The CME Group has announced plans to introduce options contracts for XRP, building on the success of its recently launched XRP futures. This expansion allows institutional investors greater flexibility to hedge or speculate on XRP, potentially increasing market participation from large players.

With institutional trading volumes expected to rise, XRP could be positioned for a significant price movement in the near future.

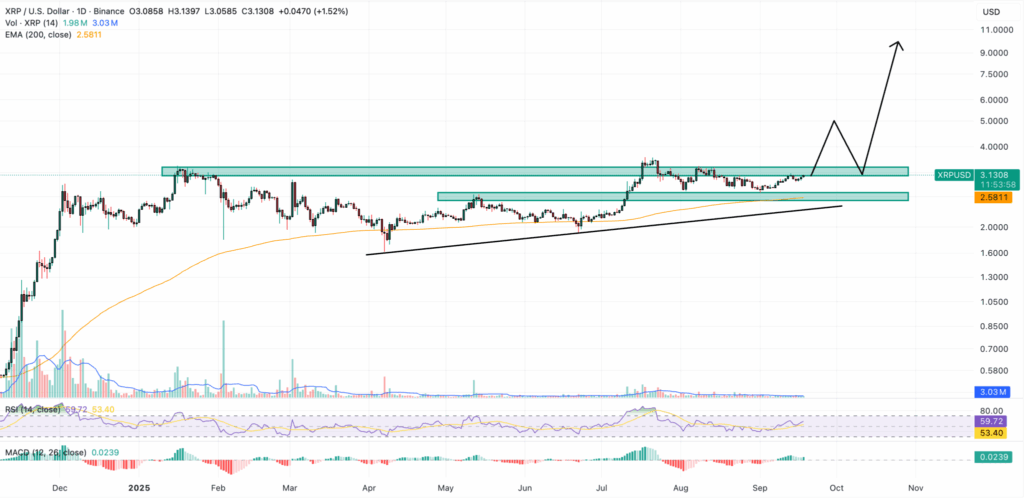

XRP Eyes Key Resistance at $3.65 — Path to $10 Possible

Recent price action indicates that XRP is nearing a breakout point. Should XRP surpass the crucial resistance level around $3.65 and maintain it as support, momentum could accelerate toward $5 and even $10.

This bullish outlook is supported by several catalysts, including the Federal Reserve’s recent rate cut, the launch of the first spot XRP ETF, and increasing institutional interest.

At $10, XRP’s market capitalization would approach $597 billion, rivaling Ethereum’s current valuation and solidifying its position among the top cryptocurrencies.

Pepenode ($PEPENODE): A Meme-Driven Crypto Mining Experience

Alongside XRP’s institutional surge, emerging projects like Pepenode ($PEPENODE) are capturing early investors’ attention.

Pepenode transforms crypto mining into an accessible, gamified experience without requiring expensive hardware. Users build virtual meme coin mining rigs, upgrade them, and earn rewards. Additionally, miners can unlock random meme coin bonuses such as $BONK and $FARTCOIN.

The project’s native token, $PEPENODE, fuels the ecosystem, powering rigs, upgrades, and the in-game economy. Interested users can join the presale by visiting Pepenode’s official website and connecting a compatible wallet.

Comments are closed.