Featured News Headlines

Bitcoin MVRV Ratio Indicates Healthy Market Mid-Cycle

Bitcoin (BTC) has continued its steady performance in what appears to be a healthy mid-cycle consolidation phase, recovering from recent liquidation shocks while altcoins lag behind amid persistent market fear.

Market Overview: Liquidations Ebb as BTC Dominance Holds Firm

As of this writing, Bitcoin dominance remains robust at approximately 47%, with the total crypto market capitalization hovering near $2.3 trillion. Recent data from on-chain analytics show a marked reduction in liquidations, with 24-hour total liquidations dropping to $120 million — a significant decline from the peaks seen during last month’s sharp correction. This suggests that market participants are increasingly adopting cautious positions rather than being forced out by volatility.

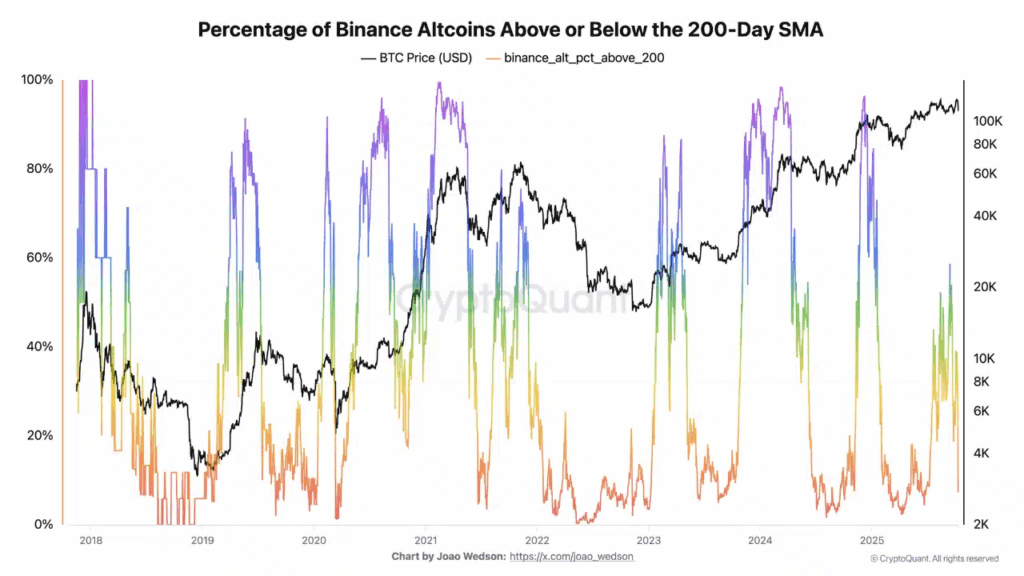

Meanwhile, altcoins are underperforming, with only about 10% of tokens on Binance trading above their 200-day moving averages. This reflects a broader trend of oversold conditions and investor hesitancy in altcoin markets, where fear and disinterest have reached extremes seldom seen outside major bear phases.

Altcoin Oversold but Showing Signs of Potential Rebound

The contrast between Bitcoin’s steadiness and altcoins’ weakness is striking. On-chain metrics indicate strong accumulation among long-term Bitcoin holders (LTHs), with steady exchange outflows reinforcing confidence in BTC as a store of value. Conversely, altcoins are exhibiting subdued volume and persistent selling pressure.

“Periods of extreme fear and oversold conditions in altcoins have historically served as contrarian entry points for traders looking to capitalize on short-term rebounds,” said Laura Chen, CEO of CryptoInsights. “However, any meaningful altcoin recovery will depend on broader market sentiment, liquidity flows, and fundamental developments within individual projects.”

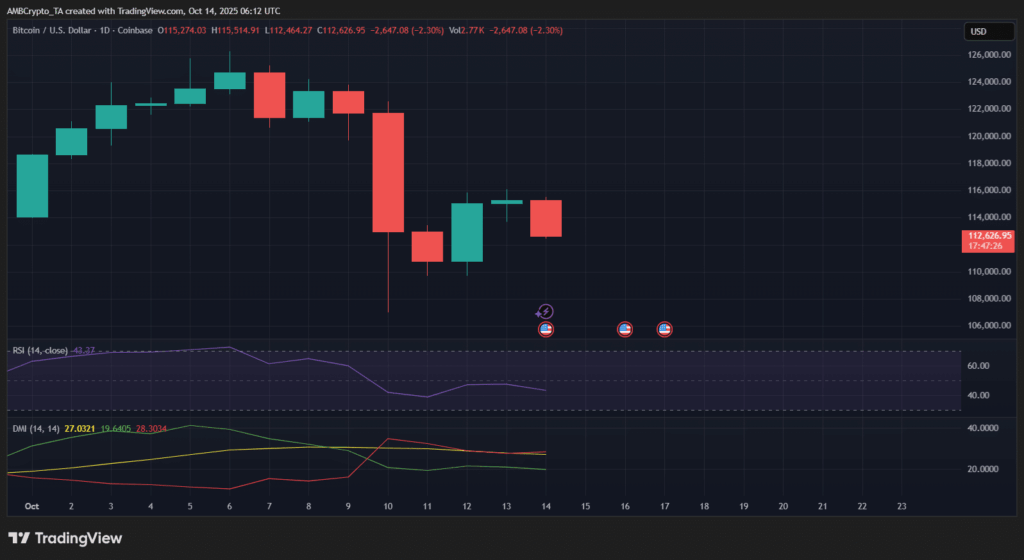

Technical Analysis: BTC Faces Resistance Below $115K, Momentum Cools

Bitcoin’s price has struggled to decisively break through the $115,000 resistance level following a rebound from the recent downturn. The Relative Strength Index (RSI) currently sits near 48, indicating neutral buying pressure, while the Directional Movement Index (DMI) shows bears holding a slight advantage with the -DI marginally above the +DI.

The Moving Average Convergence Divergence (MACD) remains flat, reflecting subdued momentum and signaling that the market is in a consolidation phase rather than entering a fresh uptrend or downtrend. Unless BTC can reclaim $115K with increased volume, analysts expect price to oscillate between $110,000 and $115,000 in the near term.

Healthy Mid-Cycle Pause Suggests More Upside Ahead

On-chain data and technical indicators collectively suggest that Bitcoin is in the midst of a mid-cycle consolidation, characterized by healthy accumulation rather than panic selling. The current MVRV ratio of 2.0 supports this narrative, indicating that most investors hold profits but are not yet exhibiting the exuberance typical of cycle peaks.

While altcoins remain under pressure, the extreme levels of fear and oversold conditions may presage a short-term bounce, especially if broader market liquidity improves. For Bitcoin, sustained institutional inflows and steady exchange outflows could underpin further upside once resistance is overcome.

Investors should watch for shifts in market sentiment and volume dynamics to better gauge whether the current consolidation marks the halfway point of the cycle or a prelude to renewed volatility.

Comments are closed.