Featured News Headlines

- 1 ZkSync Rally Highlights Ethereum Layer-2 Growth

- 2 Price Jump Amid Market Volatility

- 3 Vitalik Buterin Highlights ZkSync’s Upgrades

- 4 Governance Proposal Sparks Further Interest

- 5 Privacy Solutions Strengthen Narrative

- 6 Short-Term Outlook and Circulating Supply

- 7 Sustaining Momentum in a Volatile Market

ZkSync Rally Highlights Ethereum Layer-2 Growth

ZkSync, a Layer-2 scaling solution for Ethereum, has experienced a remarkable price rally, highlighting the growing attention to technologies that enhance Ethereum’s scalability. By utilizing zero-knowledge (ZK) proofs, ZkSync enables faster, cheaper, and more secure transactions, allowing Ethereum to scale without compromising decentralization.

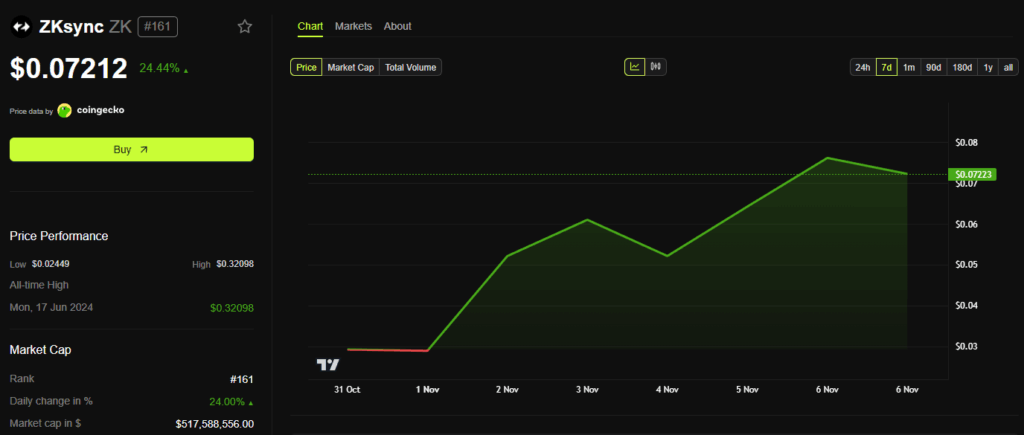

Price Jump Amid Market Volatility

Data from BeInCrypto shows ZkSync (ZK) climbing from $0.03 to over $0.07 during the first week of November. This surge occurred even as the broader crypto market faced high volatility, with altcoins dropping sharply after Bitcoin fell below $100,000. According to CoinGecko, ZK’s 24-hour trading volume skyrocketed past $700 million, a striking increase from the previous month’s daily average of under $20 million. Such a 30x jump in trading activity underscores heightened market attention toward ZkSync.

Vitalik Buterin Highlights ZkSync’s Upgrades

A pivotal moment came when Ethereum co-founder Vitalik Buterin publicly praised ZkSync’s Atlas upgrade. The update enhances transaction speed and cost efficiency on Ethereum, encouraging adoption and potentially boosting network revenue.

Vitalik commented,

“ZKsync has been doing a lot of underrated and valuable work in the Ethereum ecosystem.”

Analysts have likened this endorsement to Buterin’s support of the Solana developer community in late 2022, a move that preceded Solana’s significant price surge.

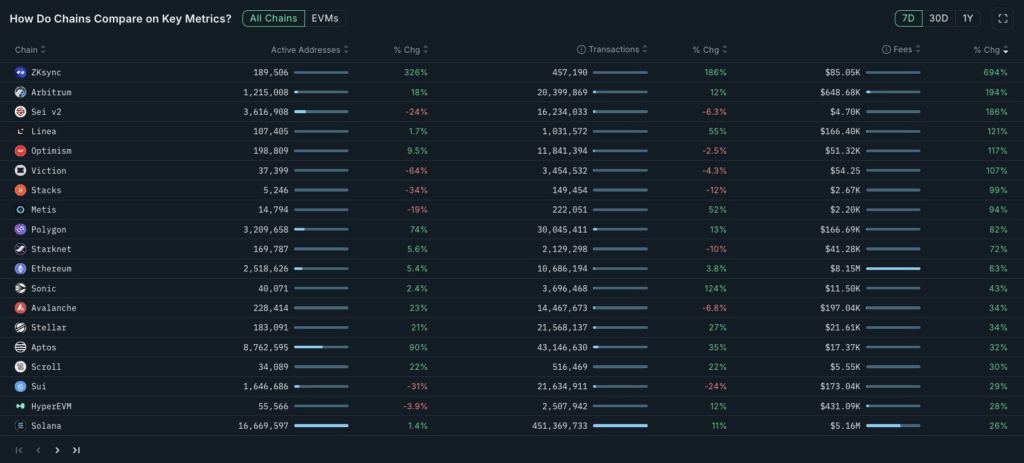

Governance Proposal Sparks Further Interest

Following Vitalik’s remarks, ZkSync’s founder Alex introduced a proposal to transform ZK from a governance token into a utility token linked to network revenue. The plan would use on-chain fees from cross-chain transactions and off-chain enterprise licensing to buy back and burn tokens, fund protocol development, and support ecosystem incentives.

This approach positions ZK to be directly tied to real network activity rather than serving solely as a voting mechanism. Nansen data indicates that ZkSync is currently among the top chains in fee revenue growth over the past week.

Privacy Solutions Strengthen Narrative

Another factor contributing to ZkSync’s momentum is the growing interest in privacy-focused cryptocurrencies. ZkSync recently launched ZkSync Prividium, a privacy solution designed for enterprises. This addition aligns with the market’s increasing attention to privacy-centric blockchain solutions, further driving discussions and interest in ZK.

Short-Term Outlook and Circulating Supply

Analysts suggest a potential short-term correction may occur, with support around $0.065. If this level holds, the structure could support additional gains, although the token would need to rise approximately 250% to reach its all-time high of $0.27. Currently, only 34% of ZK’s total supply is circulating, and around 173 million tokens are unlocked each month, highlighting supply dynamics that may influence market behavior.

Sustaining Momentum in a Volatile Market

The key challenge for ZkSync moving forward will be maintaining momentum amid broader market fluctuations. Continued attention on Ethereum upgrades, governance changes, and privacy-focused solutions will play a central role in shaping community sentiment and engagement.

Comments are closed.