Featured News Headlines

Metaplanet Eyes 210,000 BTC by 2027 as Institutional Interest in Bitcoin Grows

Metaplanet – The global Bitcoin landscape is witnessing renewed corporate and sovereign interest, with Japanese investment firm Metaplanet and crypto-forward nation El Salvador making fresh purchases as the Bitcoin Fear & Greed Index stabilizes at “neutral.”

Metaplanet Expands Its Bitcoin Treasury

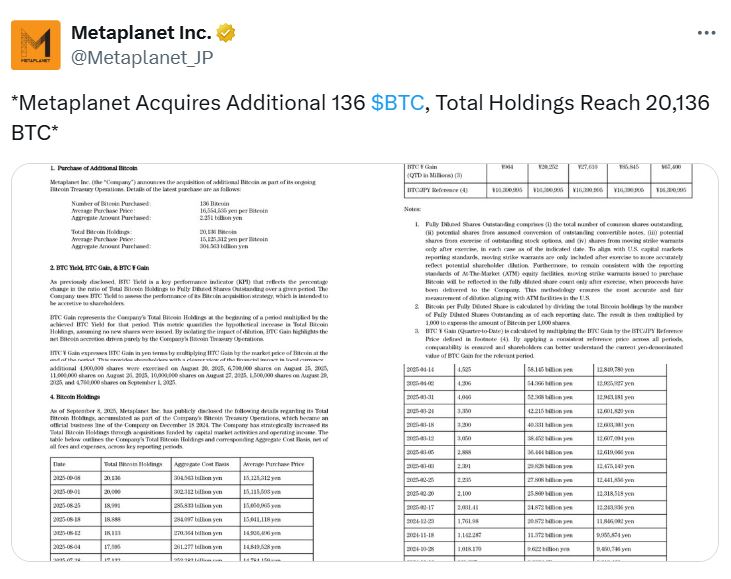

On Monday, Metaplanet disclosed the acquisition of an additional 136 BTC, raising its total holdings to 20,136 BTC, valued at over $2.2 billion at current prices. The Japanese investment company has previously indicated its long-term target of 210,000 BTC by 2027, a milestone that would position it as the second-largest corporate Bitcoin holder globally, behind Strategy (formerly MicroStrategy), according to Bitbo data.

Metaplanet currently ranks as the sixth-largest Bitcoin treasury overall and the largest among Japanese entities. The company purchased these coins at approximately 16,554,535 JPY ($111,830) per BTC.

Despite this aggressive accumulation, Metaplanet’s stock performance has been mixed. Following its initial Bitcoin buy on July 22, 2024, shares surged 19% to $1.10. However, subsequent acquisitions have not produced the same market reaction. In the most recent trading session, shares fell nearly 3% to $4.65, though they remain up 92.45% year-to-date.

To bolster its capital for future purchases, Metaplanet also announced plans to raise $880 million through an overseas public offering as of August 27, following stock price pressure that threatened its capital-raising “flywheel.”

El Salvador Marks Bitcoin Day With New Purchase

Meanwhile, El Salvador continues its proactive Bitcoin strategy. President Nayib Bukele confirmed the country acquired an additional 21 BTC as part of its Bitcoin Day celebrations, commemorating the anniversary of the legal tender law enacted in September 2021. The purchase increases El Salvador’s total stash to 6,313 BTC, as reported by its Bitcoin Office.

This move comes amid scrutiny from the International Monetary Fund, which in July noted that El Salvador had not made new Bitcoin purchases since signing a $1.4 billion loan agreement in December 2024, which required limiting additional acquisitions.

