Featured News Headlines

US Bitcoin ETFs Record $2B Weekly Outflows — Second-Worst Streak on Record

US spot Bitcoin ETFs have faced a sharp reversal, with more than $2 billion in outflows over the past week — marking their second-worst withdrawal streak on record, according to data from Farside Investors.

$2 Billion Outflow Streak Hits Bitcoin ETFs

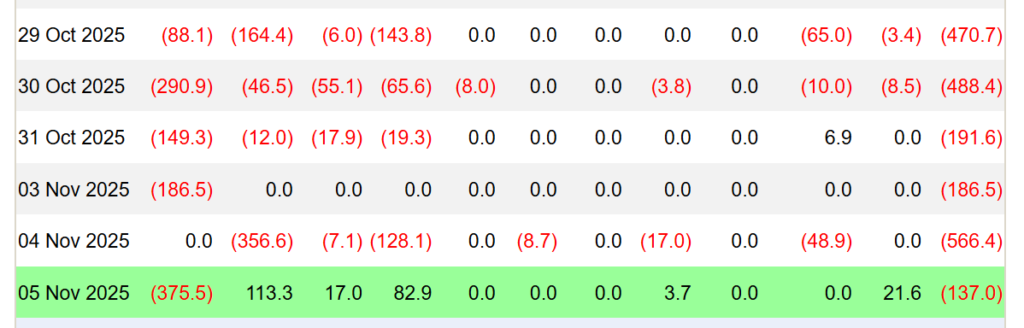

On Wednesday, spot Bitcoin (BTC) ETFs logged another $137 million in outflows, marking the sixth straight day of redemptions. The wave of withdrawals, which began on October 29, has now erased roughly $2.04 billion in total.

The largest single-day drop came on Tuesday, when investors pulled $566 million, following previous sessions of $470 million, $488 million, and $191 million in redemptions. The streak is second only to the late-February sell-off, when Bitcoin funds recorded more than $3.2 billion in outflows over one week, led by massive single-day withdrawals of $1.11 billion on Feb. 25 and $757.8 million on Feb. 26.

Ethereum ETFs Also Face Pressure

It’s not just Bitcoin. Spot Ether (ETH) ETFs also recorded $118.5 million in net outflows on Wednesday, marking their sixth consecutive day of selling pressure. BlackRock’s ETHA led the losses with $146.6 million in redemptions, while Bitwise’s ETHW and VanEck’s ETHV remained steady.

Institutional investors have now withdrawn nearly $1.2 billion from Ether products in the past week. Still, cumulative inflows remain strong at over $13.9 billion.

Solana ETFs Defy the Trend

While Bitcoin and Ethereum funds struggle, Solana (SOL) ETFs continue to attract buyers. Wednesday saw an additional $9.7 million in inflows — the seventh straight day of positive activity — bringing total net inflows since launch to $294 million.

Despite macroeconomic uncertainty and market volatility, Solana ETFs remain a rare bright spot in an otherwise risk-off crypto ETF landscape.

Comments are closed.