Featured News Headlines

$115K Bitcoin Target Amid Key Resistance Levels

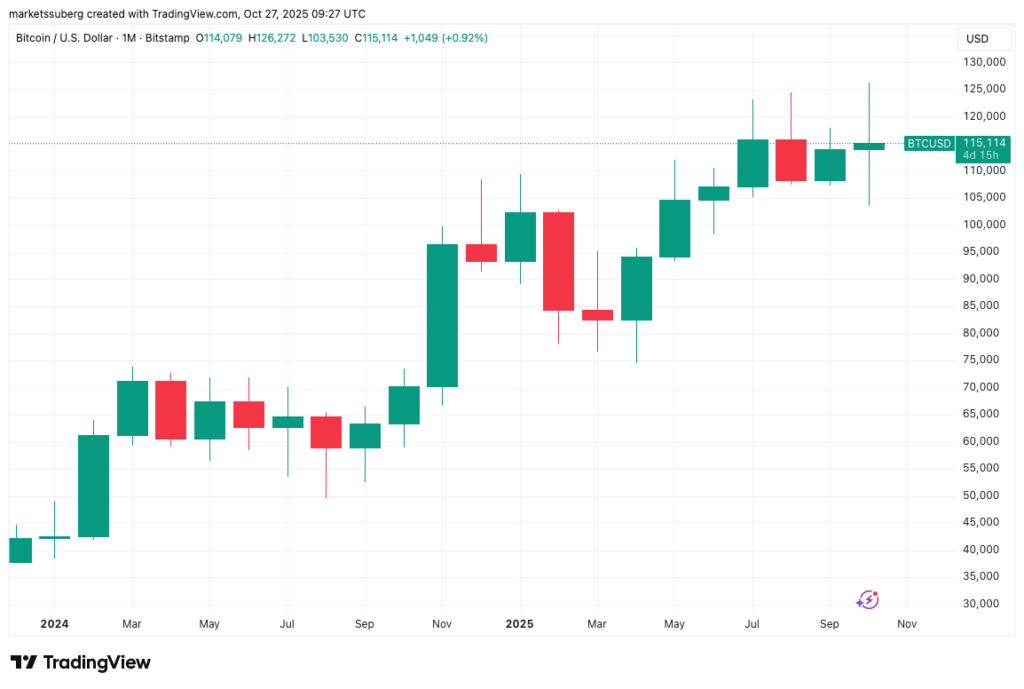

Bitcoin showed renewed strength heading into the weekly close, rebounding to around $114,500 and reclaiming its 21-week exponential moving average (EMA), according to data from Cointelegraph Markets Pro and TradingView. While this recovery sparked optimism among traders, several analysts remain cautious, warning that the broader trend still shows signs of exhaustion.

Technical Signals Show Mixed Momentum

Analyst Rekt Capital highlighted the 21-week EMA as a key level to sustain if Bitcoin’s bullish momentum is to continue. Meanwhile, trader Roman expressed skepticism about the move, noting weak volume and bearish divergences on Bitcoin’s relative strength index (RSI).

“Watching for this potential HTF Head & Shoulders bearish reversal setup. Validates on a break below 109k neckline,” Roman stated on X.

Other analysts, including HTL-NL, maintained that Bitcoin remains within an expanding triangle pattern, suggesting that the overall technical outlook has not shifted dramatically despite the rebound.

