Featured News Headlines

BTC Retention Rate Drops, Casting Doubt on October’s Uptober Momentum

BTC Price Outlook – October has long been dubbed “Uptober” in the crypto community, thanks to Bitcoin’s history of strong monthly performances. In past standout years like 2017 and 2021, BTC skyrocketed by 49% and 40% respectively. But heading into October 2025, the leading cryptocurrency is entering with clear headwinds, making its bullish tradition less certain this time around.

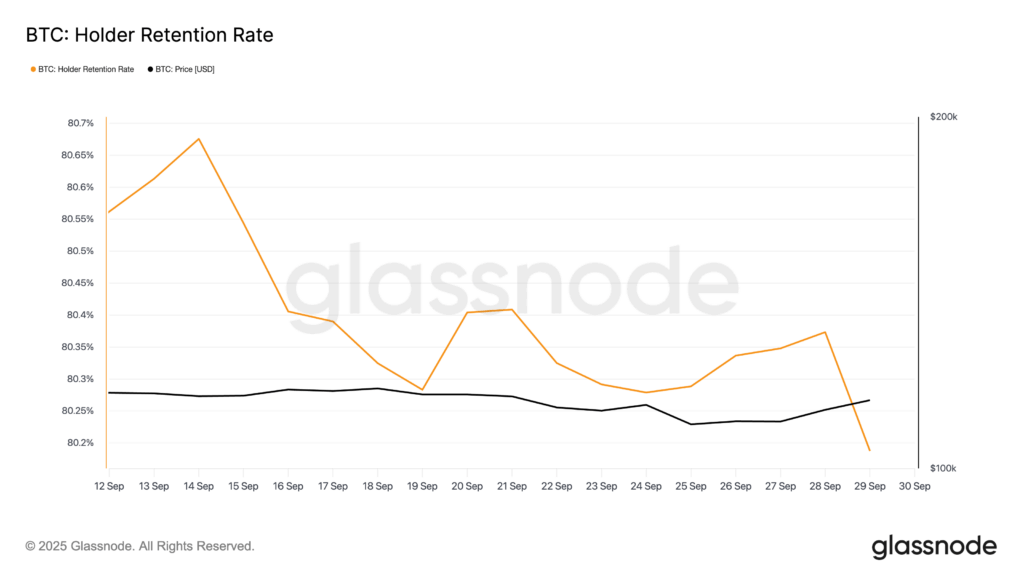

Holder Retention on the Decline

According to Glassnode, Bitcoin’s Holder Retention Rate has been slipping since mid-September, dropping to 80.17%—a 1% decline in just over two weeks. This metric tracks how many addresses consistently hold BTC across 30-day periods. The drop signals weakening conviction among investors, with more coins moving to exchanges or being sold instead of being held long term. If this trend persists, BTC could face sharper price swings due to reduced buy-side stability.

Derivatives Market Signals Bearish Sentiment

Further pressure is coming from Bitcoin’s derivatives market. Data from CryptoQuant shows the Taker Buy-Sell Ratio hovering below one for most of September, standing at 0.95 at press time. This suggests futures traders are leaning bearish, with more selling pressure than buying interest. Unless this ratio flips above one, BTC could remain under downward pressure throughout the month.

Whale Activity Retreats

Adding to the uncertainty, on-chain data from Santiment reveals that large holders owning 10,000–100,000 BTC have reduced their balances by 50,000 coins in the past week. Historically, whale participation has been a key driver of major rallies. Their retreat now weakens market depth, leaving retail investors to shoulder momentum.

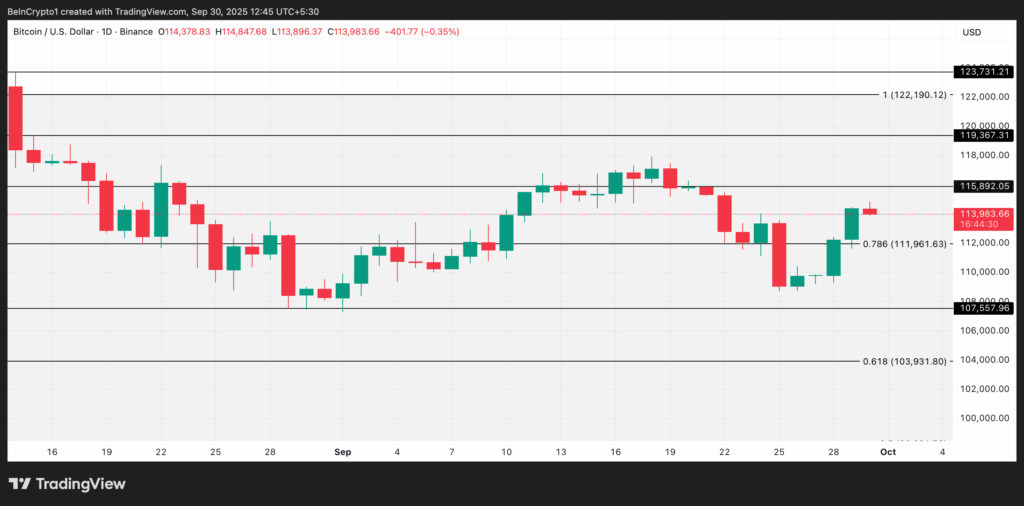

BTC Price Outlook

Bitcoin is currently trading around $113,968. Immediate support sits at $111,961, with potential downside targets near $107,557 if selling pressure intensifies. On the flip side, reclaiming resistance at $115,892 could pave the way toward $119,367—but only if buy-side demand resurfaces.

As October begins, the spotlight is on whether Bitcoin can defy these bearish signals and keep the Uptober streak alive—or if this year will break the trend.

Comments are closed.