Featured News Headlines

AVAX Price Rally: What’s Driving the Korean Market Hype?

Avalanche (AVAX) experienced a sharp rally, climbing 11.2% to an eight-month high of $33.3 before slightly correcting to $32.92 at the time of writing. The price rally was accompanied by a significant spike in trading activity, with 24-hour volume rising 88% to $1.78 billion and market capitalization increasing by 9% to $13.9 billion.

This combination of rising volume and market cap points to a strong influx of capital and heightened on-chain engagement across the Avalanche ecosystem.

Korean Market Fuels AVAX Rally

One of the primary catalysts behind the price movement was renewed interest from the South Korean market. As noted by AMBCrypto, “the Korean market primarily drove the recent AVAX price uptick.”

According to an official announcement by the Avalanche team, South Korea’s BDACS introduced the first Korean Won-backed stablecoin, KRW1, on the Avalanche blockchain. The stablecoin is fully collateralized by fiat reserves held at Woori Bank, one of South Korea’s leading financial institutions, following successful proof-of-concept validation.

On-Chain Activity Accelerates

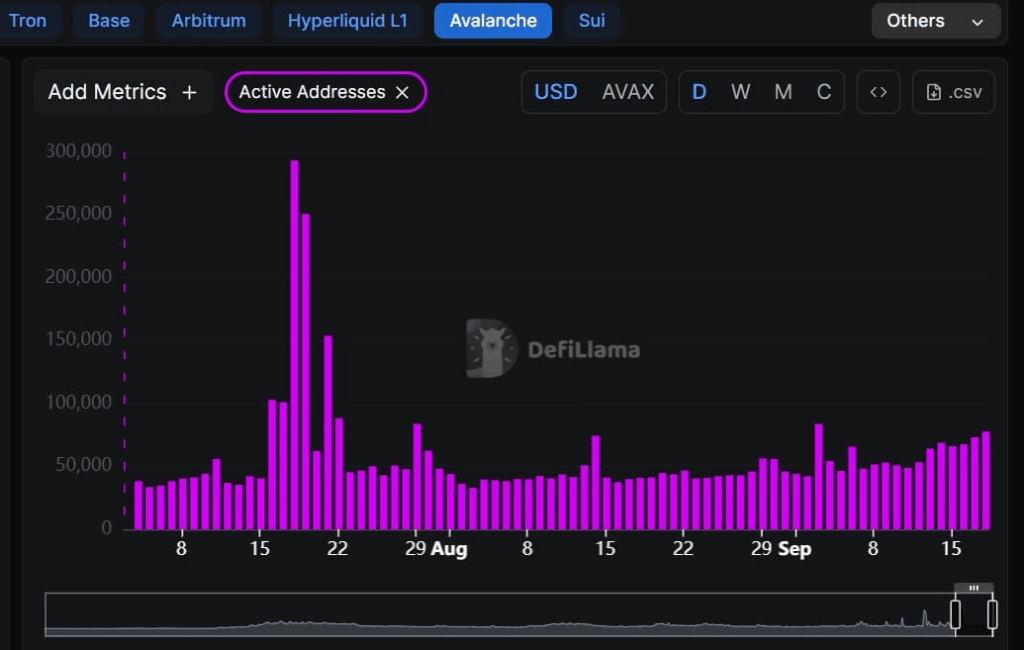

Following the news of the KRW1 stablecoin, on-chain data showed a surge in user activity on the Avalanche network. According to DeFiLlama, daily active addresses on Avalanche spiked to a two-week high of 70,000, indicating increased usage and adoption.

