Featured News Headlines

Is Bitcoin Breaking Below $112K? What Traders Need to Know Now

Bitcoin (BTC) is currently trading around $114,390, reflecting a modest 1% gain over the past 24 hours. Daily trading volume has reached approximately $69.6 billion, while Bitcoin’s total market capitalization stands at $2.27 trillion. With 19.9 million BTC already in circulation from the maximum supply of 21 million, the market continues to react to both technical pressures and longer-term fundamental optimism.

Short-Term Technical Outlook: Bearish Indicators Building

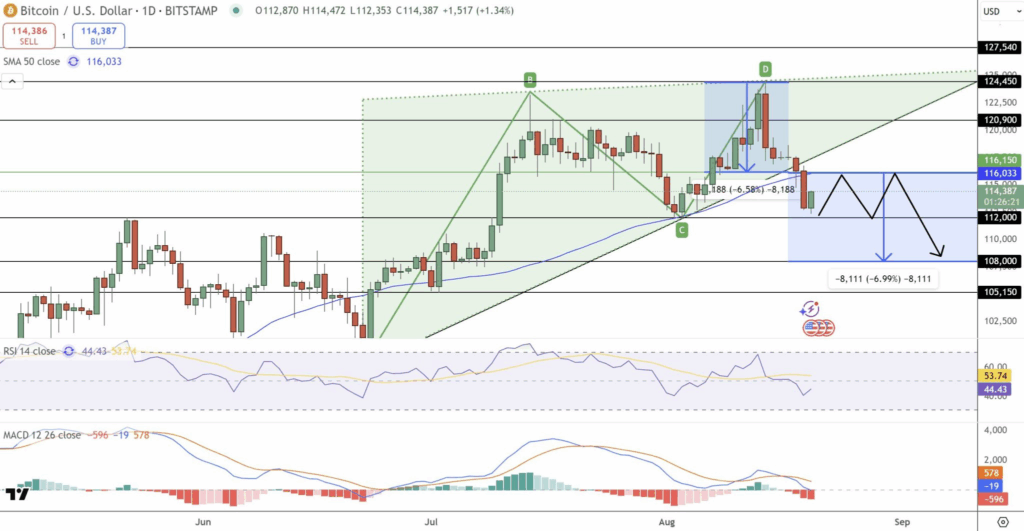

Despite July’s rally, recent price action suggests Bitcoin is losing momentum. The cryptocurrency has slipped below its 50-day moving average at $116,033, a key technical level that has now turned into resistance.

A strong rejection at $124,450 led to the formation of a bearish engulfing candle, signaling a shift in sentiment. Technical charts now show the development of a potential head-and-shoulders pattern, with the neckline forming around $112,000. If BTC breaks below this level, traders are watching for possible downside targets at $108,000 and $105,150.

Additional indicators reinforce this cautious view:

- The MACD has turned negative, suggesting momentum is shifting toward sellers.

- The Relative Strength Index (RSI) is currently around 44, which still allows room for further downward movement.

- The appearance of consecutive bearish candlesticks hints at the early stages of a three black crows pattern, a classic signal of a deeper correction.

Key Levels to Watch

- Resistance: $116,000 / $120,900 / $124,450

- Support: $112,000 / $108,000 / $105,150

If bulls manage to reclaim the $116,150 level, this could open the door for a move back toward $120,900 and potentially $124,450. A breakout above that may bring $127,540 and even a push toward $130,000 into focus.

On the downside, a clean break below $112K would likely invite stronger selling pressure, putting $108K and lower levels on the radar.

Longer-Term Structure Still Intact

While short-term charts are showing weakness, the broader market structure remains less concerning. Since June, Bitcoin has managed to maintain a series of higher lows, which often indicates ongoing accumulation. The recent presence of doji candles near $113,000 also reflects indecision, not panic selling, suggesting that buyers are still present.

Armstrong Predicts $1 Million BTC by 2030

From a fundamental standpoint, optimism remains strong. On August 20, Coinbase CEO Brian Armstrong publicly stated that he believes Bitcoin could reach $1 million per coin by 2030. While he emphasized this as a “rough idea,” his outlook was based on factors such as increased adoption, continued innovation, and Bitcoin’s fixed supply.

Importantly, Armstrong noted that he’s not relying on a specific valuation model. Instead, his view is shaped by the bigger picture: limited supply, expanding use cases, and Bitcoin’s growing role in the global financial system.

What This Means for Traders and Investors

For short-term traders, the current technical landscape provides a relatively straightforward strategy to navigate Bitcoin’s price movements. If Bitcoin manages to sustain a close above the $116,000 level, it could signal renewed buying interest and momentum. In such a scenario, traders might consider entering long positions with targets set in the range of $120,000 to $130,000. This zone represents key resistance levels where profit-taking or market hesitation could occur, but it also offers potential for continued upward moves if those levels are decisively broken.

On the other hand, if Bitcoin’s price falls below the critical support near $112,000, the outlook becomes more cautious. Traders should prepare for potential short-selling opportunities, anticipating that the price could decline further toward support zones around $108,000 or even lower. Breaking below $112,000 may accelerate selling pressure as stop-loss orders trigger and bearish sentiment increases, potentially leading to sharper corrections in the short term.

For long-term investors, however, the picture is quite different. The current price range can be seen as a favorable accumulation zone within the context of a broader and ongoing bull market cycle. Despite the short-term volatility and price fluctuations, the overall trend remains positive according to many leading market voices, including Coinbase CEO Brian Armstrong. Their perspective suggests that Bitcoin’s value is likely to rise significantly over the next several years, driven by increasing adoption, technological developments, and a shrinking supply. Therefore, long-term holders may view dips and volatility not as risks to avoid, but as opportunities to build positions in anticipation of future gains.

In summary, short-term traders should closely monitor these key levels—$116,000 on the upside and $112,000 on the downside—to adjust their strategies accordingly. Meanwhile, long-term investors might focus on the bigger picture and consider this phase as part of an extended upward trajectory that could ultimately lead to substantial returns over time.

Comments are closed.