Featured News Headlines

Bitcoin at $100K: Accumulation Signals Before the Next Rally

Analysts across the crypto and macroeconomic landscape largely agree that Bitcoin’s long-term structure remains intact, even amid current volatility. While short-term turbulence has weighed on prices, the broader outlook continues to point toward structural resilience and potential for recovery.

Many experts cite the ongoing U.S. government shutdown as a near-term drag on market sentiment and liquidity — a temporary factor rather than a fundamental shift in trend.

PlanB: “We’re Mid-Cycle, Not in Mania”

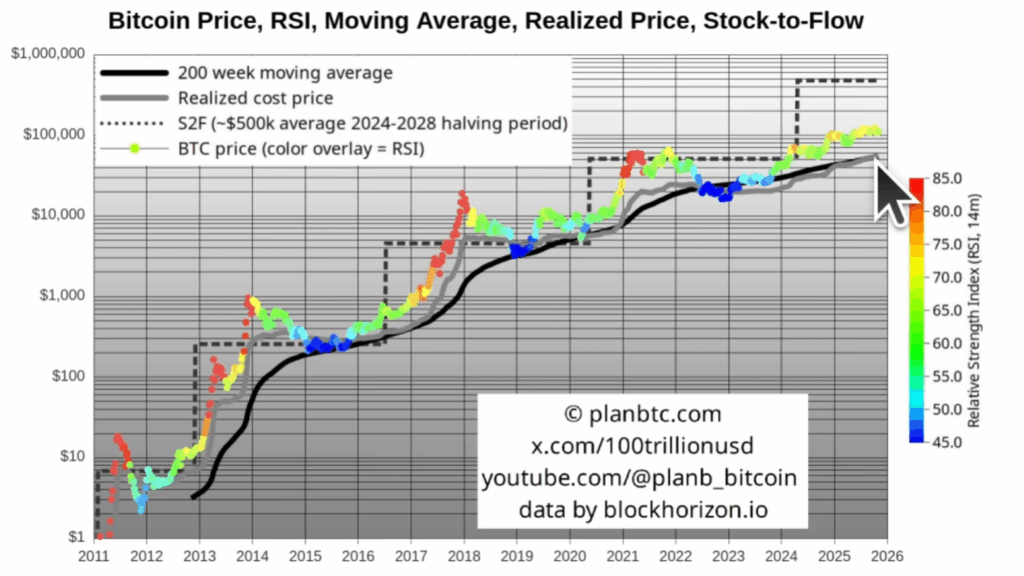

PlanB, the creator of the widely followed Stock-to-Flow (S2F) model, characterizes the recent correction as a “mid-cycle pause.” His analysis highlights that Bitcoin has traded above $100,000 for six consecutive months, marking a significant transition from former resistance to solid support.

According to PlanB, Bitcoin’s Relative Strength Index (RSI) — currently around 66 — remains well below the overheated levels (above 80) typically seen during past market tops.

“Without that mania phase, we’re likely not at the final top,”

— PlanB

The analyst believes that if Bitcoin continues to diverge positively from its realized price, a pattern consistent with ongoing bull markets, the next major move could potentially reach the $250,000–$500,000 range.

Arthur Hayes: The Setup for “Stealth QE”

BitMEX co-founder Arthur Hayes links Bitcoin’s recent weakness to the tightening of U.S. dollar liquidity. Since the U.S. debt ceiling was lifted in July, the Treasury General Account (TGA) has expanded, effectively draining liquidity from financial markets — a dynamic that has coincided with Bitcoin’s decline.

However, Hayes foresees an impending reversal once the government resumes normal operations and spends down its TGA balance. This, he argues, will amount to a form of “stealth quantitative easing.”

According to Hayes, the Federal Reserve’s Standing Repo Facility could quietly reintroduce liquidity into the system without officially labeling it as QE.

“When the Fed starts cashing the checks of politicians, Bitcoin will rise,”

— Arthur Hayes

Raoul Pal: “The Liquidity Flood Lies Ahead”

Macro investor Raoul Pal, founder of Global Macro Investor (GMI), presents a similarly constructive macro framework. His GMI Liquidity Index, which tracks global money supply and credit conditions, remains in a long-term upward trend.

Pal describes the current environment as a “Window of Pain” — a phase marked by tight liquidity and investor caution. Yet, he expects a sharp reversal as fiscal spending increases and monetary tightening subsides.

He forecasts that U.S. Treasury spending could inject $250–350 billion into markets, quantitative tightening will likely end, and interest rate cuts may follow.

“When this number goes up, all numbers go up,”

— Raoul Pal

Accumulation Phase Before Expansion

Despite short-term volatility, the prevailing consensus among macro and crypto analysts is that Bitcoin has endured its liquidity-driven correction and now sits in a phase of strategic accumulation.

Data from CryptoQuant supports this view: large Bitcoin wallets holding between 1,000 and 10,000 BTC have accumulated approximately 29,600 BTC (around $3 billion) over the past week. Their combined balance has risen to 3.504 million BTC, marking the first major accumulation event since September.

If global liquidity begins to expand again in Q1 2026, analysts such as Hayes and Pal suggest that the next major rally could emerge from the very foundation the market has just tested — the $100,000 consolidation zone.

Comments are closed.