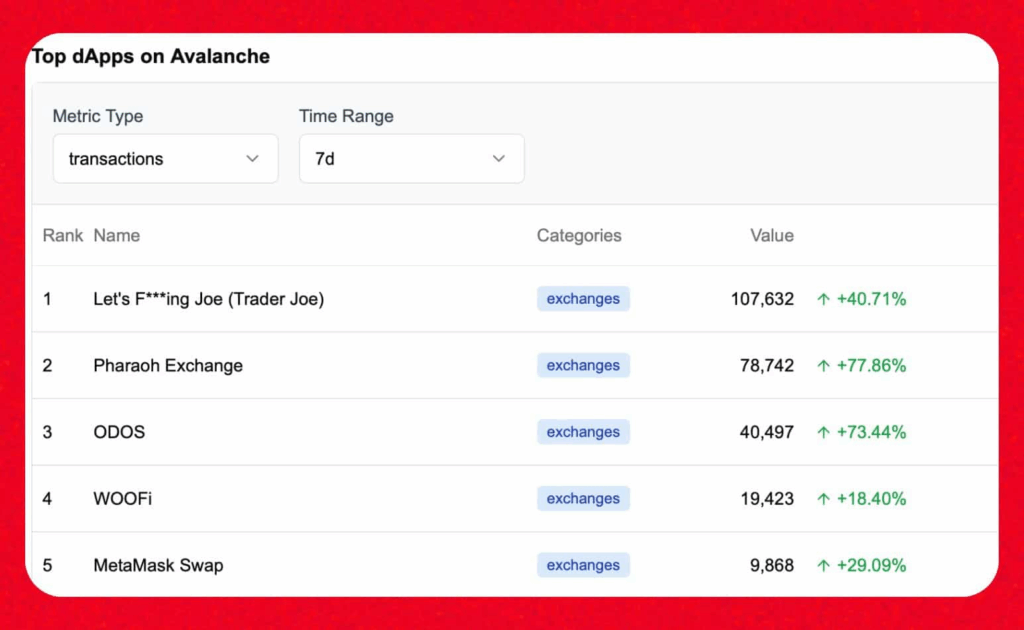

This uptick wasn’t isolated. Several platforms across the Avalanche ecosystem saw notable growth:

- LFJ_gg user count jumped by 40.7% to 107.6k

- PharaohExchange saw a 77.86% rise in users to 78.7k

- MetaMask recorded a 29% increase in Avalanche-connected users, reaching 9.9k

These figures reflect a broader ecosystem-wide expansion in user engagement.

Futures Market Sees Capital Inflow

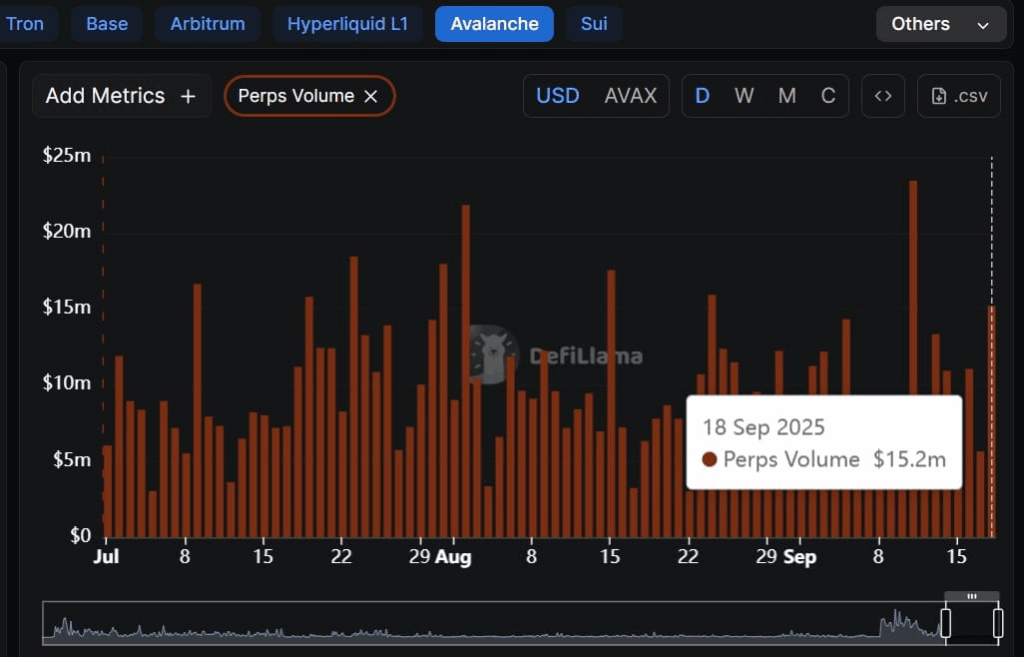

Interestingly, much of the new capital flowing into Avalanche appeared to move directly into derivatives. DeFiLlama data revealed that Perpetuals (Futures) Volume surged from $5 million to $15.2 million within a single day—a more than threefold increase.

This indicates a rise in speculative interest, with traders entering both long and short positions in anticipation of volatility.

What Lies Ahead for AVAX

The rally in AVAX has been underpinned by strong technical momentum indicators. According to AMBCrypto, the Directional Momentum Index (DMI) climbed to 35, signaling robust bullish momentum. Additionally, the Relative Vigor Index (RVGI) rose to 0.34, further validating the strength of the current trend.

However, it’s important to approach these indicators with caution. As AMBCrypto notes:

“If market conditions experienced over the past day hold, AVAX will make more gains and target $36.5. Conversely, if the uptrend was speculative, and momentum fades as soon as it emerges, AVAX will retrace to $28.”

Comments are closed.