Crypto ETFs Bleed Capital After $20B Liquidations and Tariff Shock

Crypto markets remain under pressure this week after historic weekend liquidations triggered over $755 million in outflows from U.S.-listed spot Bitcoin and Ether ETFs on Monday. Investors are retreating to the sidelines, bracing for more macroeconomic turbulence ahead.

Bitcoin traded at $111,600, down nearly 3% over the past 24 hours. Total crypto market capitalization stands at $4.12 trillion, while Bitcoin’s market dominance holds at approximately 46.7%. According to derivatives data, weekend liquidations topped $20 billion, marking one of the largest deleveraging events in recent history.

Open interest in BTC futures has declined from $45.1 billion to $42.3 billion, with the liquidation wave resetting leverage across top assets. The broader sell-off came after the U.S. announced sweeping 100% tariffs on all Chinese importsstarting November 1st, escalating trade tensions and sparking fears of global risk-off sentiment.

ETF Outflows Intensify Amid Volatility

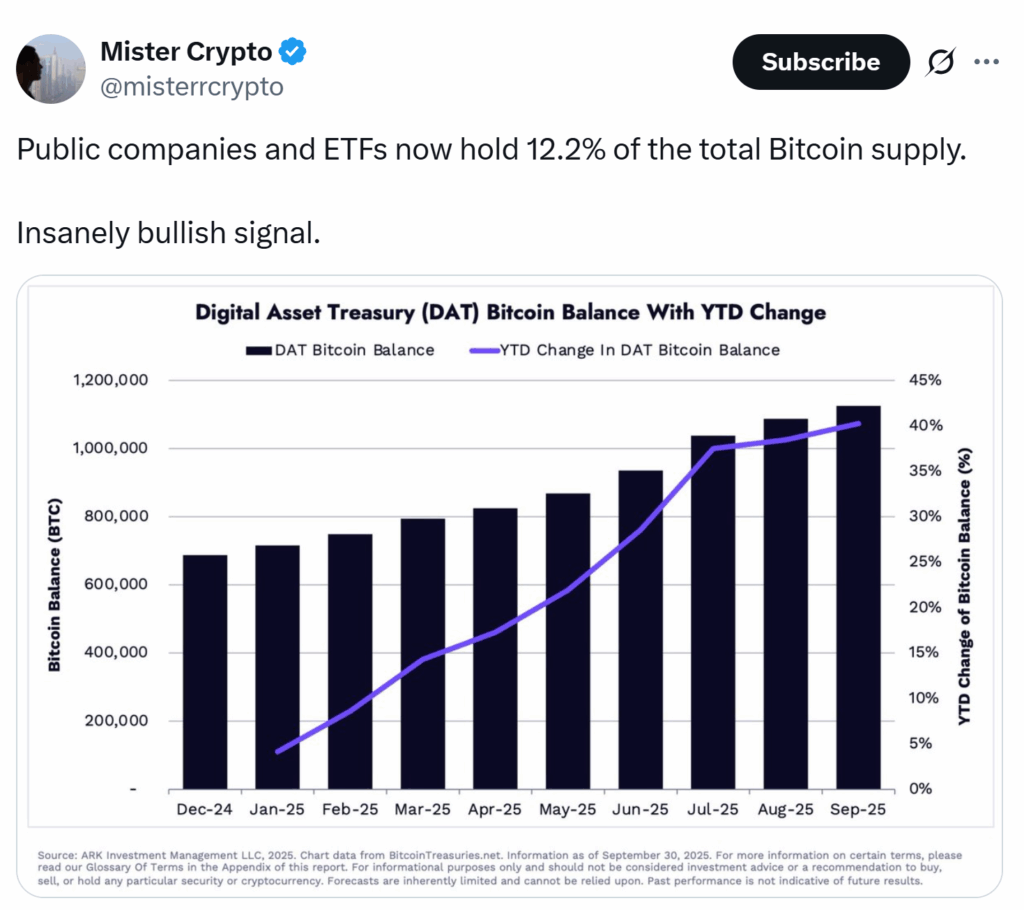

Spot ETFs bore the brunt of investor anxiety, posting sharp outflows across major funds. Bitcoin ETFs saw $326.52 million in net redemptions on Monday. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led losses at $93.28 million, while Grayscale’s GBTC shed $145.39 million. Bitwise and Ark Invest funds also reported daily outflows exceeding $20 million each.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) remained a rare bright spot, attracting $60.36 million in inflows, signaling isolated institutional confidence. Despite the turbulence, spot BTC ETFs continue to hold $157.18 billion in net assets, equal to 6.81% of Bitcoin’s total market cap.

Ethereum ETFs faced even steeper redemptions, totaling $428.52 million. BlackRock’s Ethereum Trust (ETHA) lost $310.13 million, followed by outflows from Grayscale’s ETHE and Fidelity’s FETH. Overall ETH ETF trading volume surged to $2.82 billion, reflecting heightened activity during the downturn.

Vincent Liu, Chief Investment Officer at Kronos Research, commented on the outflows:

“Investors are staying on the sidelines, waiting for clearer macro direction before re-engaging. For now, market sentiment outweighs fundamentals in driving activity.”

Technical Analysis

- RSI (14): Bitcoin’s Relative Strength Index remains neutral around 51, showing neither overbought nor oversold conditions.

- MACD: A bearish crossover persists, with the MACD line below the signal line, indicating fading momentum.

- DMI / ADX: ADX near 24 shows a weakening trend. Negative directional index (–DI) has crept above +DI, suggesting sellers are gaining control.

Key technical support rests between $108,000 and $110,000, while overhead resistance is capped near $118,500–$120,000. A confirmed break of either range could signal the next major directional move.

Comments are closed.