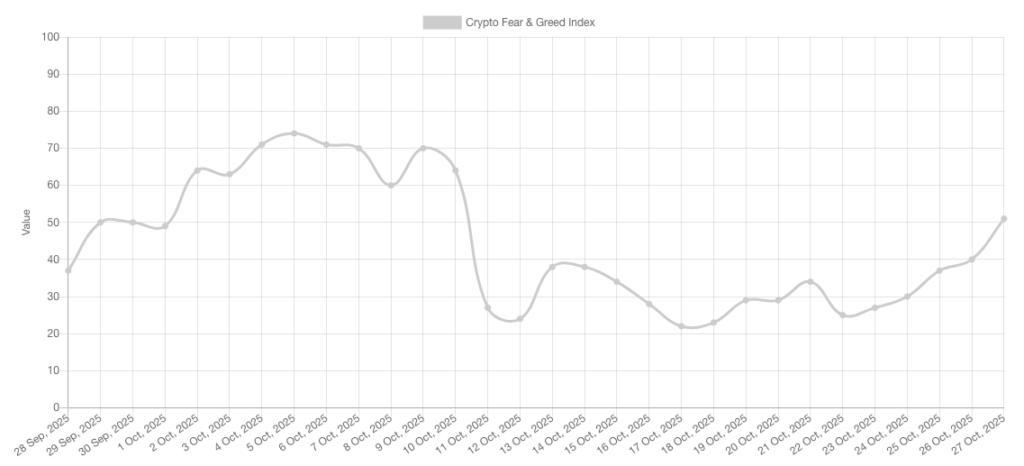

Market Volatility Returns Amid Broader Economic Shifts

Data from CoinGlass revealed heightened volatility, with price movements triggering liquidations both above and below key levels. The recent Consumer Price Index (CPI) report, which showed inflation below expectations, added momentum to risk assets, further supporting Bitcoin’s short-term recovery.

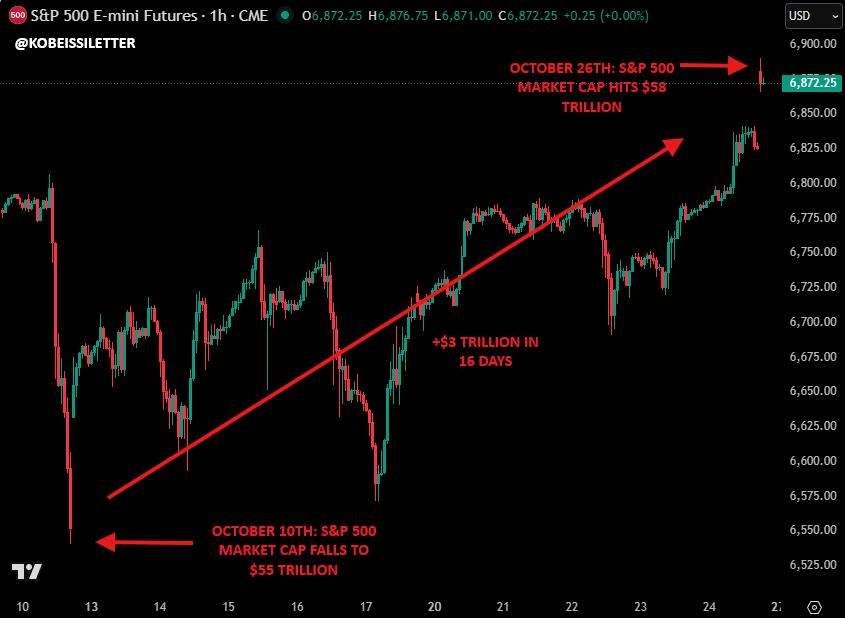

According to The Kobeissi Letter, this week’s lineup of corporate earnings from major players such as Microsoft, Meta, and Amazon could inject further volatility into markets. Additionally, optimism grew following reports that a new U.S.–China trade deal is nearing completion, with a meeting between President Donald Trump and China’s Xi Jinping set for Thursday.

