ETH ETFs Face Historic Outflows: Is the Bull Run Over?

Like many other cryptocurrencies, ETH is currently losing ground. The uptick in excitement has been replaced by a decline that deters investment. Massive amounts have been taken out of Ethereum ETFs in a single week. Withdrawals hit an unprecedented level in ETH’s recent history on September 27 alone. Ethereum, meanwhile, saw a double-digit decline in value. A profound, almost frightening atmosphere of mistrust is reflected in this combined collapse of valuation and flows.

Ethereum Investors Flee ETFs in Panic

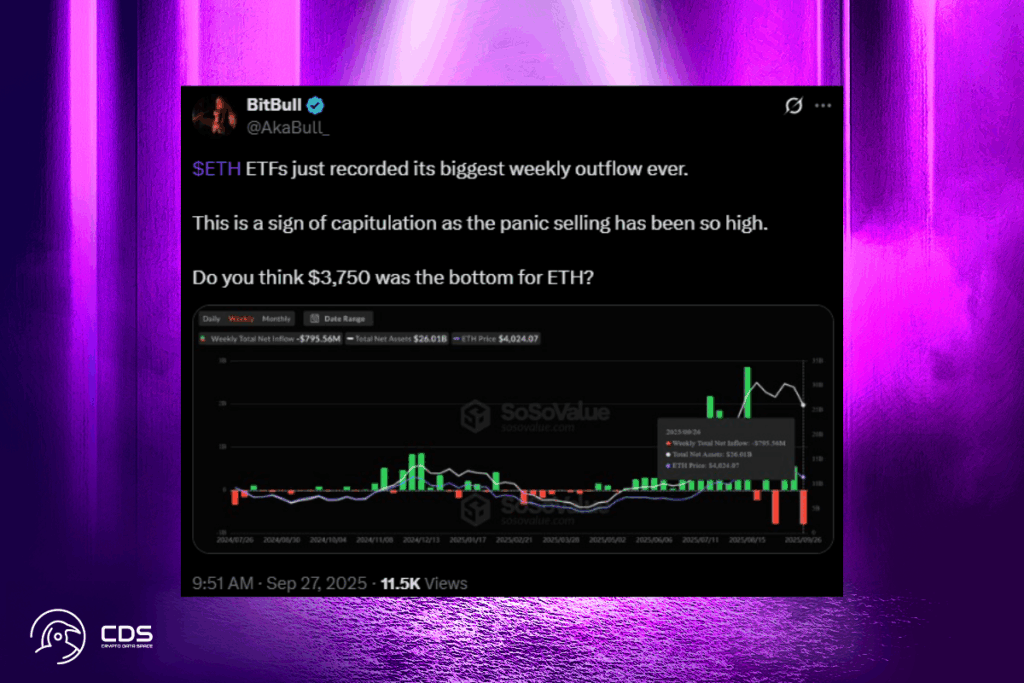

Ethereum spot ETFs had net outflows for five days in a row, with a weekly total of $795.8 million. A total of $248.4 million was taken out on September 27 alone. Since the week ending September 5, when ETH was still trading at about $4,300, this trend had not been observed. Because of how severe the panic selling is, analyst BitBull referred to these withdrawals as a sign of capitulation.

Ethereum ETFs have just recorded their largest weekly outflow of all time. It’s a sign of capitulation, given how intense the panic selling has been.

BitBull

The price of Ethereum fell 10.25% in a week, at the same time as this decline. This month’s negative “taker” net volume on Binance demonstrated ongoing buy-side weakness. BlackRock also made a significant contribution, selling close to 200 million ETH in a single session. This has accelerated Ethereum’s decline in popularity among cryptocurrency investors.

ETH Battles Supply Pressure From ETFs Amid Fragile Support Zones

Technically, Ethereum is struggling to maintain $3,875, which is a highly tense area. If it breaks down, ETH can drop below $3,626 or perhaps $3,403. Around these vulnerable areas, the 100- and 200-day moving averages converge. This structure is weakened by the conflict between a large supply, which is achieved through ETFs, and more discrete purchasers.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.