DeFi Chaos: Elixir Shuts Down deUSD Stablecoin Following Massive Loss

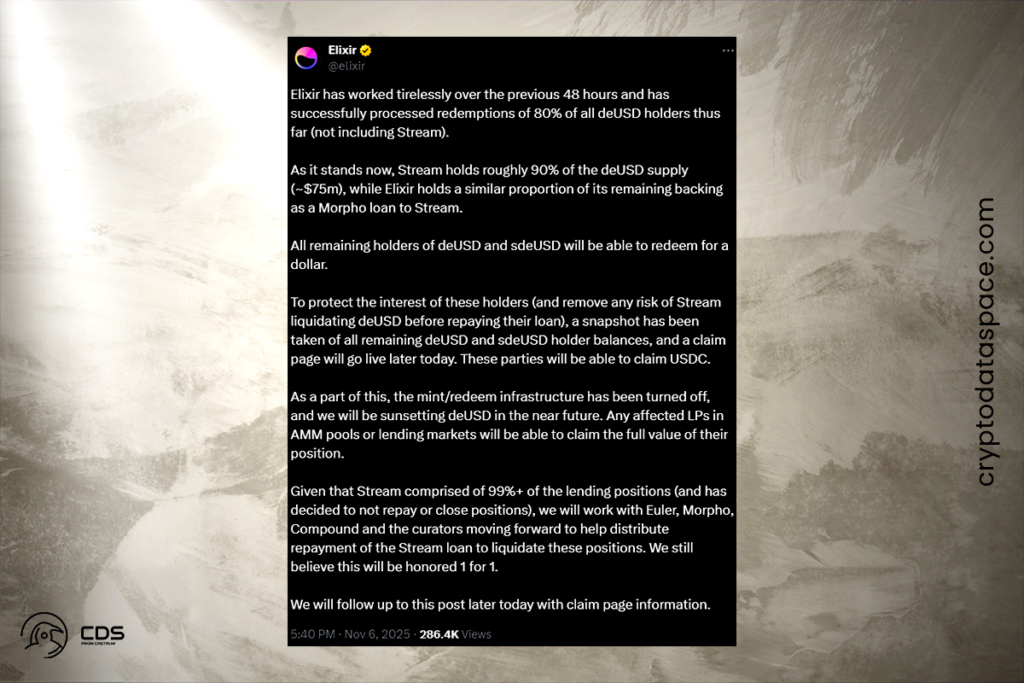

Elixir, a decentralized finance liquidity provider, has stopped supporting deUSD, its artificial stablecoin. The rippling effects of Stream Finance’s $93 million loss earlier this week led to the decision. Eighty percent of all deUSD holders have already had their redemptions successfully processed, according to an X post made by Elixir on Thursday. The stablecoin depegged from the US dollar as a result, falling to 1.5 cents, according to statistics from CoinGecko.

Stream Finance Halts Withdrawals After $93M Loss and Mounting Debt

After an external fund manager disclosed a $93 million decline in net assets, Stream suspended withdrawals on Tuesday. Among the losses was an estimated $285 million in debt to different lenders, of which Elixir owed roughly $68 million. In addition, to keep the Staked Stream USD (XUSD) stablecoin stable, Stream borrowed deUSD. XUSD dropped to $0.10 when the protocol revealed a $93 million loss.

Elixir Partners With DeFi Giants to Cover Stream’s deUSD Shortfall

About 90% of the remaining deUSD supply, valued at $75 million, is held by Stream, according to Elixir. It asserts, however, that Stream decided not to close or reimburse that employment. In order to adequately compensate deUSD holders, Elixir was compelled to work with other decentralized lenders like Euler, Morpho, and Compound. In order to reduce the possibility that Stream may liquidate deUSD before repaying their loan, Elixir made the decision to disable withdrawals.

We still believe this will be honored 1 for 1.

Elixir

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.