Strategy Signals More Bitcoin Buying Ahead

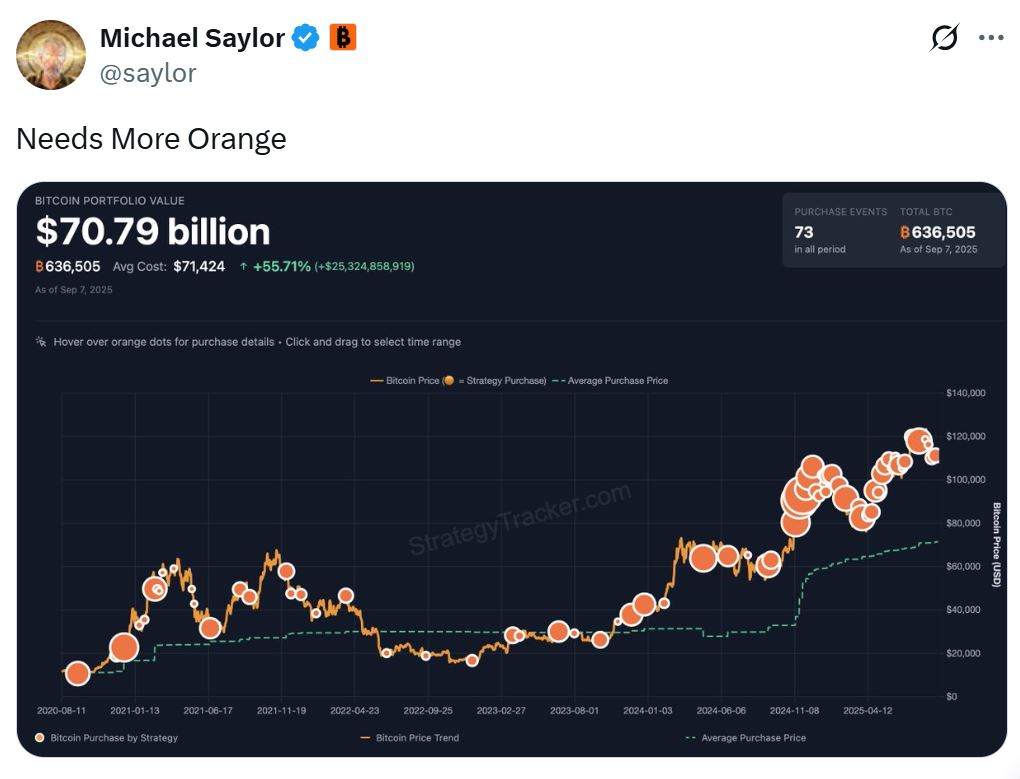

In parallel, corporate Bitcoin leader Strategy continues to hint at further purchases. Executive Chairman Michael Saylor teased another incoming buy on X (formerly Twitter) on Sunday, sharing a screenshot of the company’s Bitcoin portfolio with the caption: “needs more orange.”

Strategy currently holds 636,505 BTC, making it the largest corporate Bitcoin treasury by a significant margin, according to Bitbo. While MSTR shares shed much of August’s gains, the last trading session saw a 2.5% rise to $335.87, leaving the stock up nearly 12% year-to-date.

Market Sentiment Turns Neutral

These high-profile purchases coincided with the Crypto Fear & Greed Index returning to 51, signaling neutral sentiment after spending three consecutive days in the “fear” zone. Analysts interpret this stabilization as a potential harbinger for renewed investor confidence and speculative activity in the Bitcoin market.

Implications for Global Bitcoin Adoption

Metaplanet’s aggressive accumulation strategy and El Salvador’s symbolic purchases highlight two distinct but complementary trends in Bitcoin adoption: corporate treasury expansion and sovereign experimentation with digital assets.

While Metaplanet aims to build a multi-billion-dollar Bitcoin treasury over the next several years, El Salvador leverages its Bitcoin Day narrative to reinforce the currency’s role as legal tender and national investment asset.

The ongoing activity from these buyers, coupled with Strategy’s hints of further acquisitions, underscores a broader trend of institutional and sovereign confidence in Bitcoin as a strategic reserve asset. Market observers now closely watch whether these moves, in conjunction with stabilizing sentiment, could spur additional momentum across both spot and derivative markets.

Comments are closed.