RSI Divergence Signals Potential Stabilization

Following the sharp drop, Bitcoin’s Relative Strength Index (RSI), which tracks buying versus selling momentum, began stabilizing despite a lower low between October 22 and 30.

“That created a bullish divergence, a setup that often signals sellers losing control while buyers slowly regain footing.”

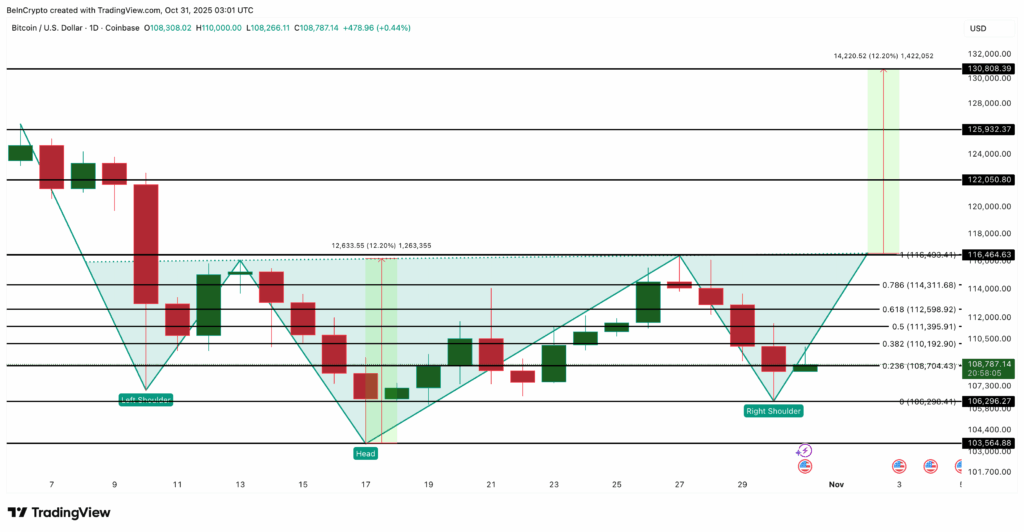

This RSI behavior coincided with a near-complete inverse head-and-shoulders pattern, a reversal-specific formation in technical analysis. The latest dip contributed to forming the right shoulder of this structure, suggesting that a breakout near $116,400 could lead to higher price movements.

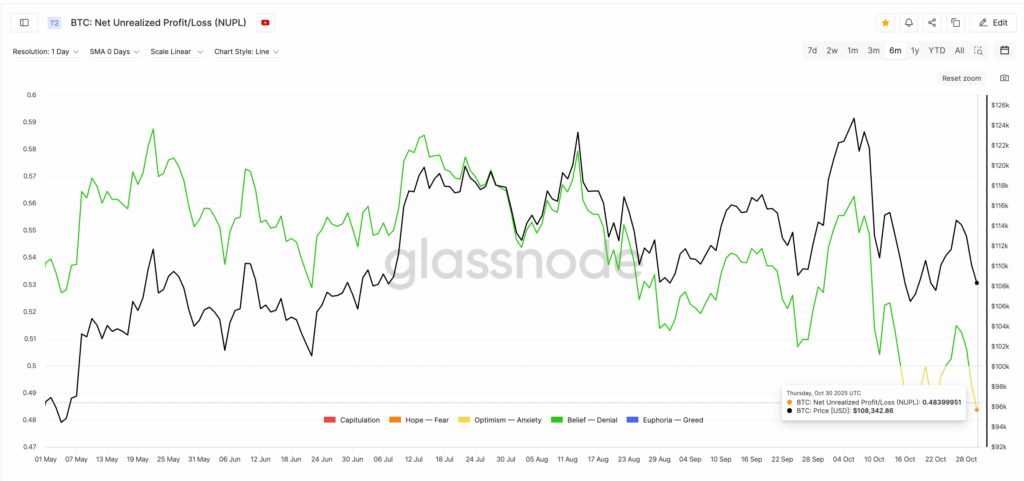

Supporting this, the Net Unrealized Profit/Loss (NUPL) metric from Glassnode — which tracks the proportion of investors in profit or loss — dropped to 0.483, one of its lowest levels in six months.

“Such levels usually appear when weaker traders exit and stronger hands hold their ground,” analysts note. A declining NUPL indicates reduced incentive to sell or realize gains.

$111,000 Zone Represents Key Test

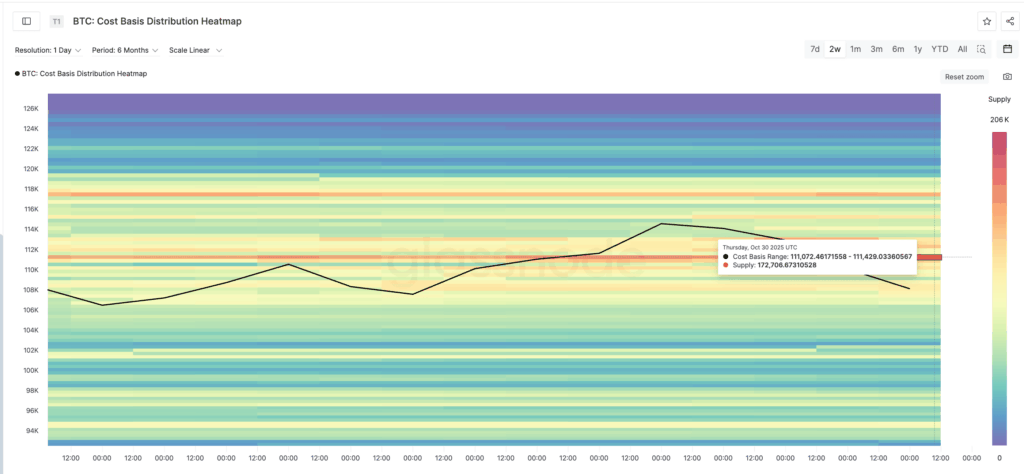

If the dip-surge movement reflects a structural market reset, the next critical area lies between $111,000 and $111,400. According to the Cost-Basis Heatmap, this range contains the largest concentration of previously purchased coins — around 172,700 BTC, representing approximately $18.82 billion at current prices.

“This zone acts as the first major hurdle for any sustained recovery,” market observers say. Successfully surpassing this range would suggest renewed buyer activity, while failing to do so could delay any potential stabilization.

Breakout or Fakeout: Levels to Watch

Completion of the reversal pattern depends on Bitcoin closing above $116,400, which would validate the technical formation and point toward a 12.2% target near $130,800. Analysts note an intermediate checkpoint near $125,900, close to the previous all-time high, where short-term profit-taking may occur.

Conversely, a drop below $106,200 would invalidate the bullish setup, potentially sending prices toward $103,500.

Comments are closed.