Featured News Headlines

U.S. Bitcoin ETFs Record $368M Inflows Ahead of Fed Rate Decision

Bitcoin (BTC) is grappling with conflicting signals across on-chain metrics, exchange volumes, and derivatives activity, raising questions about the sustainability of its current cycle. While supportive macro conditions—such as anticipated Fed rate cuts in 2025—offer a tailwind, technical indicators point to underlying fragility that could shape Bitcoin’s trajectory into year-end.

MVRV Ratio Slips Below SMA365

Traditionally, Bitcoin’s MVRV ratio—a measure of holder profitability—stays above its 365-day simple moving average (SMA365) during strong bull markets. Since mid-2024, however, MVRV has repeatedly dipped below this key level, suggesting that long-term holder gains may be under pressure. Analysts warn that unless BTC reclaims this metric, the durability of the current cycle remains uncertain.

Volume Divergence Highlights Liquidity Risks

Trading patterns reveal a rare imbalance between on-chain and centralized exchange (CEX) activity. On-chain volumes surged to $62 billion, far surpassing the $41 billion across CEX spot and futures. While robust network activity suggests healthy usage, the broader trend of declining volumes during price growth signals thin liquidity. Historically, sustained bull runs have required rising participation from exchange traders—something the market has yet to confirm.

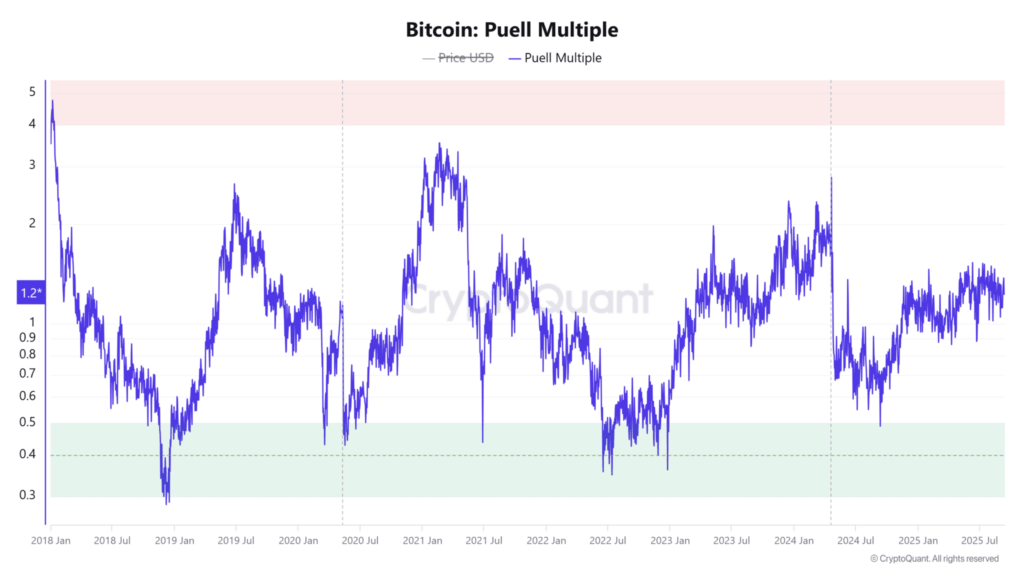

Miner Stress Adds Selling Pressure

The Puell Multiple, a key indicator of miner revenue, has dropped nearly 15% to 1.22. This decline highlights mounting pressure on miners, who may sell BTC to cover operational costs. Still, with the metric above 1.0, the stress is not considered extreme, indicating selling remains manageable rather than signaling full capitulation.

Open Interest Builds Ahead of Volatility

In derivatives markets, Open Interest (OI) has climbed 2.50% to $86.05 billion, reflecting a surge in leveraged positions. With longs holding a slight edge at 53.23%, sentiment leans modestly bullish. Elevated OI often precedes increased volatility, leaving traders on both sides bracing for sharp moves and potential liquidations.

The Road Ahead

Despite miner strain and liquidity concerns, the mix of rising OI and potential macro easing tilts the balance toward another breakout—provided buyers defend key levels and the MVRV ratio climbs back above SMA365. For now, Bitcoin’s path remains a tug-of-war between bullish momentum and structural fragility.

Comments are closed.