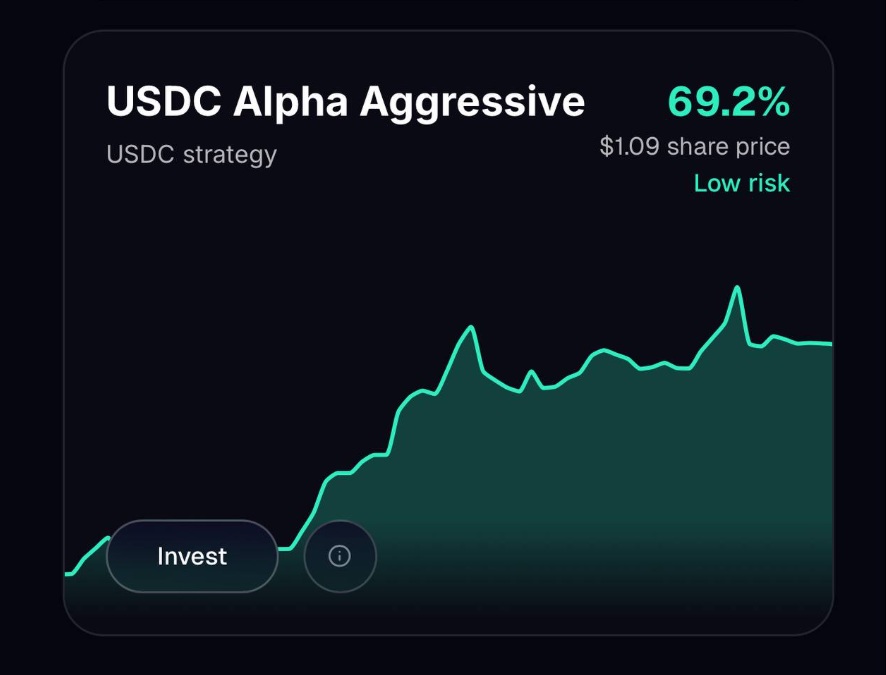

Kvants announces the launch of its market-neutral vault suite, which delivered a 22% net return in July with an estimated 4% maximum drawdown. Built by former Citigroup and JPMorgan portfolio managers and supported by a broad network of VC investors, Kvants brings institutional discipline to DeFi through transparent, rules-based quantitative strategies and a non-custodial infrastructure.

Featured News Headlines

- 1 Kvant Bringing Quantitative Trading Strategies on Drift Protocol & Hyperliquid

- 2 Kvants Strategic Partnerships with Kucoin

- 3 Kvants Deflationary Tokenomics Tied to Strategy Performance

- 4 Kvants Whitelisted Access, Allocation Opportunities, and Upcoming IDO Announcement

- 5 On-Chain Capital Allocations Surge as Investors Shift Toward Structured DeFi Strategies

- 6 How Kvants Vault Is Redefining On-Chain Asset Management for Retail and Institutional Investors

- 7 Strategic Roadmap: Expanding Kvants Vault Offerings and Investor Solutions

Kvant Bringing Quantitative Trading Strategies on Drift Protocol & Hyperliquid

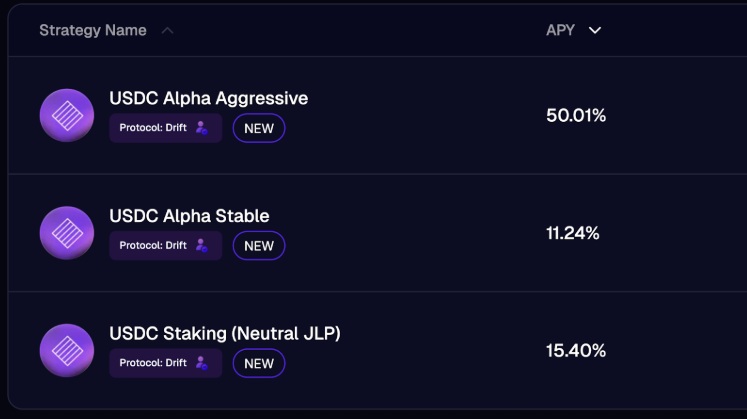

Kvants vaults operate a neutralised JLP base on Drift and execute systematic overlays across BTC, ETH, and SOl. The architecture targets near-zero net delta while harvesting exchange fee carry and short-horizon momentum captured from real-time microstructure signals. Positions, fees, and share price are observable on chain, and APY presented in app is a trailing 90-day annualised figure for context.

Kvants Strategic Partnerships with Kucoin

Kvants has entered into an official partnership with KuCoin, one of the world’s most active digital asset exchanges. This collaboration enhances the platform’s liquidity operations and offers deep execution capabilities for its algorithmic strategies.

