BTC Holds Strong: Key On-Chain Signal Flashes Hope

Whether or not Bitcoin (BTC) has found a floor is still up for debate in the market. Price movements actually suggested that it would close higher for three days in a row at the start of September. There hasn’t been a situation like this since early August. At that point, Bitcoin hit $113k, and during the following two weeks, it rose back to $124k. The STH NUPL may avoid the red (capitulation) zone if this configuration stays true. This contrasts with last week’s BTC decline below $110,000, which resulted in realized losses of $943 million and was a post-April FUD top.

BTC Pullback Looks Like a Reset, Not Capitulation

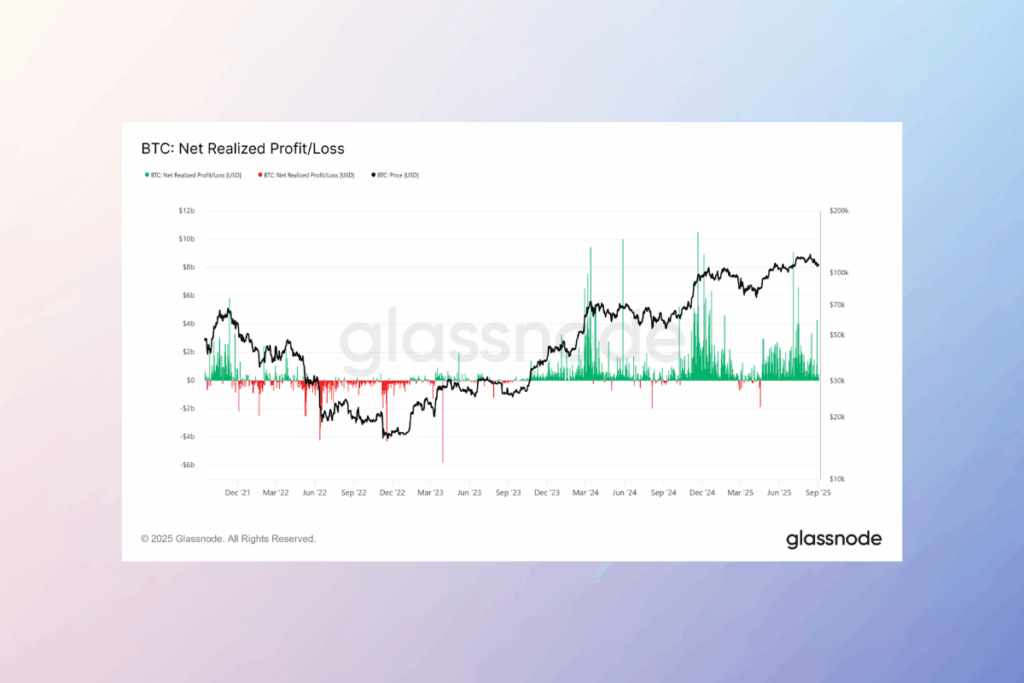

Many people were afraid that Bitcoin would capitulate, but it hasn’t. NRPL, or net realized profit/loss, increased to $4.2 billion, the most in a month, according to on-chain data. The market is strong because Bitcoin holders are primarily locking in profits rather than panic-selling.

While 25% of Bitcoin’s supply was underwater at the bottom of the previous cycle, only 9% of it is now at $110,000. This implies the market is in far better shape than it was during conventional bearish periods. Rather than a collapse, this pullback appears to be a reset.

Why Does Bitcoin’s Structure Appear to Be on an Uptrend Despite Market Volatility?

In actual bear markets, losses have reached 78%, and over 50% of supply has been submerged. Currently, that figure is a small portion of that, indicating that holders have great conviction. Generally speaking, a bullish foundation is formed when the sellers’ cost basis stays above spot. Bitcoin may be preparing for its next surge, as the majority of it is above water, and whale accumulation is still going strong. In conclusion, holders continue to have confidence. This further suggests that the structure of Bitcoin exhibits resilience rather than fragility.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.