Cardano Price Coils Near Resistance Amid Whale Buying

Cardano [ADA] is witnessing renewed interest from large holders, even as retail traders remain cautious. On-chain data reveals that wallets holding between 100 million to 1 billion ADA have increased their balances from 4.22 billion to 4.25 billion coins, while wallets in the 10 million to 100 million ADA range have grown from 13.02 billion to 13.06 billion.

That’s an addition of roughly 70 million ADA, worth around $59 million — a clear signal that bigger players are positioning themselves ahead of a potential price shift.

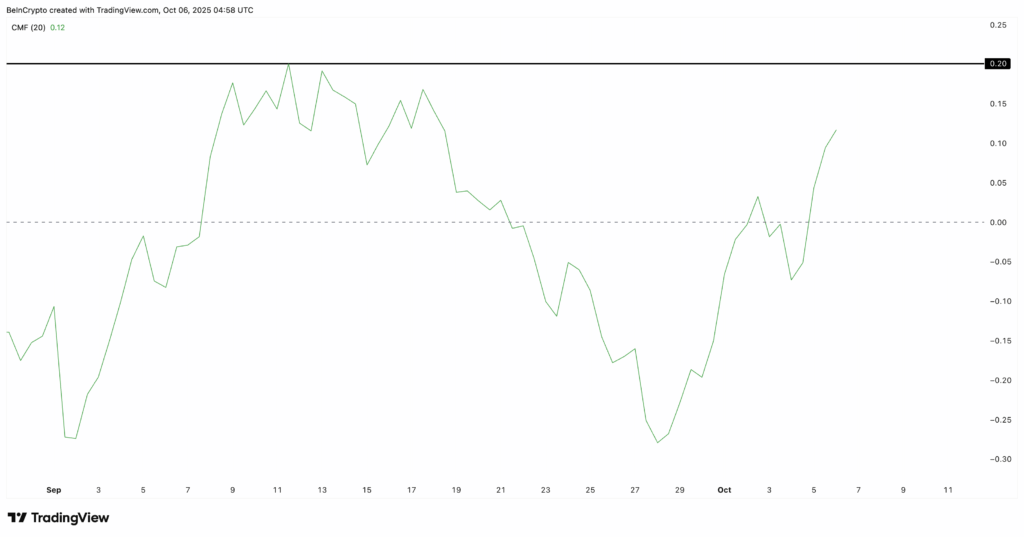

Supporting this, the Chaikin Money Flow (CMF) indicator has recently flipped positive and now hovers around 0.12, indicating net inflows. While this is a bullish sign, it’s not as aggressive as seen in other major altcoins. A CMF above 0.20 would reflect stronger conviction from institutional money.

Retail traders hesitate as ADA price compresses within triangle

In contrast, retail sentiment remains weak. The Money Flow Index (MFI), which gauges momentum from smaller traders, has been trending lower — a sign that retail is not matching the whales’ confidence. This divergence explains ADA’s current consolidation, with price action stuck within a symmetrical triangle pattern.

As of writing, Cardano trades around $0.83, just below a key resistance zone between $0.86 and $0.89. A daily close above $0.89 could trigger a breakout toward $0.93 and $0.95, especially if retail demand follows whale accumulation.

However, if uncertainty lingers, ADA may retest supports at $0.82 and $0.80. A decisive drop below $0.78 would invalidate the bullish setup and suggest further downside.

Comments are closed.