Kvants Deflationary Tokenomics Tied to Strategy Performance

Kvants introduces a deflationary token model designed to align the incentives of investors, strategists, and token holders. The platform’s native token, $KVAI, incorporates a unique value accrual mechanism where Performance fees generated from the vaults are used to buy back and burn $KVAI from the open market. This creates direct economic linkage between strategy performance and token scarcity, enhancing long-term value for holders. Inspired by successful deflationary ecosystems in the crypto market, Kvants rewards capital allocators through APY multipliers and token airdrops tied to ecosystem participation. Users who allocate to Kvants vaults gain points that boost returns and qualify for token distributions, creating a synergistic loop between capital input and protocol output. For investors familiar with the mechanics of deflationary supply models.

Kvants Whitelisted Access, Allocation Opportunities, and Upcoming IDO Announcement

The TGE is scheduled for the 15th-25th September, and will take place on top-tier launchpads including Seedify and Decubate. Investors looking to secure early access to $KVAI must complete the whitelist process in advance. With token demand tied directly to strategy performance and enforced through an aggressive buyback mechanism, $KVAI is structured to reward early participation and long-term alignment.

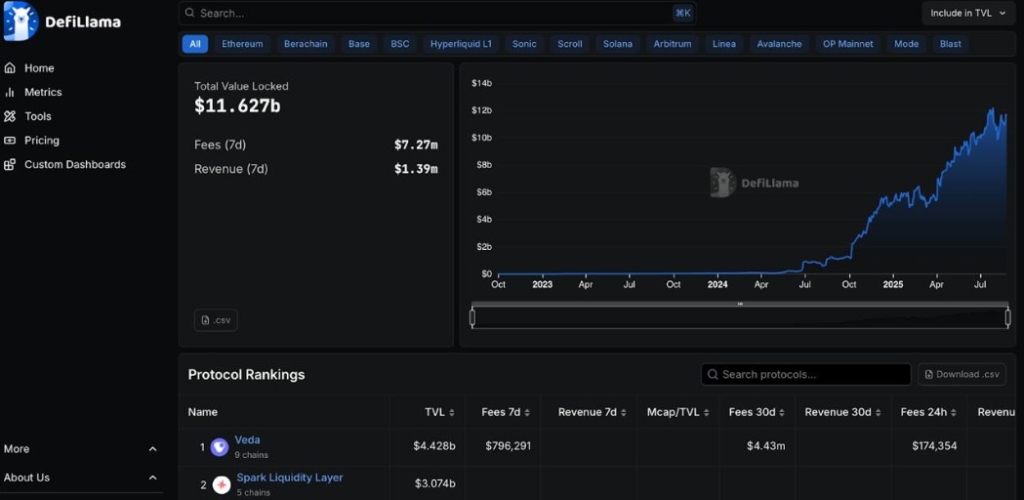

On-Chain Capital Allocations Surge as Investors Shift Toward Structured DeFi Strategies

A significant shift is underway in digital asset markets, as capital increasingly gravitates toward structured, algorithmic investment vehicles within DeFi. According to recent data from DeFiLlama, total value locked across on-chain capital allocator protocols now exceeds $11.78 billion, underscoring a growing preference for systems that offer verifiability, automation, and embedded risk controls. Unlike the speculative flows that once defined the altcoin market, this new capital rotation reflects a demand for transparency and measurable performance. Investors are migrating from unstructured exposure toward quant-driven vaults, which offer real-time strategy execution and on-chain performance visibility.

How Kvants Vault Is Redefining On-Chain Asset Management for Retail and Institutional Investors

Kvants is not merely offering another yield product, it is redefining how on-chain asset management can be institutionalized. By combining automated quant infrastructure, real-time capital routing, and composable DeFi architecture, the platform provides an end-to-end solution for market-neutral strategy deployment.

$KVAI IDO / TGE / Listing Timeline

- Token Generation Event (TGE): September 15–25, 2025

$KVAI Vesting Schedule

- 25% unlocked at TGE

- 1-month cliff

- Remaining 75% unlocks daily across 4 months (starting day 30)

$KVAI on Seedify Launchpad:

- Main Round — September 22, 2025 at 13:00 UTC

- FCFS Round — September 23, 2025 at 16:00 UTC

- Claims Open — September 25, 2025 at 14:30 UTC

- Remaining Rounds — September 25, 2025 at 14:35 UTC

- Whitelist here: Link

$KVAI on Decubate Launchpad:

- Decubate Whitelist is open on here

- General Access Round: September 23, 2025 at 09:00 UTC (22-hour window)

$KVAI Exchange Listings

- DEX Listing: September 25, 2025 at 14:30 UTC

- CEX Listing: September 25, 2025 at 14:00 UTC

Strategic Roadmap: Expanding Kvants Vault Offerings and Investor Solutions

Kvants is entering its next phase of growth with a strategic focus on expanding the scope and sophistication of its Vault strategies. The roadmap features the rollout of diversified investment themes designed to cater to a broad spectrum of portfolio goals and risk profiles. Kvants aims to empower investors with the tools to build tailored, risk-adjusted portfolios within a fully on-chain framework.

Check Out Available Vaults Strategies

Connect With Us

Comments are closed.