Featured News Headlines

Crypto ETF Market Shaken: $672M Outflows and $500M Fraud Hit BlackRock

Crypto ETF Market Shaken – The crypto investment world was hit by a double shock on October 30, as Bitcoin and Ethereum ETFs suffered $672 million in combined outflows—just as BlackRock faced fallout from a $500 million telecom-financing fraud linked to its private-credit arm.

Institutional Redemptions Signal Growing Risk Aversion

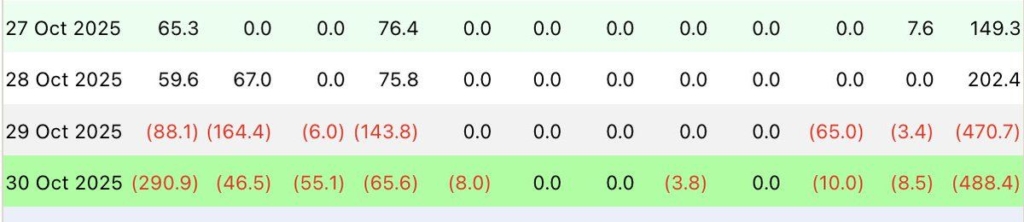

According to Farside Investors, institutional clients withdrew $490 million from Bitcoin ETFs in a single day. BlackRock’s IBIT ETF led the exodus with $290.9 million in redemptions, followed by heavy outflows from Fidelity, Bitwise, ARK, Invesco, VanEck, and Grayscale.

Ethereum ETFs also felt the pressure, posting $184 million in losses, including $118 million from BlackRock’s ETHA fund. Analysts say these withdrawals reflect profit-taking and portfolio rebalancing, rather than panic selling, amid increasing macroeconomic uncertainty.

The timing, however, couldn’t be worse for BlackRock, which is now under closer scrutiny following reports of a massive fraud in its private-credit division.

$500 Million Fraud Exposes Private Credit Weakness

Bloomberg revealed that BlackRock’s HPS Investment Partners—acquired for $12 billion in July 2025—lost more than $500 million in a telecom-financing scheme built on forged invoices and fake contracts. Borrowers Broadband Telecom and Bridgevoice allegedly fabricated receivables from major firms like T-Mobile and Telstra to secure loans. The fraud, uncovered in August 2025, has triggered multiple lawsuits and bankruptcies, with BNP Paribas, BlackRock’s lending partner, also implicated.

The revelation has raised serious questions about risk management and due diligence within the world’s largest asset manager.

Bitcoin Volatility Looms Despite ETF Outflows

Despite the turmoil, BlackRock’s IBIT remains the dominant force in crypto ETFs, drawing $28.1 billion in inflows since January. Without IBIT, the sector would have posted $1.2 billion in net outflows this year—highlighting its market concentration risk.

Meanwhile, traders are bracing for volatility. Whale Insider noted that over $3 billion in Bitcoin short positions could be liquidated if the price climbs to $112,600, just 2.48% above current levels. This sets the stage for a potential short squeeze, where even a modest rally could rapidly flip bearish sentiment into a bullish rebound.

Comments are closed.