Featured News Headlines

Ethereum Ecosystem Boasts Largest Developer Base, Despite Slower Growth

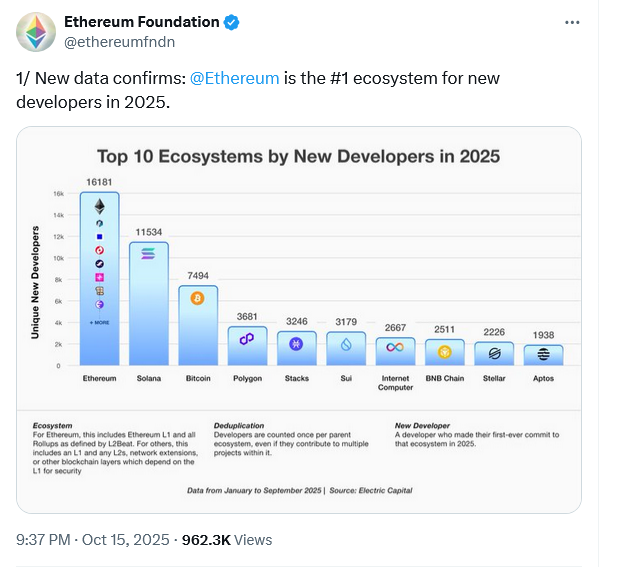

Ethereum Ecosystem – According to recent data from Electric Capital cited by the Ethereum Foundation, more than 16,000 new developers have entered the Ethereum ecosystem between January and September 2024. This influx solidifies Ethereum’s position as the blockchain with the largest active developer base, boasting a total of 31,869 developers across its layer-1 network and layer-2 solutions like Arbitrum, Optimism, and Unichain.

Solana’s Developer Growth Surges, But Numbers Disputed

Trailing behind Ethereum, Solana attracted over 11,500 new developers, marking it as the second most popular blockchain for coders this year. The total active developer count on Solana stands at around 17,708, but the Solana Foundation disputes these figures. Jacob Creech, head of developer relations at Solana, claims that Electric Capital’s data undercounts developers by nearly 7,800, urging developers to submit their GitHub repositories for more accurate tracking.

Despite the controversy, Solana’s growth rate is impressive — a 29.1% increase over the past year and an astounding 61.7% over two years according to Electric Capital’s tracker. This stands in contrast with Ethereum’s relatively modest 5.8% growth this year and 6.3% over two years.

Bitcoin’s Developer Community Remains Smaller but Stable

Bitcoin added close to 7,500 new developers in the same period, bringing its total active developer base to 11,036. This still places Bitcoin third behind Ethereum and Solana in terms of blockchain developer engagement.

Questions Over Data Accuracy and AI’s Impact

The data has faced criticism from industry experts. Tomasz K. Stańczak, founder of Nethermind, pointed out inconsistencies in how EVM-compatible chains like Polygon and Binance Smart Chain are grouped or excluded, which may distort the developer counts.

Furthermore, Jarrod Watts from layer-2 project Abstract questioned the validity of the figures, suggesting that many new repos might be inflated by AI-generated code or hackathon projects that don’t evolve into sustained development. Watts remarked, “I don’t think I can name one new crypto dev that started this year.”

What’s Next for Blockchain Development?

While Ethereum still leads by sheer developer numbers, Solana’s rapid growth and the debates over data accuracy highlight the evolving and complex landscape of blockchain development. How these communities grow and innovate remains a key factor in shaping the future of decentralized technologies.

Comments are closed.