Analysts Eye $125,000 as Possible Next Target

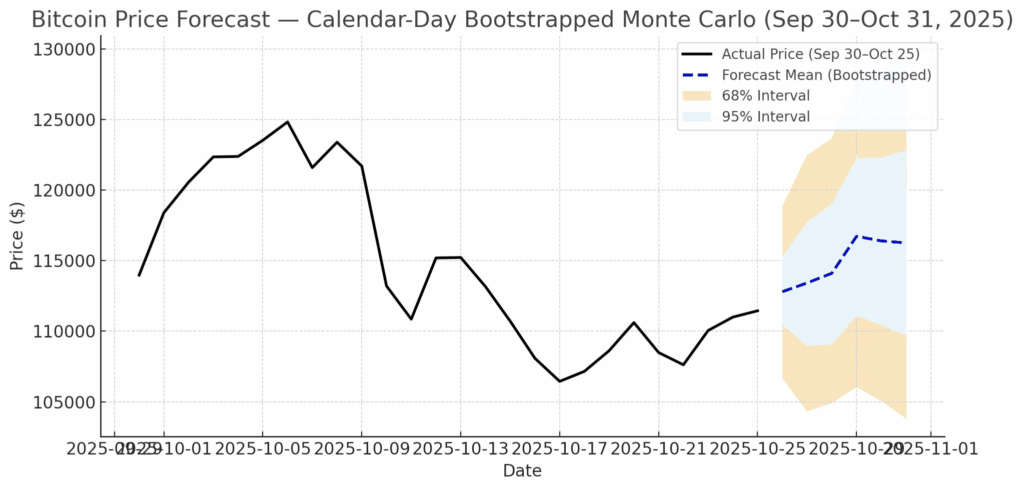

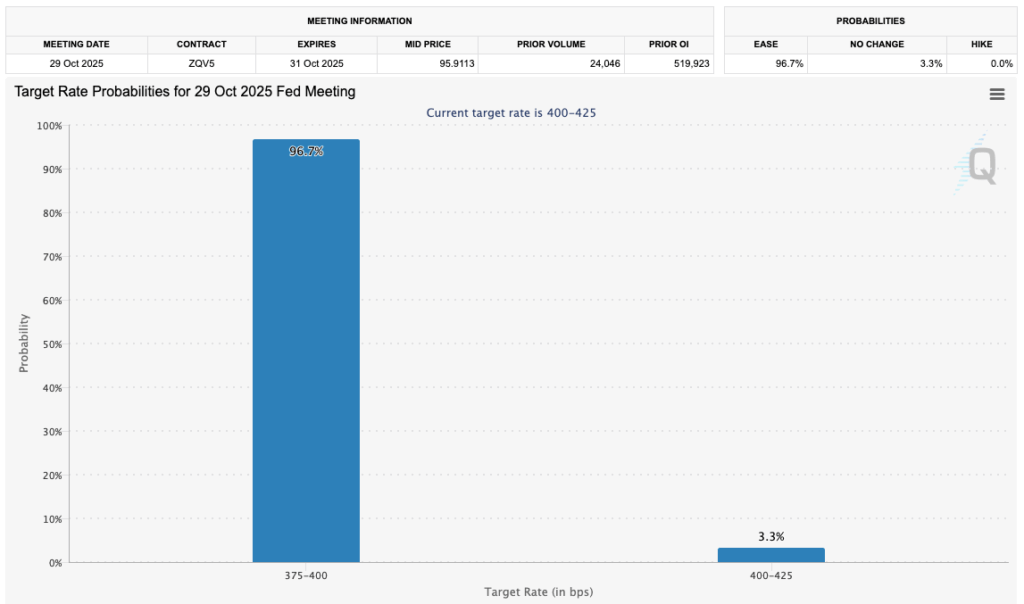

Network economist Timothy Peterson pointed to macroeconomic factors as a potential driver for Bitcoin’s next move, particularly the possibility of quantitative easing (QE).

“Interest rates still too high, but QE coming,” Peterson noted, adding that Bitcoin’s valuation follows Metcalfe’s Law, linking network growth to long-term price appreciation.

An AI-based simulation shared by Peterson suggested $115,000 as a short-term focal point, with $125,000 still a realistic target before the end of October.

