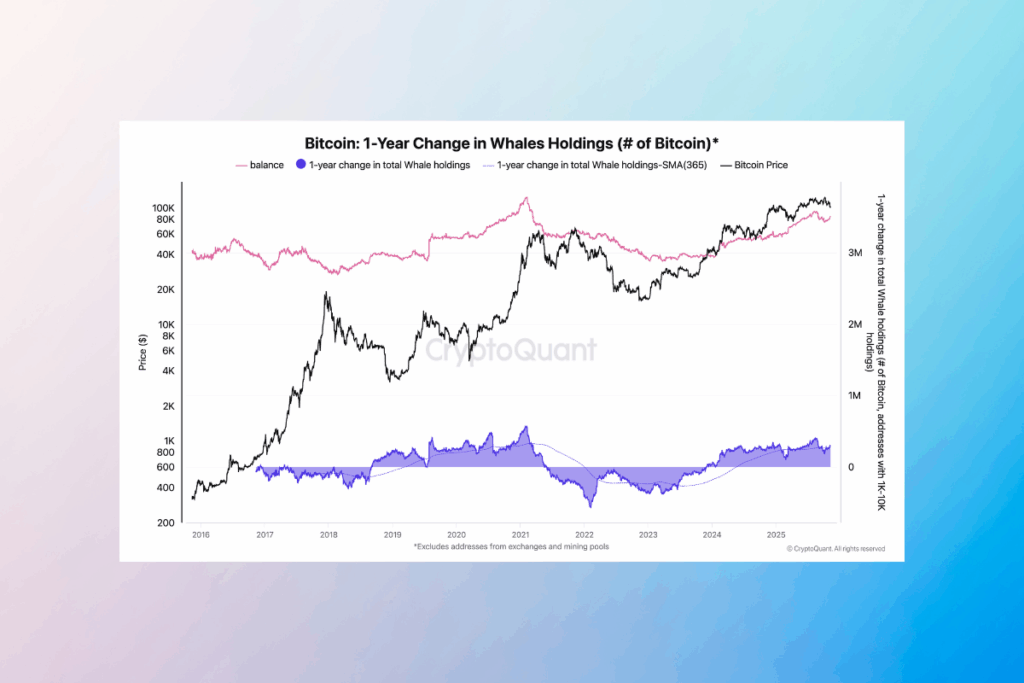

Bitcoin Whales Continue Accumulating Despite Market Dips

As BTC prices declined, short-term traders’ fear was heightened by the continued selling of Bitcoin whales. Long-term whale holders have steadily decreased their exposure throughout 2025, frequently selling more than 1,000 BTC per day. A more comprehensive perspective shows that major holders are still accumulating despite these withdrawals, suggesting possible positive momentum. The one-year shift in whale holdings has been positive since 2023, according to on-chain analytics, with accumulation picking up following recent declines. Whale holdings increased to 294,000 BTC by early November after a precipitous drop from 398,000 BTC in August to 185,000 BTC in October. New players are joining the market, and current holders are increasing their holdings even as some whales leave.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.