Featured News Headlines

XRP Faces Critical Pressure After Trendline Break

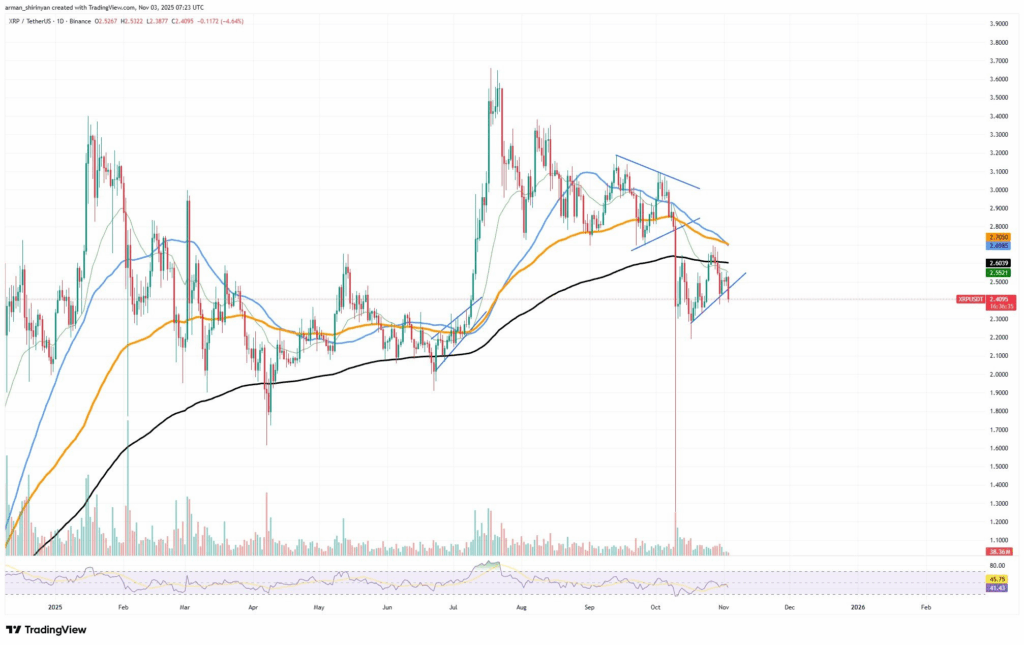

Ripple’s XRP has entered a precarious phase following a break below its short-term ascending trendline. This technical shift signals a renewed dominance of bearish forces and casts a spotlight on the $2.00 support level as a potential reference point for near-term price action.

Current Market Status

As of press time, XRP is trading near $2.40, down roughly 5% for the day. The decline reflects weakening buying momentum and continues a string of rejections from the 200-day moving average, a level closely watched by market participants. Analysts note:

“The recent trendline break renders invalid the brittle recovery pattern that developed following the crash in October.”

Without a solid recovery structure, the chart now appears more vulnerable. There are no notable support zones between the current price and $2.00, heightening the potential for a sharper downward move.

Moving Averages and Technical Signals

XRP’s moving averages paint a cautious picture. The 100-day (blue) and 200-day (black) lines are converging, hinting at a potential death cross formation — a technical pattern that historically suggests increasing downward pressure if confirmed. This convergence reinforces the narrative that XRP’s short-term technical strength has waned.

Low Volume and RSI Signals

Further emphasizing the fragile market state, XRP’s Relative Strength Index (RSI) is hovering around 41, indicating declining momentum. Trading volume remains muted, suggesting that bulls are not actively defending key levels. Observers note:

“It appears that bulls are stepping aside rather than defending important levels because there has not been any discernible spike in trading activity despite the recent decline.”

The absence of volume spikes coupled with low RSI readings highlights the market’s vulnerability to additional selling pressure in the near term.

Potential Support Levels

If downward momentum persists, XRP may test the $2.10–$2.00 range, a psychological support zone where price stabilization could temporarily occur. Beyond this level, historical buying interest is sparse, leaving the path of least resistance toward lower levels. Analysts caution that unless XRP recovers and sustains trading above $2.55, further declines are likely.

Broader Market Context

XRP’s current structure suggests susceptibility to broader market trends. Heightened Bitcoin volatility or worsening market sentiment could exacerbate selling pressure, accelerating declines. The inability to maintain the rising trendline underscores the fragility of the recovery:

“XRP’s inability to maintain its rising trendline, in summary, signifies a critical breakdown; if momentum does not change soon, the $2 mark may be the next stop in this developing correction.”

Observations on Market Dynamics

Technical patterns indicate that XRP is navigating a phase of uncertainty. The combination of trendline failure, low volume, and converging moving averages highlights the need for caution in interpreting near-term movements. Traders and analysts often monitor such setups to gauge potential short-term market pressure, focusing on support and resistance areas, RSI trends, and volume changes to assess momentum shifts.

Psychological Considerations

The $2.00 level holds psychological significance, serving as a reference point for market participants. While it may act as temporary support, the lack of historical buying interest below this price suggests that any bounce could be limited. XRP’s path downward will likely be influenced by broader sentiment and the stability of major cryptocurrencies, particularly Bitcoin.

Comments are closed.