On-Chain Data Shows Growing Confidence

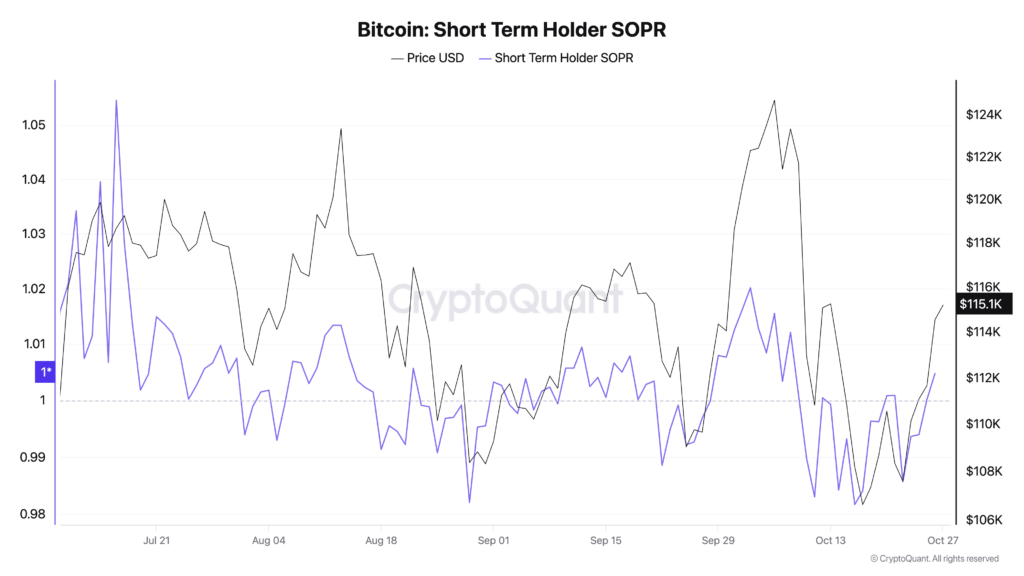

On-chain analytics from CryptoQuant indicate that short-term holders — investors who purchased Bitcoin within the past six months — are once again in profit, with their average cost basis near $113,000. The Short-Term Holder Profit Ratio (SOPR) recently climbed above 1, its highest level since early October.

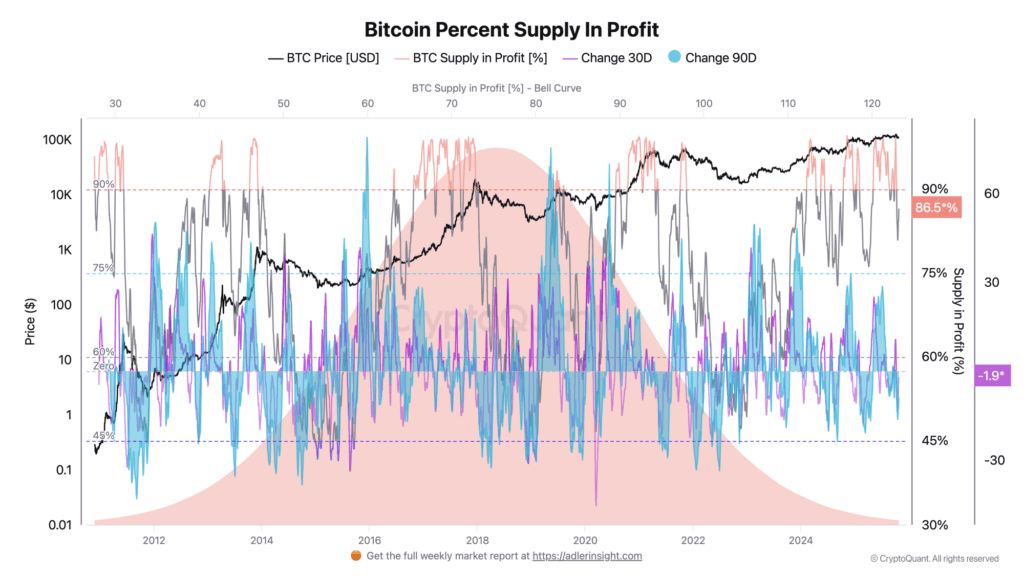

CryptoQuant contributor Darkfost observed that around 83.6% of Bitcoin supply is currently in profit, suggesting that holders are showing renewed confidence in maintaining their positions while anticipating potential further upside.

Comments are closed.