Featured News Headlines

LINK Price Steady as Social Sentiment Signals Potential Reversal

Chainlink (LINK) has recently captured the attention of analysts as social sentiment around the coin hits its highest level in nearly three years, despite a period of price weakness. Market observers are closely monitoring this dynamic, as similar sentiment-price divergences in the past have often preceded strong recovery phases.

Social Sentiment Reaches Multi-Year High

Crypto analyst Ali highlighted in a recent X post that Chainlink’s weighted social sentiment—derived from on-chain data by Santiment—has climbed to levels not seen in almost three years. Ali noted, “The sentiment data shows a clear bullish divergence, with community optimism rising even as the price trends lower.”

This divergence between market psychology and price action suggests that investors and community members are increasingly confident about the token’s potential, despite the short-term struggle to maintain upward momentum. Historically, periods where social sentiment improves while prices stagnate or decline have coincided with accumulation phases, where buyers gradually position for a potential reversal.

Analysts caution that sentiment-driven recoveries usually require a stabilization period before prices begin to reflect the optimism. If LINK continues to trade within its current range while social sentiment remains elevated, the setup could lay the groundwork for a broader recovery.

Price Consolidation Near $14.82

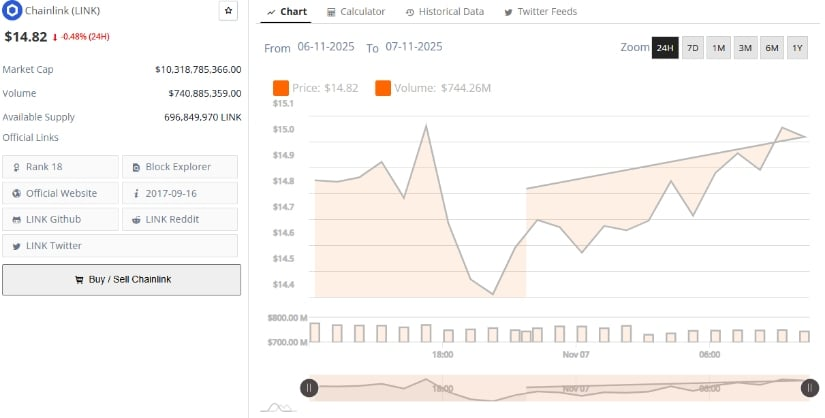

According to BraveNewCoin, Chainlink is currently trading around $14.82, down slightly -0.48% in the last 24 hours. The token’s market capitalization stands at $10.31 billion, with daily trading volume near $740.88 million. With a circulating supply of 696.8 million tokens, Chainlink remains among the top 20 digital assets by market capitalization.

Over recent sessions, LINK has traded in a relatively narrow range, suggesting a consolidation phase after previous volatility. Volume has remained steady, yet it has not reached the breakout intensity typically needed for trend reversals. Market conditions indicate a neutral-to-cautious environment, with participants awaiting clearer directional signals.

This consolidation pattern aligns with broader sentiment trends, where speculative excitement has tempered while long-term holders continue to maintain positions. Analysts see this as a potential foundation for recovery, assuming buying pressure increases.

Historical Context and Recovery Potential

Periods of high social sentiment amid price weakness are often precursors to accumulation phases, during which long-term holders consolidate their positions before broader market recoveries. In Chainlink’s case, the combination of strong community optimism and a stable technical base could support such a pattern if market conditions improve.

While price movement remains restrained for now, the divergence between positive sentiment and lackluster price action is attracting significant analyst attention. Historically, this type of setup has preceded recoveries that occur once broader market participation resumes and liquidity conditions support upward momentum.

Market Sentiment and Community Confidence

Ali’s analysis underscores that Chainlink’s community is increasingly confident despite short-term price challenges. “Positive discussion and engagement have surged, reflecting growing belief in the token’s medium-term potential,” he noted.

This heightened engagement from retail investors and long-term holders is consistent with strategic accumulation, where participants position themselves ahead of potential upward moves. Analysts stress that monitoring both sentiment and price consolidation levels is crucial in understanding the next phase of market dynamics for LINK.

Comments are closed.