DOGE Nears Resistance as ETF Hopes Clash With Profit-Taking

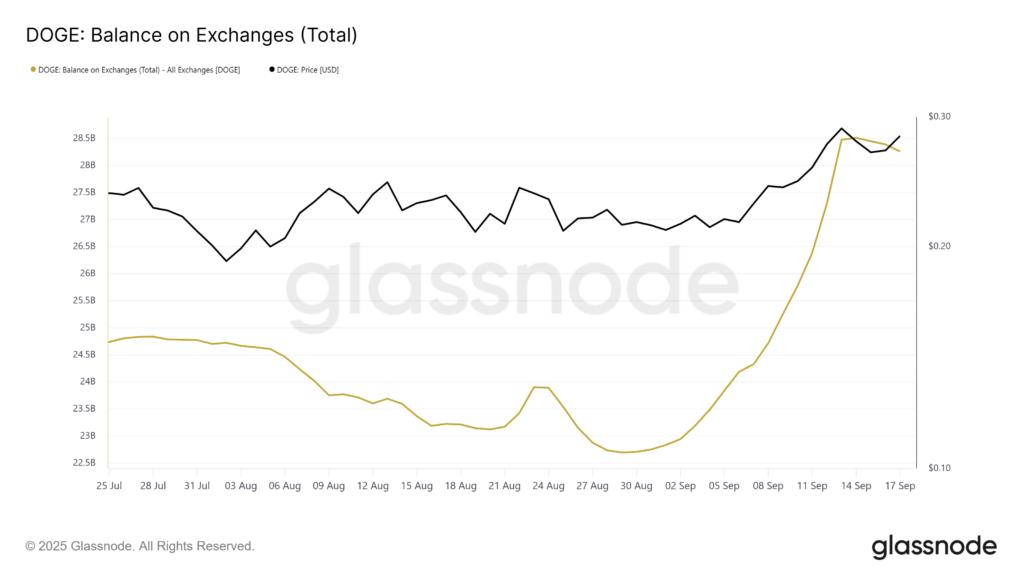

Dogecoin (DOGE) remains in the spotlight as bullish momentum continues, but recent on-chain data suggests that caution is building among investors. Exchange wallets have seen an influx of nearly 5.81 billion DOGE, valued at over $1.63 billion, since early September. This sharp increase signals potential profit-taking as traders capitalize on recent price gains, fueled largely by optimism around a possible DOGE ETF approval.

Although this wave of selling has not yet reversed DOGE’s price trajectory, it raises questions about the rally’s sustainability. If selling pressure intensifies, the meme coin may struggle to maintain its current momentum.

Long-Term Holders Begin to Move

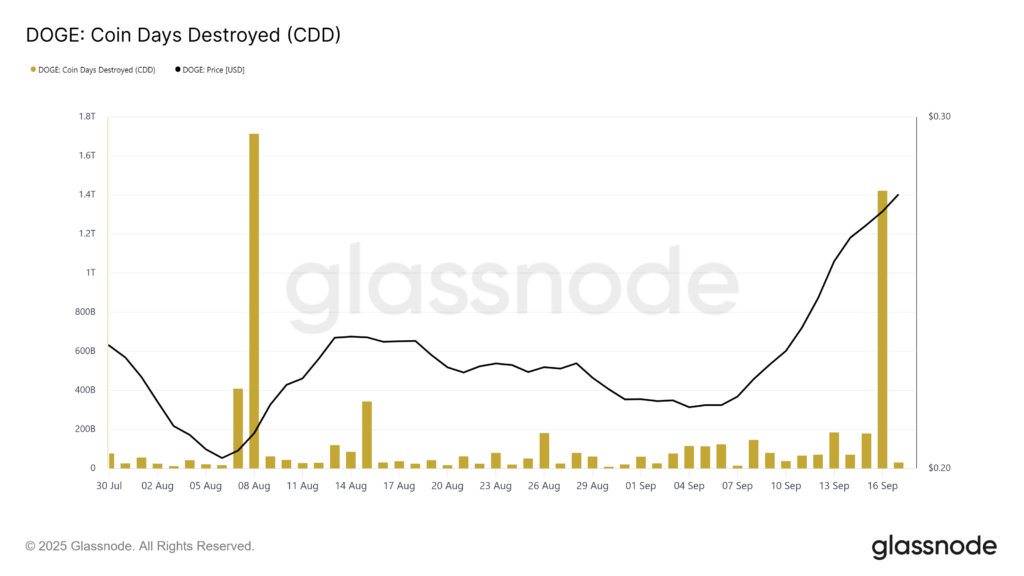

For the first time in over a month, the Coin Days Destroyed (CDD) indicator has shown that long-term DOGE holders are moving their assets. Historically, such behavior often precedes increased market volatility.

This shift is notable because long-term holders had previously acted as a stabilizing force, avoiding large sell-offs. Their renewed activity suggests a potential vulnerability in the market.

Key Levels to Watch Amid ETF Hopes

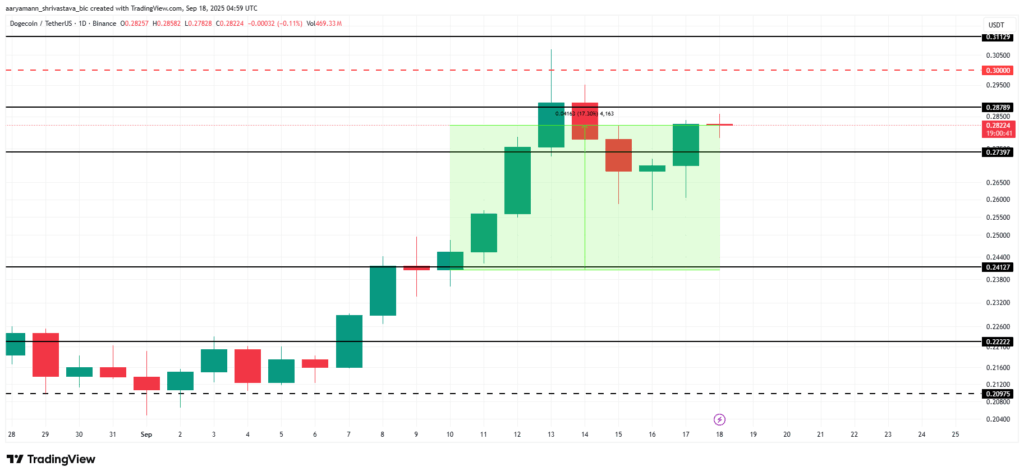

DOGE is currently trading around $0.282, posting a 17% gain over the past week. It faces immediate resistance at $0.287, with support forming at $0.273. A breakdown below this level could push prices toward $0.241, signaling a potential short-term reversal.

However, sentiment could shift quickly. Bloomberg ETF analyst Eric Balchunas noted that should an ETF launch occur today, Dogecoin may “surge past $0.287 and test $0.300,” possibly invalidating bearish outlooks.

Comments are closed.